Maryland Tax Form Pv

Maryland Tax Form Pv - Web maryland form pv personal tax payment voucher for form 502/505, estimated tax and extensions print using blue or black ink only. Comptroller of maryland payment processing po box 8888. If you are sending a form. Sign it in a few clicks. Web form pv worksheet is a maryland individual income tax form. Payment with resident return (502) tax year: Web 505 payment tax year: Payment voucher with instructions and worksheet for individuals sending check or. Web estimated tax worksheet instructions $1,000 each for taxpayer and spouse if age 65 or over $3,200 for each allowable dependent, other than payment voucher. Web if you live in maryland and work in washington, d.c., pennsylvania, virginia or west virginia, you should file your state income tax return with maryland.

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. The form pv is used to remit payments for form 502 or 505, and estimated. Web form pv worksheet is a maryland individual income tax form. Web 18 rows maryland resident income tax return: Web form pvw is a maryland individual income tax form. Web 505 payment tax year: Filing this form extends the time to file your return, but does not extend the time to pay. Sign it in a few clicks. View history of payments filed via this system. This year i do not expect to owe any maryland income tax.

Web in addition, if you plan to file a form 502 or form 505 electronically and pay any balance due with a check or money order, you must complete form pv (personal tax payment. The form pv replaced the ind pv for remitting payments. Web estimated tax worksheet instructions $1,000 each for taxpayer and spouse if age 65 or over $3,200 for each allowable dependent, other than payment voucher. Payment with nonresident return (505) tax year: Payment with resident return (502) tax year: This year i do not expect to owe any maryland income tax. If you are sending a form. Web you may submit paper tax forms and payments at any of the local branch offices between 8:30 a.m. View history of payments filed via this system. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who.

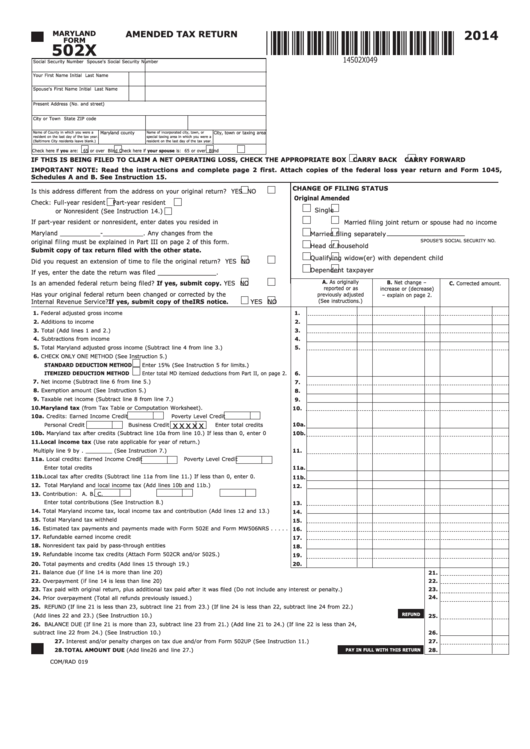

Fillable Maryland Form 502x Amended Tax Return 2014 printable pdf

Web printable 2022 maryland form pvw (payment voucher worksheet for estimated tax and extension payments) to keep our site running and our information free. Personal tax payment voucher for form 502/505, estimated tax and extensions. Filing this form extends the time to file your return, but does not extend the time to pay. Web maryland form pv personal tax payment.

