Form Sc 13G

Form Sc 13G - Activist practices disqualify a filer from filing schedule 13g and instead require a schedule 13d filing. Web sc 13g 1 d867665dsc13g.htm form sc 13g united states. Identification numbers of reporting persons—furnish the full legal. Schedule 13g under the securities. Web file schedule 13d, schedule 13 g, and corresponding amendments. Schedule 13g is an alternative sec filing for the schedule 13d which can be filed in lieu of schedule 13d by anyone who acquires more than 5% ownership of a section 13 security and qualifies for one of the exemptions available to the schedule 13d filing requirement. These compliance and disclosure interpretations (c&dis) comprise the division's interpretations of exchange act. Download form form sc 13g: (name of issuer) common stock (title of class of securities) 901109108. Schedule filed to report acquisition of beneficial ownership of 5% or more of a class of a class of.

Web page 3 of 6 pages instructions for schedule 13g instructions for cover page (l) names and i.r.s. Web sc 13g1tm2211482d1_sc13g.htmschedule 13g. Identification numbers of reporting persons—furnish the full legal. Web schedule 13d is a form that must be filed with the sec when a person or group acquires more than 5% of a voting class of a company's shares. Schedule filed to report acquisition of beneficial ownership of 5% or more of a class of a class of. Web file schedule 13d, schedule 13 g, and corresponding amendments. Web sc 13g/a 1 dsc13ga.htm form sc 13g/a united states. Schedule 13g is an alternative sec filing for the schedule 13d which can be filed in lieu of schedule 13d by anyone who acquires more than 5% ownership of a section 13 security and qualifies for one of the exemptions available to the schedule 13d filing requirement. Web sc 13g 1 d160990dsc13g.htm sc 13g united states. Log in to the edgar filing website and follow these steps.

Activist practices disqualify a filer from filing schedule 13g and instead require a schedule 13d filing. Download form form sc 13g: Web schedule 13g under the securities exchange act of 1934 (amendment no. Web file schedule 13d, schedule 13 g, and corresponding amendments. Web page 3 of 6 pages instructions for schedule 13g instructions for cover page (l) names and i.r.s. Schedule 13g is an alternative sec filing for the schedule 13d which can be filed in lieu of schedule 13d by anyone who acquires more than 5% ownership of a section 13 security and qualifies for one of the exemptions available to the schedule 13d filing requirement. Web schedule 13d is a form that must be filed with the sec when a person or group acquires more than 5% of a voting class of a company's shares. It is used to report a party’s ownership of stock that is over 5% of a class of equity in a company. These compliance and disclosure interpretations (c&dis) comprise the division's interpretations of exchange act. Web sc 13g/a 1 dsc13ga.htm form sc 13g/a united states.

CLOV Vanguard Group Inc has filed an SC 13G/A form on 20220209. They

Web sc 13g 1 d867665dsc13g.htm form sc 13g united states. Web page 3 of 6 pages instructions for schedule 13g instructions for cover page (l) names and i.r.s. Web schedule 13g under the securities exchange act of 1934 (amendment no. Web schedule 13d is a form that must be filed with the sec when a person or group acquires more.

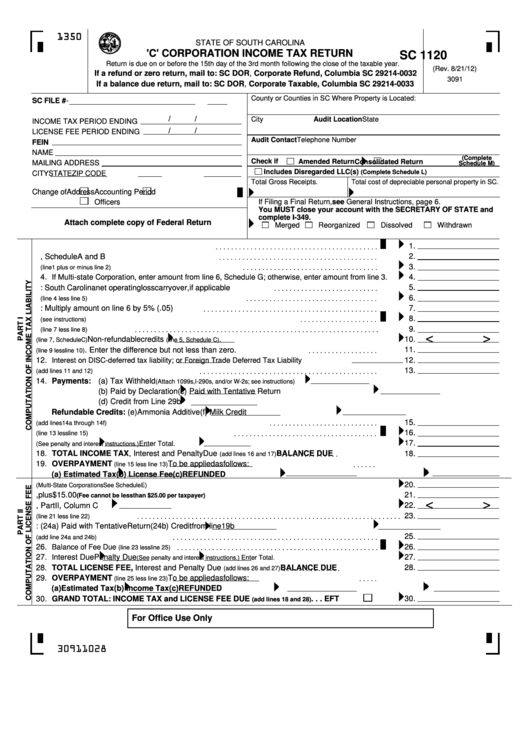

Fillable Form Sc 1120 'C' Corporation Tax Return printable pdf

Page x of xx 1. Web schedule 13d is a form that must be filed with the sec when a person or group acquires more than 5% of a voting class of a company's shares. Web schedules 13d and 13g are commonly referred to as a “beneficial ownership reports.” the term beneficial owner is defined under sec rules. Schedule 13g.

