Heavy Use Tax Form 2290 Instructions

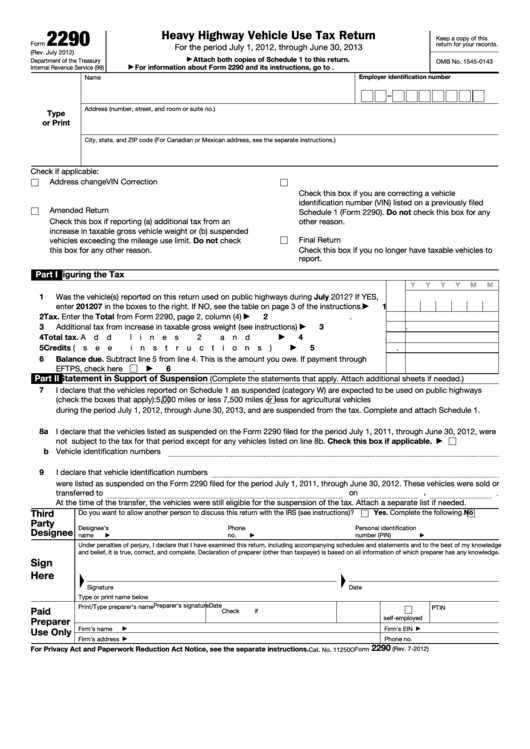

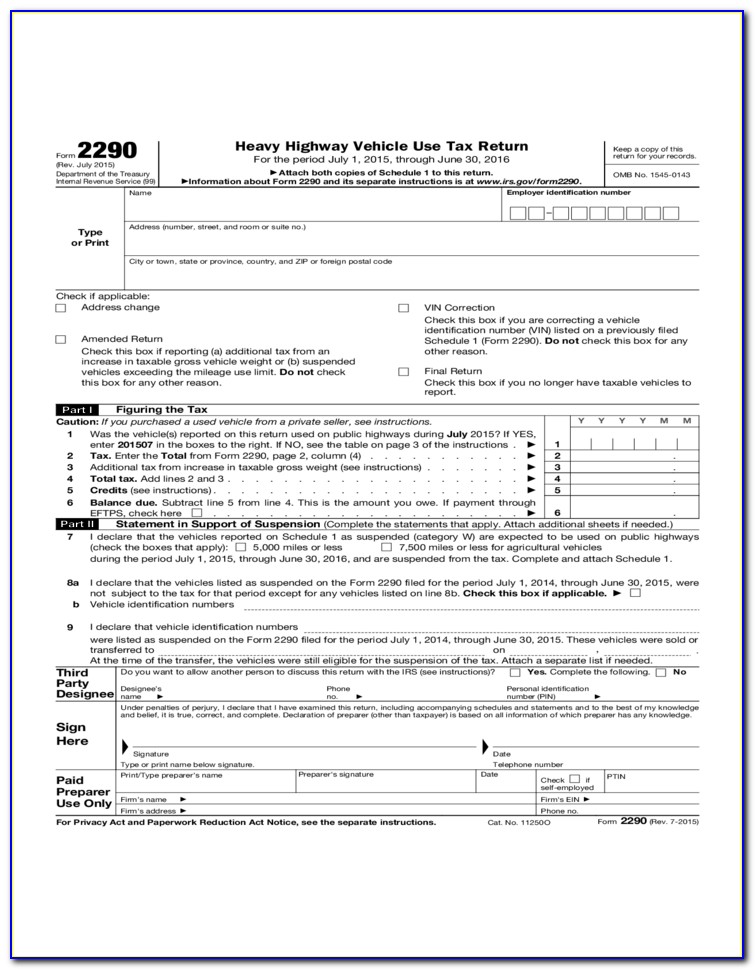

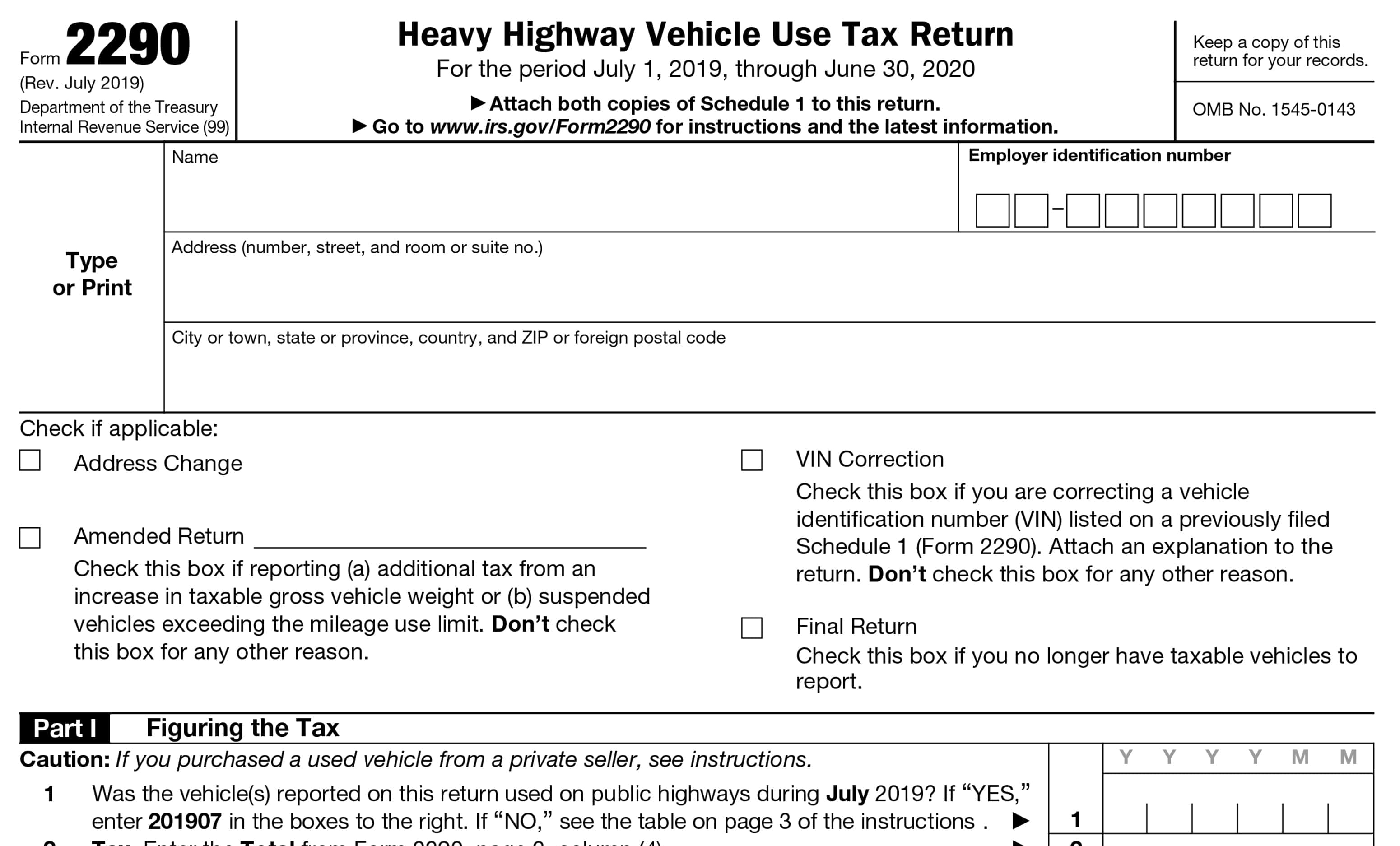

Heavy Use Tax Form 2290 Instructions - Gather your information employer identification number. Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. To obtain a prior revision of form 2290 and its separate instructions, visit. The irs mandates that everyone who owns a heavy vehicle with 5000 miles or above in the odometer should file their form 2290 before the due date. Web the heavy highway vehicle use tax is based on a vehicle gross taxable weight. Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of first use on the public highways during the reporting period must file form 2290, heavy highway vehicle use tax return. 2022 the 2290 form is used to report the annual heavy vehicle use tax. 2022 the online 2290 form is used for the filing of heavy vehicle use tax (hvut) returns. Taxable gross weight of each. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the tax period and the.

Gather your information employer identification number. When is the form 2290 due date? Web 12/6/2022 new updates printable version: It does not apply to vehicles used strictly for off road purposes. And it does apply to highway vehicles used on public roads. 2022 the 2290 form is used to report the annual heavy vehicle use tax. To obtain a prior revision of form 2290 and its separate instructions, visit. This revision if you need to file a return for a tax period that began on or before june 30, 2023. Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of first use on the public highways during the reporting period must file form 2290, heavy highway vehicle use tax return. Web this july 2023 revision is for the tax period beginning on july 1, 2023, and ending on june 30, 2024.

It does not apply to vehicles used strictly for off road purposes. And it does apply on highway motor vehicles with a taxable gross weight of 55,000 pounds or more. And it does apply to highway vehicles used on public roads. To obtain a prior revision of form 2290 and its separate instructions, visit. When is the form 2290 due date? This revision if you need to file a return for a tax period that began on or before june 30, 2023. The form is used to report the taxable use of heavy vehicles duri. Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of first use on the public highways during the reporting period must file form 2290, heavy highway vehicle use tax return. Web a trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more must complete and file form 2290 to figure out and pay hvut with the irs every tax year. Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles.

2290 heavy use tax 3451892290 heavy use tax 2020

Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of first use on the public highways during the reporting period must file form 2290, heavy highway vehicle use tax return. Web 12/6/2022 new updates printable version: When is.

2290 Heavy Highway Tax Form 2017 Universal Network

Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of first use on the public highways during the reporting period must file form 2290, heavy highway vehicle use tax return. And it does apply to highway vehicles used.