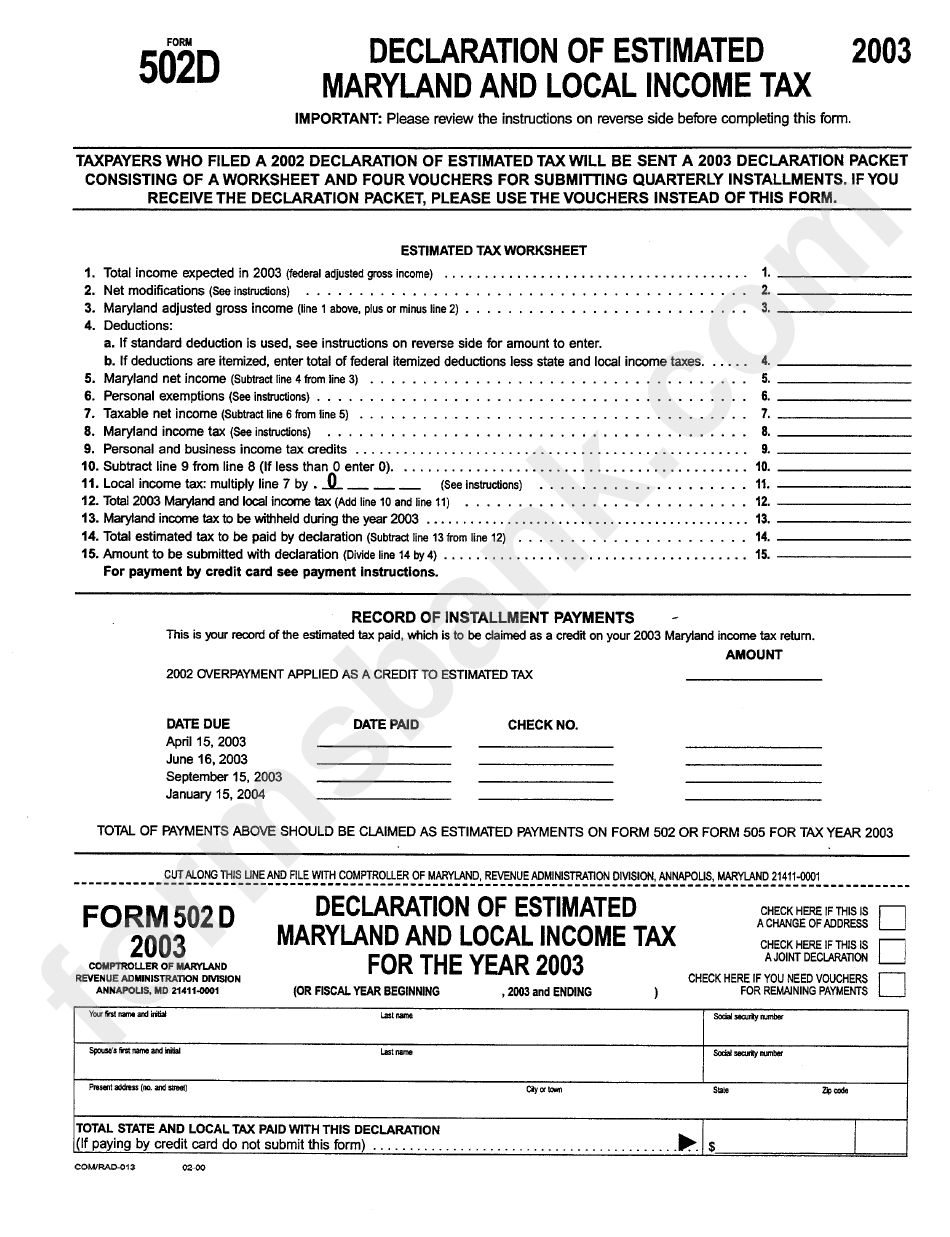

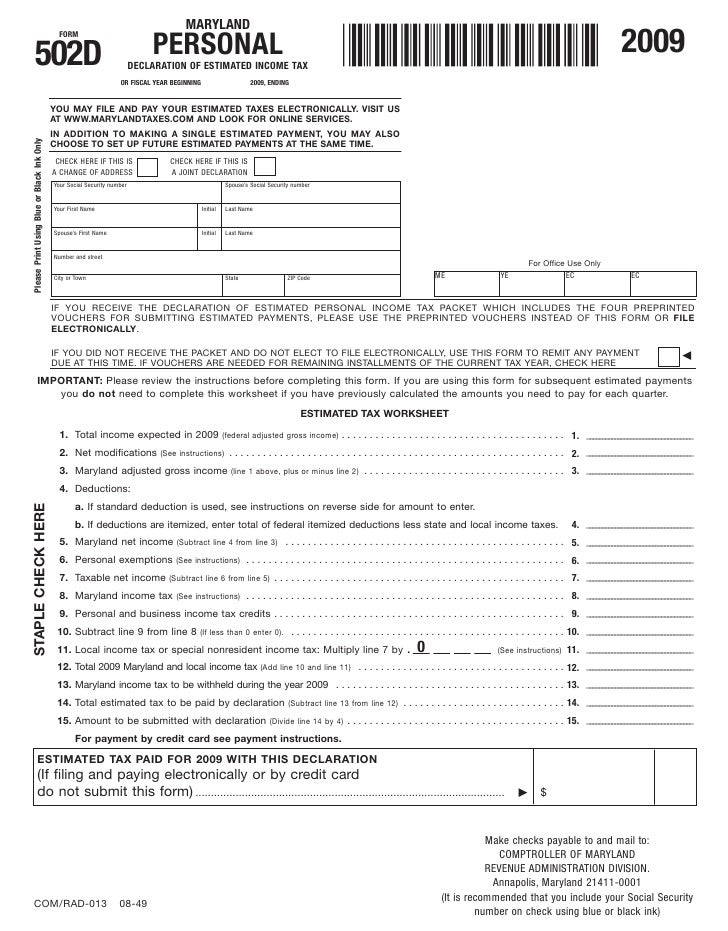

2012 Form MD 502D Fill Online, Printable, Fillable, Blank pdfFiller

New account extension payment comptroller of marylandtax year: Web printable 2022 maryland form pvw (payment voucher worksheet for estimated tax and extension payments) to keep our site running and our information free. Web maryland form pv personal tax payment voucher for form 502/505, estimated tax and extensions print using blue or black ink only. Edit your maryland form ind pv.

Maryland Estimated Tax Form 2020

Web form pv worksheet is a maryland individual income tax form. Web payment is sent using the form pv. Payment with resident return (502) tax year: Web 505 payment tax year: Type text, add images, blackout confidential details, add comments, highlights and more.

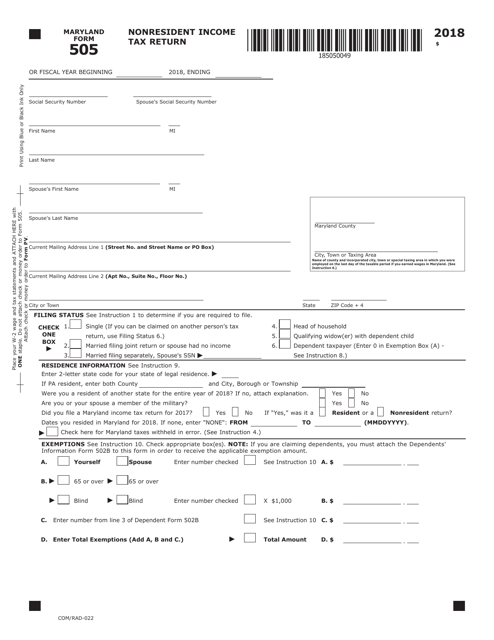

Form COM/RAD022 (Maryland Form 505) Download Fillable PDF or Fill

This year i do not expect to owe any maryland income tax. The form pv replaced the ind pv for remitting payments. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Payment voucher with instructions and worksheet for individuals sending check or. Sign it in a few clicks.

Form 502d Declaration Of Estimated Maryland And Lockal Tax