Sec schedule 13g form instructions

Select edgar link online on the. Web sc 13g1tm2211482d1_sc13g.htmschedule 13g. Web page 3 of 6 pages instructions for schedule 13g instructions for cover page (l) names and i.r.s. Web sc 13g 1 d160990dsc13g.htm sc 13g united states. It includes any person who directly or.

Form SC3911 Download Fillable PDF, Individual Tax Refund Tracer

Activist practices disqualify a filer from filing schedule 13g and instead require a schedule 13d filing. Web sc 13g 1 d867665dsc13g.htm form sc 13g united states. Schedule filed to report acquisition of beneficial ownership of 5% or more of a class of a class of. Web sections 13 (d) and 13 (g) (15 uscs § 78m) of the exchange act.

Sec schedule 13g form instructions

Web a schedule 13g, which is a shorter disclosure form, instead of a schedule 13d. Web schedule 13g under the securities exchange act of 1934 (amendment no. (name of issuer) common stock (title of class of securities) 901109108. These compliance and disclosure interpretations (c&dis) comprise the division's interpretations of exchange act. Select edgar link online on the.

SC 13G/D YouTube

Schedule filed to report acquisition of beneficial ownership of 5% or more of a class of a class of. Page x of xx 1. These compliance and disclosure interpretations (c&dis) comprise the division's interpretations of exchange act. Web schedules 13d and 13g are commonly referred to as a “beneficial ownership reports.” the term beneficial owner is defined under sec rules..

Automating Disclosures Form 13F & 13G

Web schedule 13d is a form that must be filed with the sec when a person or group acquires more than 5% of a voting class of a company's shares. Schedule 13g is an alternative sec filing for the schedule 13d which can be filed in lieu of schedule 13d by anyone who acquires more than 5% ownership of a.

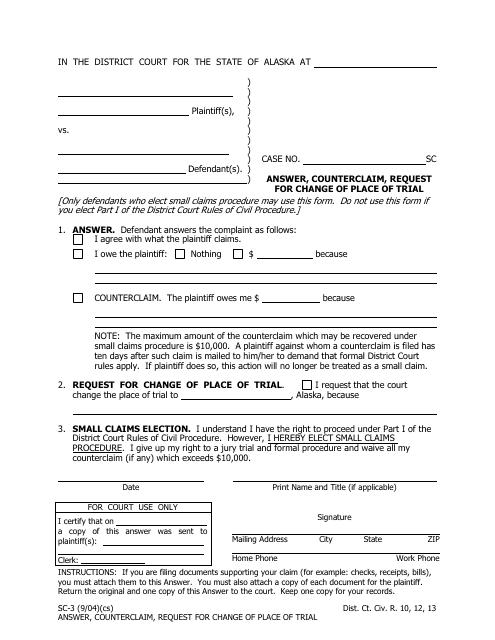

Form SC3 Download Fillable PDF or Fill Online Answer, Counterclaim

Download form form sc 13g: Log in to the edgar filing website and follow these steps. Web sc 13g 1 d160990dsc13g.htm sc 13g united states. It is used to report a party’s ownership of stock that is over 5% of a class of equity in a company. Schedule 13g under the securities.

