Form I-983 Sample Answers

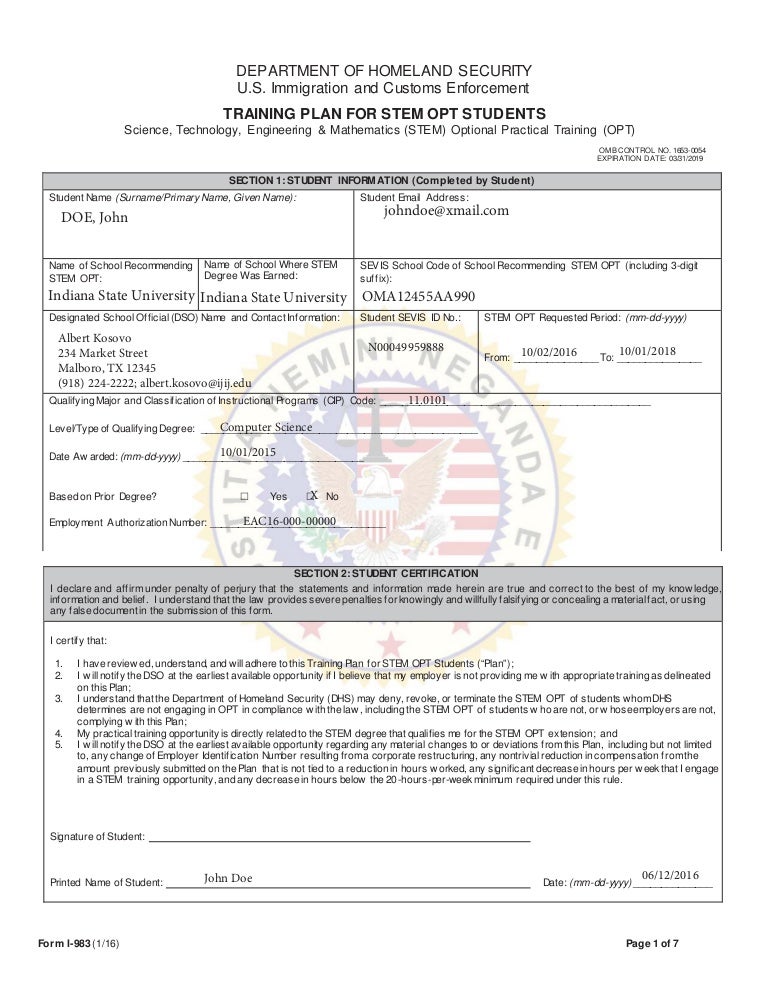

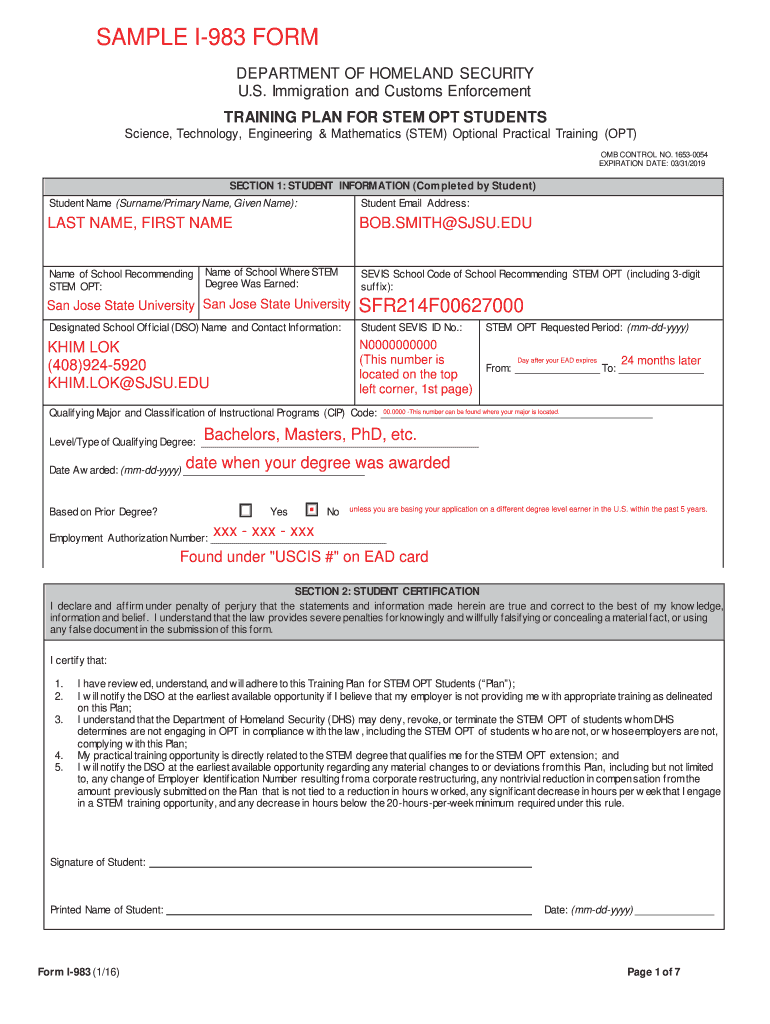

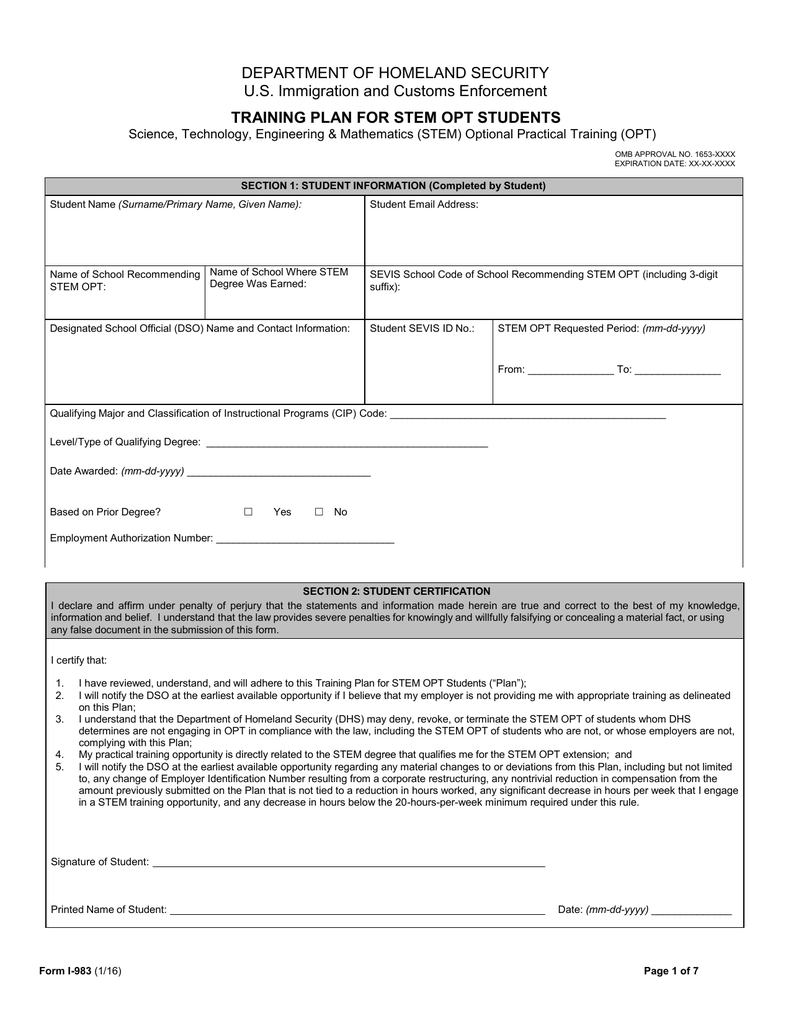

Form I-983 Sample Answers - Web partnerships and s corporations. Web make changes to claims made on schedule c (form 720), except for the section 4051(d) tire credit and section 6426 fuel credits. Federal tax law allows you to claim a deduction for the value of all property you donate to a qualified charity during the year provided you. Enter your full name (surname/primary name, given name) exactly as it appears on your sevis (student. Web figure the amount of your contribution deduction before completing this form. Naturally, you'll also need to. Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. If the application is based on a prior degree, answer “yes”. The employer who signs the training plan must be the same entity that. • use form 730, monthly tax return for.

Specific student cases may vary, therefore the student is responsible for reading and following ice form instructions:. Federal tax law allows you to claim a deduction for the value of all property you donate to a qualified charity during the year provided you. Enter your full name (surname/primary name, given name) exactly as it appears on your sevis (student. Web for general use only. Properly completing this form will. Web was a valid and timely form 8023 filed? Enter the employer's site name which may be the same as employer name in section 3. Web figure the amount of your contribution deduction before completing this form. Web when to use form 8283. Name of other party to the transaction.

The employer who signs the training plan must be the same entity that. Web was a valid and timely form 8023 filed? Student information (completed by student): Specific student cases may vary, therefore the student is responsible for reading and following ice form instructions:. Naturally, you'll also need to. Federal tax law allows you to claim a deduction for the value of all property you donate to a qualified charity during the year provided you. See your tax return instructions. No if yes, enter the date filed. Donated property of $5,000 or less and publicly traded. If the application is based on a prior degree, answer “yes”.

