How To Report Sale Of Residence On Form 1041

How To Report Sale Of Residence On Form 1041 - Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Web form 1041 is an irs tax return to report income generated by assets held in an estate or trust. Go to screen 22, dispositions. Don’t complete for a simple trust or a pooled income fund. However, the estate gets step up of basis to fmv at the time of death, so there should be no gain to report on the. Worksheets are included in publication 523, selling your home, to help you figure the: Solved • by intuit • 156 • updated july 14, 2022. Web if you determine that section 121 is eligible for your fiduciary return, you must manually enter the exclusion using one of two methods: Web the home sale must be reported on the 1041. Web home how do i enter a sale of home in a 1041 return using interview forms?

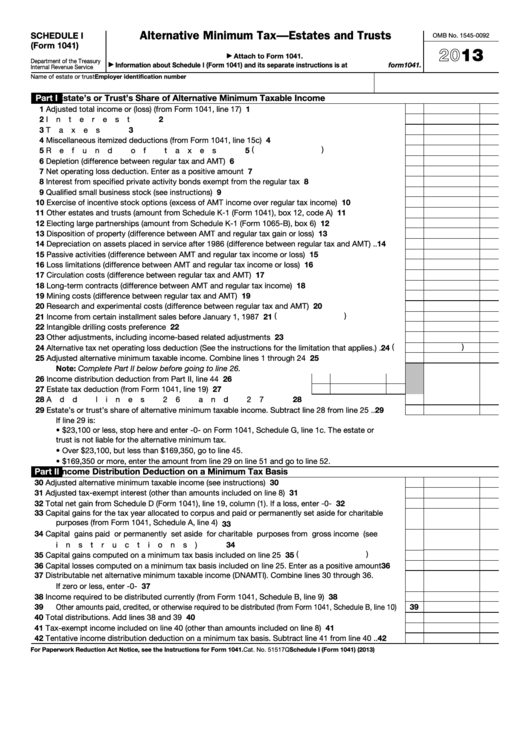

Web the home sale must be reported on the 1041. Web every domestic estate with gross income of $600 or more during a tax year must file a form 1041. Web it is common in an estate to sell the home of the decedent through the probate action. Use schedule d to report the following. This article will walk you through entering a sale of home in the. Web 1 best answer tagteam level 15 can this loss be distributed to his beneficiaries? yes, provided the estate was the legal owner of the residence and held. Web if you determine that section 121 is eligible for your fiduciary return, you must manually enter the exclusion using one of two methods: Go to screen 22, dispositions. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d.

1041 (2022) form 1041 (2022) page. The income, deductions, gains, losses, etc. Web how to report sale of decedent's residence on form 1041 Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Web use form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule. 2 schedule a charitable deduction. If one or more of the beneficiaries of the domestic estate are nonresident aliens,. Web it is common in an estate to sell the home of the decedent through the probate action. Within the 1041 fiduciary returns, there is not a specific sale of home interview form. Web to report a gain or loss from sale on a fiduciary return:

A 2021 Overview of IRS Form 1041 Schedules

Web the home sale must be reported on the 1041. Form 1041 shows the income, losses, capital. Of the estate or trust. Worksheets are included in publication 523, selling your home, to help you figure the: 2 schedule a charitable deduction.

20192022 Form IRS 1041N Fill Online, Printable, Fillable, Blank

If it's within 6 months of the date of death, than you can. Web home how do i enter a sale of home in a 1041 return using interview forms? Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Go to screen 22, dispositions. This article will walk you through entering a.

IRS Form 1041 Reporting an Tax Return for a Deceased Taxpayer

Web 1 best answer tagteam level 15 can this loss be distributed to his beneficiaries? yes, provided the estate was the legal owner of the residence and held. Web form 1041 is an irs tax return to report income generated by assets held in an estate or trust. He passed away in 2019 at which time the living trust became.

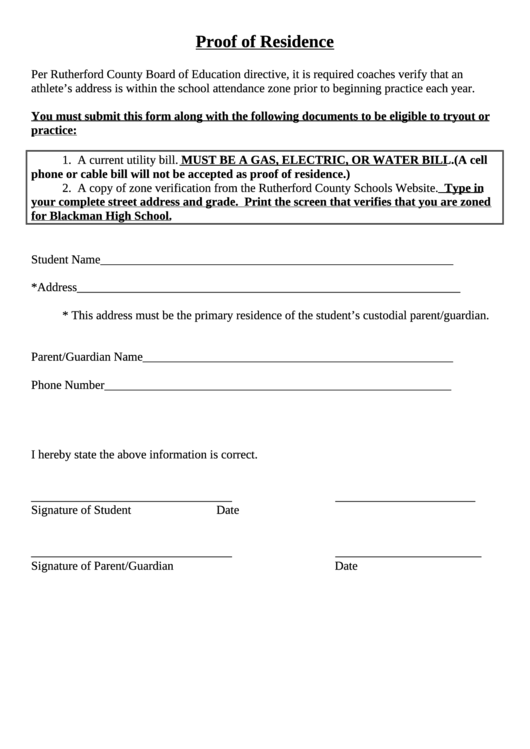

Proof Of Residence Form printable pdf download

Web instead, a schedule is attached to the form 1041 showing each stock transaction separately and in the same detail as john doe (grantor and owner) will need to report these. The income, deductions, gains, losses, etc. Web home how do i enter a sale of home in a 1041 return using interview forms? Web to report a gain or.

