How Much Is 2290 Form

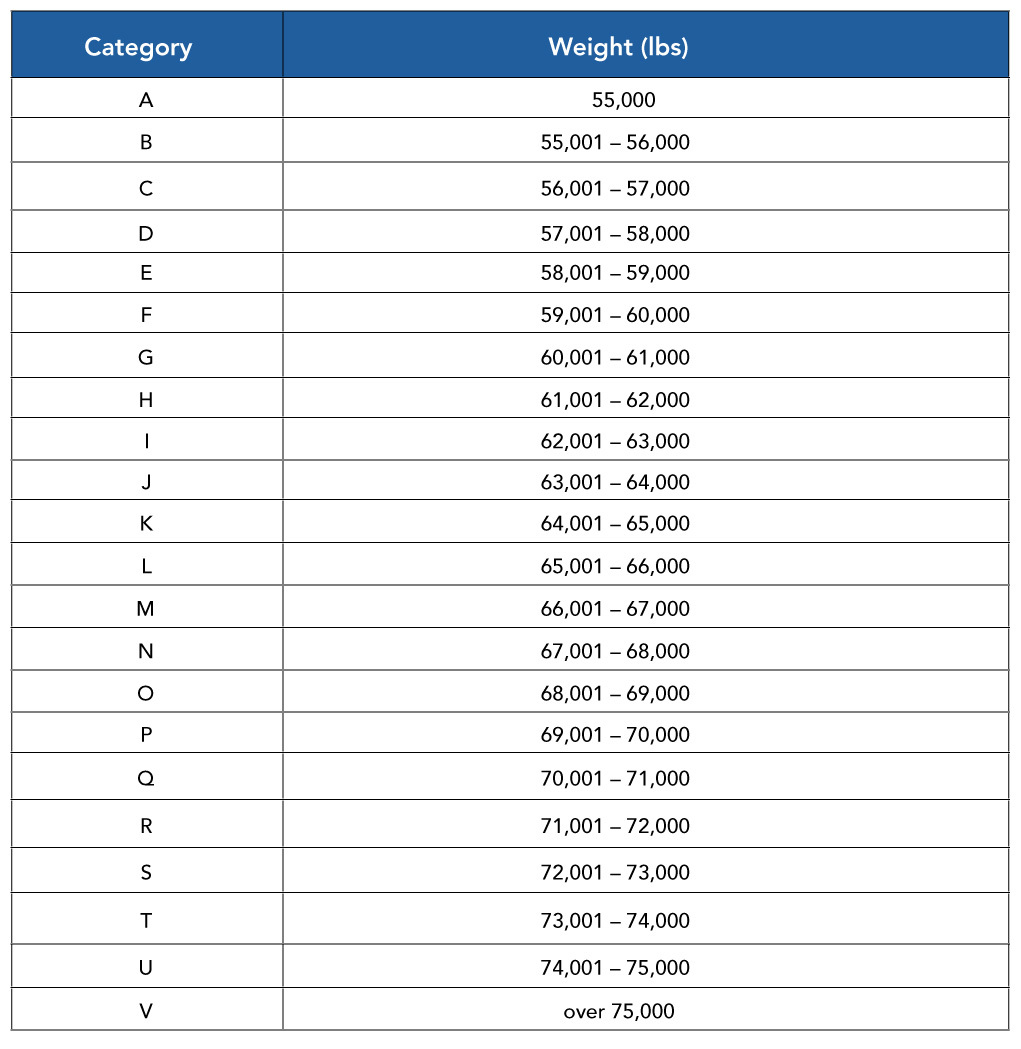

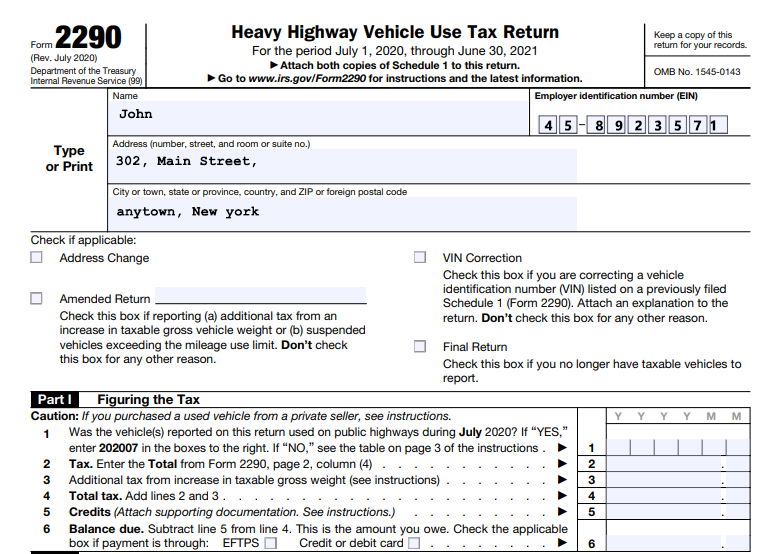

How Much Is 2290 Form - Web 25 vehicles or more: Web what is the cost to file form 2290? Web figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. One truck (single vehicle) $ 14.90: Choose to pay per filing. Web if the vehicle only traveled 3,000 miles during that time, you can claim a credit on form 2290 (or refund on form 8849) after june 30, 2022. Do i have to file 2290 after buying. Try it for free now! And it does apply on highway motor vehicles with a taxable gross weight of 55,000 pounds or. How much does it cost?

Keller's pricing is set up to accommodate any size fleet or filing frequency. Web essentially, hvut is the federal program, and the form 2290 is the tax return used to comply with the filing requirements under the program. General instructions purpose of form use form 2290 for the following actions. How much does it cost? And it does apply on highway motor vehicles with a taxable gross weight of 55,000 pounds or. Figure and pay the tax due on a vehicle for. Do i have to file 2290 after buying. Web how much does 2290 tax cost? $59.99 annual subscription (1 ein, unlimited forms and unlimited trucks): And there’s kind of two answers.