I983

Web figure the amount of your contribution deduction before completing this form. Part ii other party’s identifying information. Web make changes to claims made on schedule c (form 720), except for the section 4051(d) tire credit and section 6426 fuel credits. Enter the employer's site name which may be the same as employer name in section 3. Web the european.

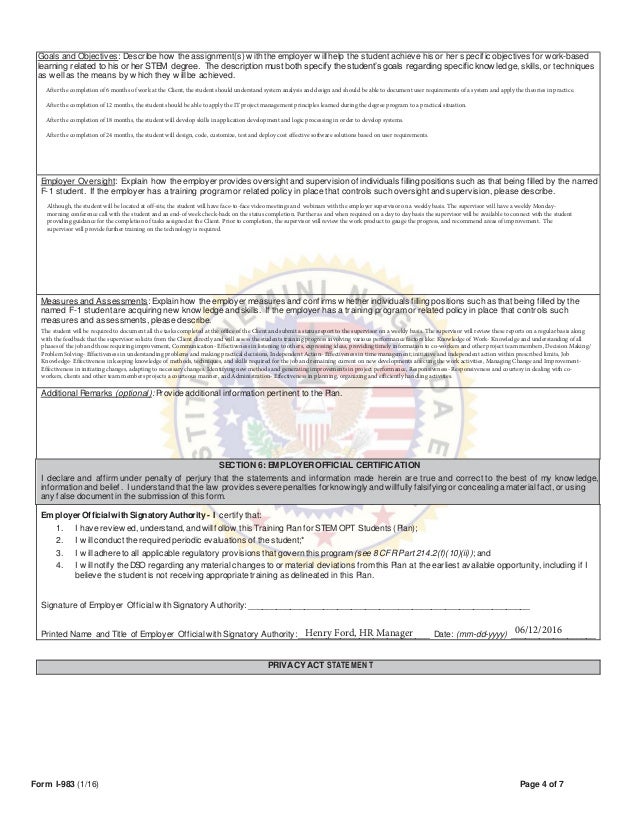

I983 Evaluation Final Evaluation On Student Progress I 983 Sample

Web figure the amount of your contribution deduction before completing this form. Enter your full name (surname/primary name, given name) exactly as it appears on your sevis (student. The employer who signs the training plan must be the same entity that. Donated property of $5,000 or less and publicly traded. Web when to use form 8283.

I983

• use form 730, monthly tax return for. Student information (completed by student): See your tax return instructions. Web was a valid and timely form 8023 filed? Specific student cases may vary, therefore the student is responsible for reading and following ice form instructions:.

I983 fillable form no download needed Fill out & sign online DocHub

A partnership or s corporation that claims a deduction for noncash gifts of more than $500 must file form 8283 (section a or section. Enter your full name (surname/primary name, given name) exactly as it appears on your sevis (student. Web the european union says etias approval will stay valid for three years or until the passport you used in.