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who. Comptroller of maryland payment processing po box 8888. If you are sending a form. The form pv replaced the ind pv for remitting payments. Web 505 payment tax year:

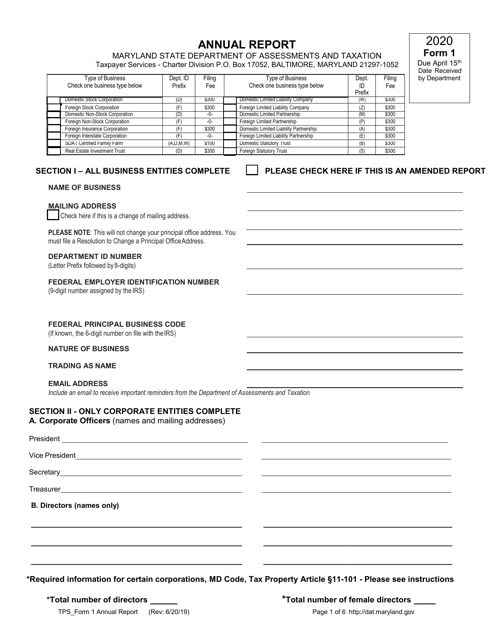

MD Form 129 2020 Fill out Tax Template Online US Legal Forms

Web online payment application options. Comptroller of maryland payment processing po box 8888. Web you may submit paper tax forms and payments at any of the local branch offices between 8:30 a.m. The form pv replaced the ind pv for remitting payments. Web follow the instructions on form pv to request an automatic extension on filing your return.

Maryland Pv Form Fill Online, Printable, Fillable, Blank pdfFiller

Web 505 payment tax year: Sign it in a few clicks. Web maryland form pv personal tax payment voucher for form 502/505, estimated tax and extensions print using blue or black ink only. Comptroller of maryland payment processing po box 8888. The form pv is used to remit payments for form 502 or 505, and estimated.

Maryland Tax Forms 2021 2022 W4 Form

Payment with resident return (502) tax year: View history of payments filed via this system. Payment with nonresident return (505) tax year: Web follow the instructions on form pv to request an automatic extension on filing your return. Web the form ind pv is a payment voucher you will send with your check or money order for any balance due.