Web pricing depends heavily on which service you choose; And it does apply on highway motor vehicles with a taxable gross weight of 55,000 pounds or. File form 2290 for vehicles weighing 55,000 pounds or more. Medium fleet (25 to 100 vehicles) $ 89.90: How much does it cost? It is always good to determine the estimated tax amount for form 2290 federal heavy vehicle use taxes in advance. One truck (single vehicle) $ 14.90: Do i have to file 2290 after buying. Figure and pay the tax due on a vehicle for. Web buyer's tax computation for a used vehicle privately purchased on or after july 1, 2022, but before june 1, 2023, from a seller who has paid the tax for the current period,.

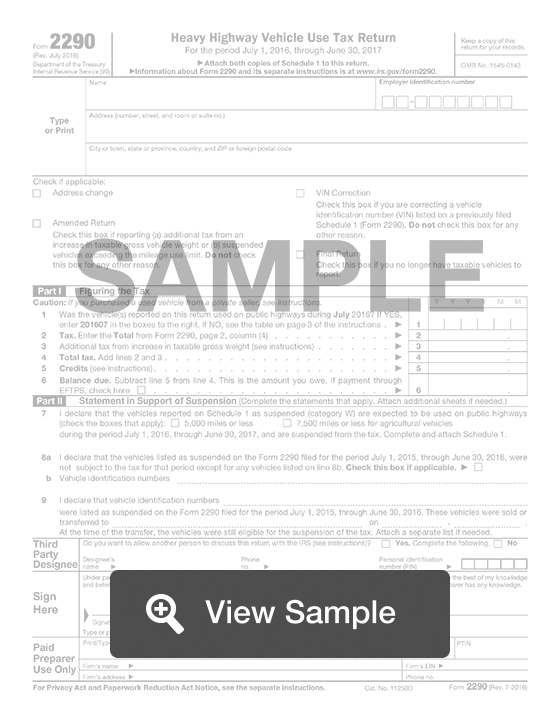

Download Form 2290 for Free Page 3 FormTemplate

File form 2290 for vehicles weighing 55,000 pounds or more. File your 2290 online & get schedule 1 in minutes. $59.99 annual subscription (1 ein, unlimited forms and unlimited trucks): Select the ‘first used month‘. It is always good to determine the estimated tax amount for form 2290 federal heavy vehicle use taxes in advance.