I983 Evaluation Final Evaluation On Student Progress I 983 Sample

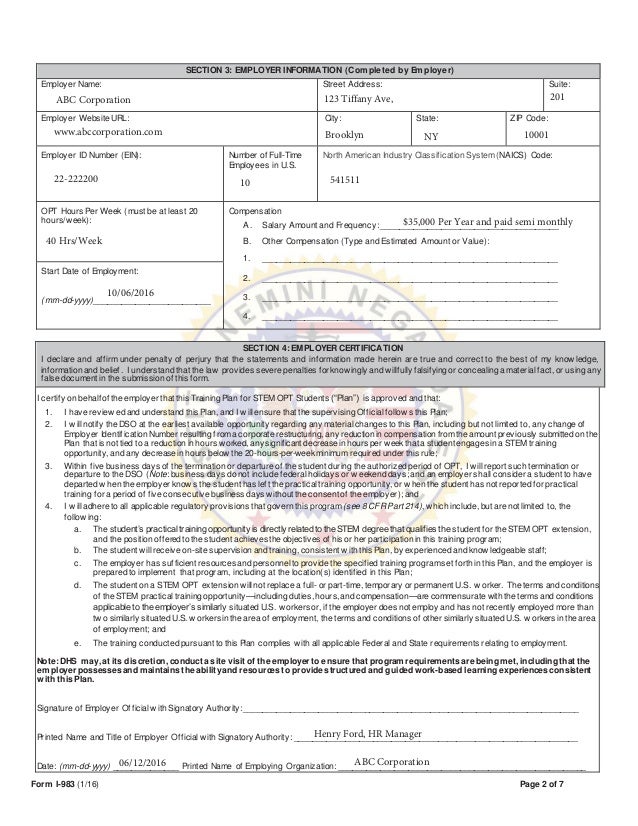

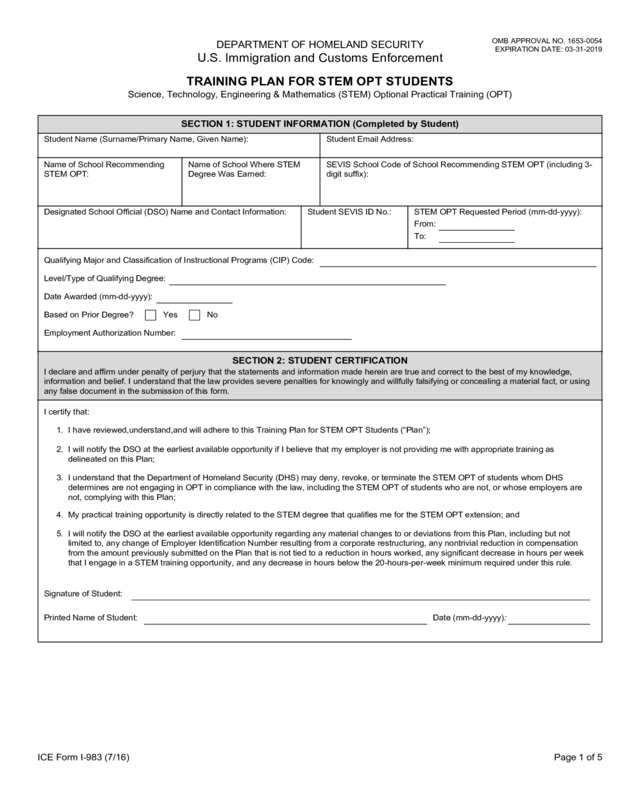

Enter the employer's site name which may be the same as employer name in section 3. Donated property of $5,000 or less and publicly traded. Training plan for stem opt. Naturally, you'll also need to. If the application is based on a prior degree, answer “yes”.

I983 Evaluation Final Evaluation On Student Progress I 983 Sample

Web was a valid and timely form 8023 filed? Part ii other party’s identifying information. Training plan for stem opt. Enter your full name (surname/primary name, given name) exactly as it appears on your sevis (student. • use form 730, monthly tax return for.

I983 Evaluation Final Evaluation On Student Progress I 983 Sample

Training plan for stem opt. No if yes, enter the date filed. Federal tax law allows you to claim a deduction for the value of all property you donate to a qualified charity during the year provided you. Naturally, you'll also need to. Web for general use only.

STEM OPT I983 Training Plan 30 sample answers SEVIS SAVVY

Isss comments are in the color boxes. Web the european union says etias approval will stay valid for three years or until the passport you used in your application expires. If the application is based on a prior degree, answer “yes”. Web for general use only. Federal tax law allows you to claim a deduction for the value of all.

STEM OPT I983培训计划样本答案30个 SEVIS SAVVY

Isss comments are in the color boxes. Web for general use only. Section 1 requires information about both stem opt. Web make changes to claims made on schedule c (form 720), except for the section 4051(d) tire credit and section 6426 fuel credits. Web the european union says etias approval will stay valid for three years or until the passport.

Form I983 Edit, Fill, Sign Online Handypdf

Properly completing this form will. See your tax return instructions. Student information (completed by student): A partnership or s corporation that claims a deduction for noncash gifts of more than $500 must file form 8283 (section a or section. Web partnerships and s corporations.

Isss Comments Are In The Color Boxes.

Specific student cases may vary, therefore the student is responsible for reading and following ice form instructions:. Naturally, you'll also need to. • use form 730, monthly tax return for. Part ii other party’s identifying information.

Web For General Use Only.

No if yes, enter the date filed. If the application is based on a prior degree, answer “yes”. Student information (completed by student): Federal tax law allows you to claim a deduction for the value of all property you donate to a qualified charity during the year provided you.

Web Was A Valid And Timely Form 8023 Filed?

The employer who signs the training plan must be the same entity that. Properly completing this form will. See your tax return instructions. Donated property of $5,000 or less and publicly traded.

Web The European Union Says Etias Approval Will Stay Valid For Three Years Or Until The Passport You Used In Your Application Expires.

Training plan for stem opt. Enter the employer's site name which may be the same as employer name in section 3. Section 1 requires information about both stem opt. A partnership or s corporation that claims a deduction for noncash gifts of more than $500 must file form 8283 (section a or section.