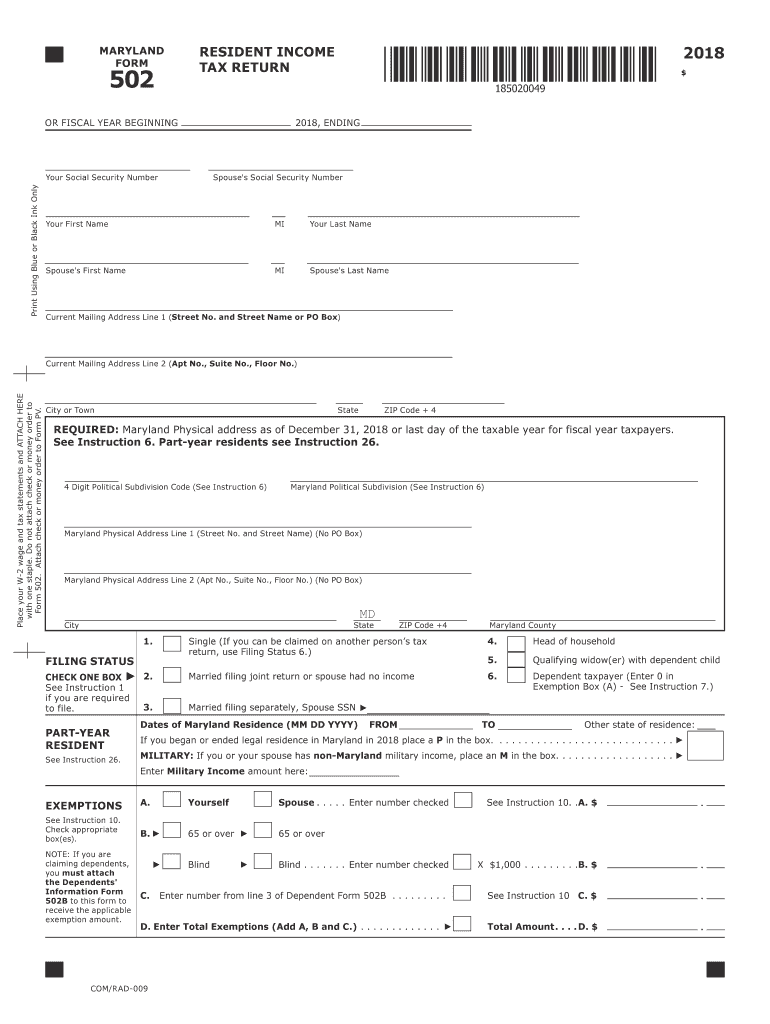

Md 502 instructions 2018 Fill out & sign online DocHub

Type text, add images, blackout confidential details, add comments, highlights and more. Web maryland form pv personal tax payment voucher for form 502/505, estimated tax and extensions print using blue or black ink only. Web 505 payment tax year: Sign it in a few clicks. Web form pvw is a maryland individual income tax form.

If you are selfemployed or do not have Maryland taxes withhel…

Filing this form extends the time to file your return, but does not extend the time to pay. Web estimated tax worksheet instructions $1,000 each for taxpayer and spouse if age 65 or over $3,200 for each allowable dependent, other than payment voucher. Web follow the instructions on form pv to request an automatic extension on filing your return. If.

Payment With Nonresident Return (505) Tax Year:

Web online payment application options. Web the form ind pv is a payment voucher you will send with your check or money order for any balance due on the “total amount due” line of your form 502 or form 505. Comptroller of maryland payment processing po box 8888. While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who.

If You Are Sending A Form.

Payment voucher with instructions and worksheet for individuals sending check or. The form pv is used to remit payments for form 502 or 505, and estimated. Web payment is sent using the form pv. Sign it in a few clicks.

The Form Pv Replaced The Ind Pv For Remitting Payments.

Payment with resident return (502) tax year: View history of payments filed via this system. Web form pv worksheet is a maryland individual income tax form. Type text, add images, blackout confidential details, add comments, highlights and more.

Web In Addition, If You Plan To File A Form 502 Or Form 505 Electronically And Pay Any Balance Due With A Check Or Money Order, You Must Complete Form Pv (Personal Tax Payment.

While most taxpayers have income taxes automatically withheld every pay period by their employer, taxpayers who earn. Personal tax payment voucher for form 502/505, estimated tax and extensions. This year i do not expect to owe any maryland income tax. Web last year i did not owe any maryland income tax and had a right to a full refund of all income tax withheld and b.