Instant IRS Form 2290 Schedule 1 Proof Efile 2290 Form HVUT 2290

File form 2290 for vehicles weighing 55,000 pounds or more. Get ready for tax season deadlines by completing any required tax forms today. Web the heavy highway vehicle use tax is based on a vehicle gross taxable weight. Mini fleet (2 vehicles) $ 25.90: Web buyer's tax computation for a used vehicle privately purchased on or after july 1, 2022,.

What is Taxable Gross Weight on Form 2290?

Web buyer's tax computation for a used vehicle privately purchased on or after july 1, 2022, but before june 1, 2023, from a seller who has paid the tax for the current period,. $59.99 annual subscription (1 ein, unlimited forms and unlimited trucks): Web 25 vehicles or more: It is always good to determine the estimated tax amount for form.

202021 IRS Printable Form 2290 Fill & Download 2290 for 6.90

General instructions purpose of form use form 2290 for the following actions. Web 25 vehicles or more: One truck (single vehicle) $ 14.90: Small fleet (3 to 24 vehicles) $ 44.90: It is always good to determine the estimated tax amount for form 2290 federal heavy vehicle use taxes in advance.

File IRS Form 2290 Online Heavy Vehicle Use Tax (HVUT) Return

Web figure and pay the tax due on highway motor vehicles used during the period with a taxable gross weight of 55,000 pounds or more. Get ready for tax season deadlines by completing any required tax forms today. Web know your estimated tax amount for your trucks here! General instructions purpose of form use form 2290 for the following actions..

File 20222023 Form 2290 Electronically 2290 Schedule 1

Web pricing depends heavily on which service you choose; How much does it cost? Web 2290 form must be filed by every trucker who operates heavy vehicles on public highways with a gross vehicle weight of 55,000 pounds or more and covers a mileage of 5000. Web the heavy highway vehicle use tax is based on a vehicle gross taxable.

Instructions For Form 2290 For 2018 Form Resume Examples djVaq1nVJk

Small fleet (3 to 24 vehicles) $ 44.90: How much does it cost? Figure and pay the tax due on a vehicle for. General instructions purpose of form use form 2290 for the following actions. Web 2290 form must be filed by every trucker who operates heavy vehicles on public highways with a gross vehicle weight of 55,000 pounds or.

√99以上 2290 form irs.gov 6319142290 form irs.gov

General instructions purpose of form use form 2290 for the following actions. Try it for free now! File form 2290 for vehicles weighing 55,000 pounds or more. Select the ‘first used month‘. Ad upload, modify or create forms.

IRS Form 2290 Truck Tax Return Fill Out Online PDF FormSwift

Web know your estimated tax amount for your trucks here! Figure and pay the tax due on a vehicle for. Small fleet (3 to 24 vehicles) $ 44.90: It is always good to determine the estimated tax amount for form 2290 federal heavy vehicle use taxes in advance. Web how much does 2290 tax cost?

Web Essentially, Hvut Is The Federal Program, And The Form 2290 Is The Tax Return Used To Comply With The Filing Requirements Under The Program.

Figure and pay the tax due on a vehicle for. Web buyer's tax computation for a used vehicle privately purchased on or after july 1, 2022, but before june 1, 2023, from a seller who has paid the tax for the current period,. And there’s kind of two answers. Web know your estimated tax amount for your trucks here!

And It Does Apply On Highway Motor Vehicles With A Taxable Gross Weight Of 55,000 Pounds Or.

Web 25 vehicles or more: One truck (single vehicle) $ 14.90: Medium fleet (25 to 100 vehicles) $ 89.90: File form 2290 for vehicles weighing 55,000 pounds or more.

Web Figure And Pay The Tax Due On Highway Motor Vehicles Used During The Period With A Taxable Gross Weight Of 55,000 Pounds Or More.

How much does it cost? Web if the vehicle only traveled 3,000 miles during that time, you can claim a credit on form 2290 (or refund on form 8849) after june 30, 2022. Web how much does 2290 tax cost? File your 2290 online & get schedule 1 in minutes.

Get Ready For Tax Season Deadlines By Completing Any Required Tax Forms Today.

Mini fleet (2 vehicles) $ 25.90: Web 2290 form must be filed by every trucker who operates heavy vehicles on public highways with a gross vehicle weight of 55,000 pounds or more and covers a mileage of 5000. It is always good to determine the estimated tax amount for form 2290 federal heavy vehicle use taxes in advance. Ad upload, modify or create forms.