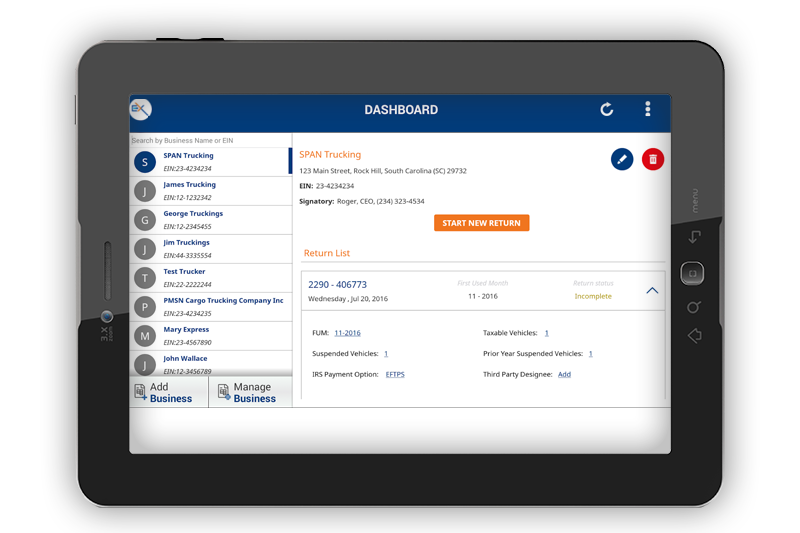

Efile HVUT (Heavy Vehicle Use Tax) Form 2290 for 20222023

The irs mandates that everyone who owns a heavy vehicle with 5000 miles or above in the odometer should file their form 2290 before the due date. And it does apply to highway vehicles used on public roads. Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000.

When to Fill Out a Heavy Use Tax Form 2290 by taxform2290 s Issuu

It does not apply to vehicles used strictly for off road purposes. Taxable gross weight of each. And it does apply on highway motor vehicles with a taxable gross weight of 55,000 pounds or more. Irs form 2290 instructions can be found on the irs website. And it does apply to highway vehicles used on public roads.

Heavy Vehicle Use Tax Form 2290 Schedule 1 Form Resume Examples

And it does apply to highway vehicles used on public roads. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. The form is used to report the taxable use of heavy vehicles duri. Form 2290 is used to figure and pay the tax due on certain heavy.

Heavy Vehicle Use Tax and Form 2290 DrivePFS

And it does apply on highway motor vehicles with a taxable gross weight of 55,000 pounds or more. You cannot use your social security number don't have an ein? Taxable gross weight of each. To obtain a prior revision of form 2290 and its separate instructions, visit. Web form 2290 is an irs tax form that you need to file.

Heavy Vehicle Use Tax Form 2290 Schedule 1 Form Resume Examples

Taxable gross weight of each. Web a trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more must complete and file form 2290 to figure out and pay hvut with the irs every tax year. Web the heavy highway vehicle use tax is based.

Heavy Highway Use Tax Form 2290 Due Date Form Resume Examples

Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. Vehicle identification number of each vehicle. Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the.

IRS Form 2290 Instructions How to Fill HVUT 2290 Form

When is the form 2290 due date? 2022 the online 2290 form is used for the filing of heavy vehicle use tax (hvut) returns. Taxable gross weight of each. To obtain a prior revision of form 2290 and its separate instructions, visit. Web the heavy highway vehicle use tax is based on a vehicle gross taxable weight.

Irs 2290 Form Instructions Form Resume Examples a6YnOeWVBg

Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more. 2022 the online 2290 form is used for the filing of heavy vehicle use tax (hvut) returns. Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross.

Web The Heavy Highway Vehicle Use Tax Is Based On A Vehicle Gross Taxable Weight.

This revision if you need to file a return for a tax period that began on or before june 30, 2023. 2022 the 2290 form is used to report the annual heavy vehicle use tax. Web a trucker owner or a driver who registers in their name of a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more must complete and file form 2290 to figure out and pay hvut with the irs every tax year. Web form 2290 is an irs tax form that you need to file if you own a heavy vehicle weighing 55,000 pounds or more.

Gather Your Information Employer Identification Number.

Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Web this july 2023 revision is for the tax period beginning on july 1, 2023, and ending on june 30, 2024. Web anyone who has registered or is required to register a heavy highway motor vehicle with a taxable gross weight of 55,000 pounds or more in their name at the time of first use on the public highways during the reporting period must file form 2290, heavy highway vehicle use tax return. To obtain a prior revision of form 2290 and its separate instructions, visit.

Taxable Gross Weight Of Each.

Form 2290 is used to figure and pay the tax due on certain heavy highway motor vehicles. Vehicle identification number of each vehicle. And it does apply to highway vehicles used on public roads. Irs form 2290 instructions can be found on the irs website.

2022 The Online 2290 Form Is Used For The Filing Of Heavy Vehicle Use Tax (Hvut) Returns.

It does not apply to vehicles used strictly for off road purposes. The irs mandates that everyone who owns a heavy vehicle with 5000 miles or above in the odometer should file their form 2290 before the due date. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined later) is registered, or required to be registered, in your name under state, district of columbia, canadian, or mexican law at the time of its first use during the tax period and the. The form is used to report the taxable use of heavy vehicles duri.