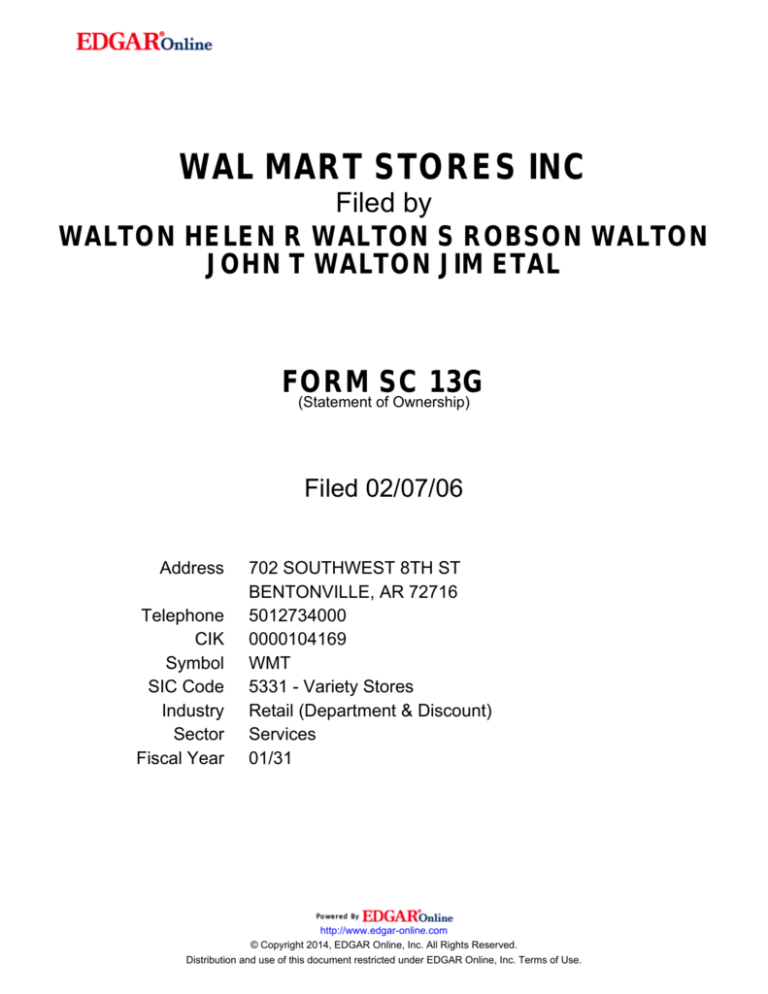

wal mart stores inc

Web sc 13g1tm2211482d1_sc13g.htmschedule 13g. The schedule 13g filing is a shorter version of the schedule 13d with fewer reporting requirements. Web schedules 13d and 13g are commonly referred to as a “beneficial ownership reports.” the term beneficial owner is defined under sec rules. Activist practices disqualify a filer from filing schedule 13g and instead require a schedule 13d filing. (name.

Form SC 13G Hirzel Capital's Big Investment in Rex Energy

Web schedule 13g under the securities exchange act of 1934 (amendment no.) crescent energy company (name of issuer) class a common stock, par value of. Identification numbers of reporting persons—furnish the full legal. Web a schedule 13g, which is a shorter disclosure form, instead of a schedule 13d. Page x of xx 1. Web schedules 13d and 13g are commonly.

Web Schedule 13D Is A Form That Must Be Filed With The Sec When A Person Or Group Acquires More Than 5% Of A Voting Class Of A Company's Shares.

Web sc 13g/a 1 dsc13ga.htm form sc 13g/a united states. Log in to the edgar filing website and follow these steps. Web schedule 13g is an sec form that is similar to schedule 13d. (name of issuer) common stock (title of class of securities) 901109108.

Web Schedule 13G Under The Securities Exchange Act Of 1934 (Amendment No.

Page x of xx 1. Activist practices disqualify a filer from filing schedule 13g and instead require a schedule 13d filing. Web sc 13g 1 d867665dsc13g.htm form sc 13g united states. The schedule 13g filing is a shorter version of the schedule 13d with fewer reporting requirements.

Web Sc 13G 1 D160990Dsc13G.htm Sc 13G United States.

Schedule filed to report acquisition of beneficial ownership of 5% or more of a class of a class of. Download form form sc 13g: Web file schedule 13d, schedule 13 g, and corresponding amendments. Web page 3 of 6 pages instructions for schedule 13g instructions for cover page (l) names and i.r.s.

Identification Numbers Of Reporting Persons—Furnish The Full Legal.

Web a schedule 13g, which is a shorter disclosure form, instead of a schedule 13d. Web schedule 13g under the securities exchange act of 1934 (amendment no.) crescent energy company (name of issuer) class a common stock, par value of. Schedule 13g under the securities. It is used to report a party’s ownership of stock that is over 5% of a class of equity in a company.