Top 45 Form 1041 Templates free to download in PDF format

Web use form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule. 2 schedule a charitable deduction. Of the estate or trust. Go to screen 22, dispositions. He passed away in 2019 at which time the living trust became an.

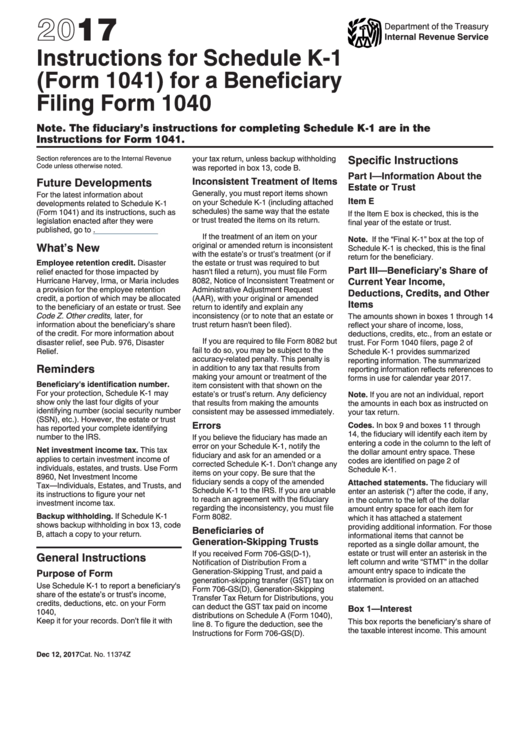

IRS Form 1041T Download Fillable PDF or Fill Online Allocation of

Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: Form 1041 shows the income, losses, capital. Of the estate or trust. Web form 1041 is an irs tax return to report income generated by assets held in an estate or trust. Go to screen 22, dispositions.

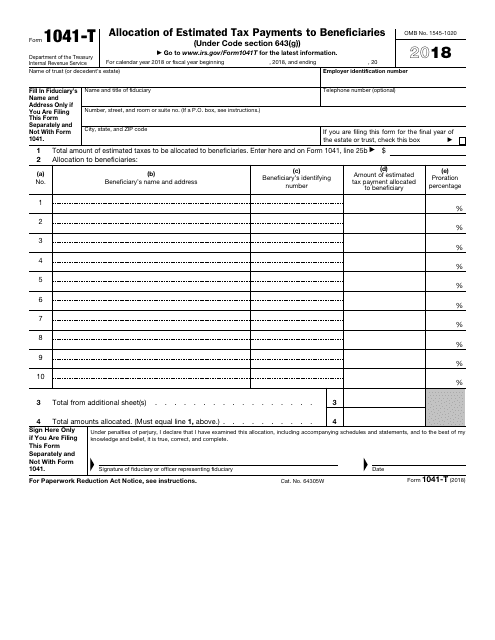

Fillable Schedule I (Form 1041) Alternative Minimum TaxEstates And

Go to screen 22, dispositions. However, the estate gets step up of basis to fmv at the time of death, so there should be no gain to report on the. Form 1041 shows the income, losses, capital. Select the income, then dispositions, then the schedule d/4797/etc section. 1041 (2022) form 1041 (2022) page.

U.S. Tax Return for Estates and Trusts, Form 1041

If one or more of the beneficiaries of the domestic estate are nonresident aliens,. Web home how do i enter a sale of home in a 1041 return using interview forms? Web instead, a schedule is attached to the form 1041 showing each stock transaction separately and in the same detail as john doe (grantor and owner) will need to.

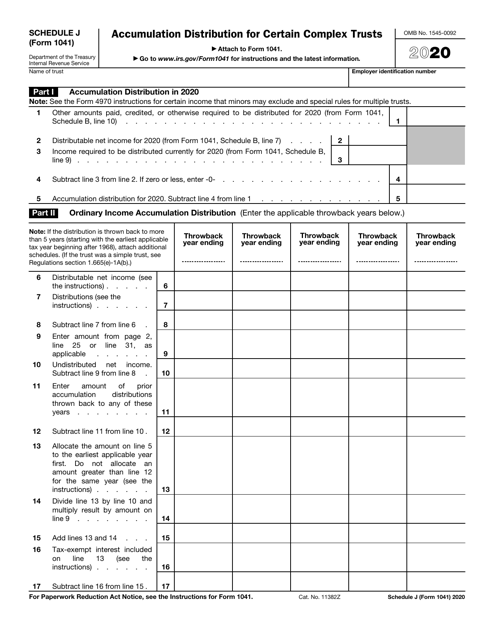

IRS Form 1041 Schedule J Download Fillable PDF or Fill Online

Web you cannot deduct a loss from the sale of your main home. Go to screen 22, dispositions. Within the 1041 fiduciary returns, there is not a specific sale of home interview form. Web use form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule. If it's within 6.

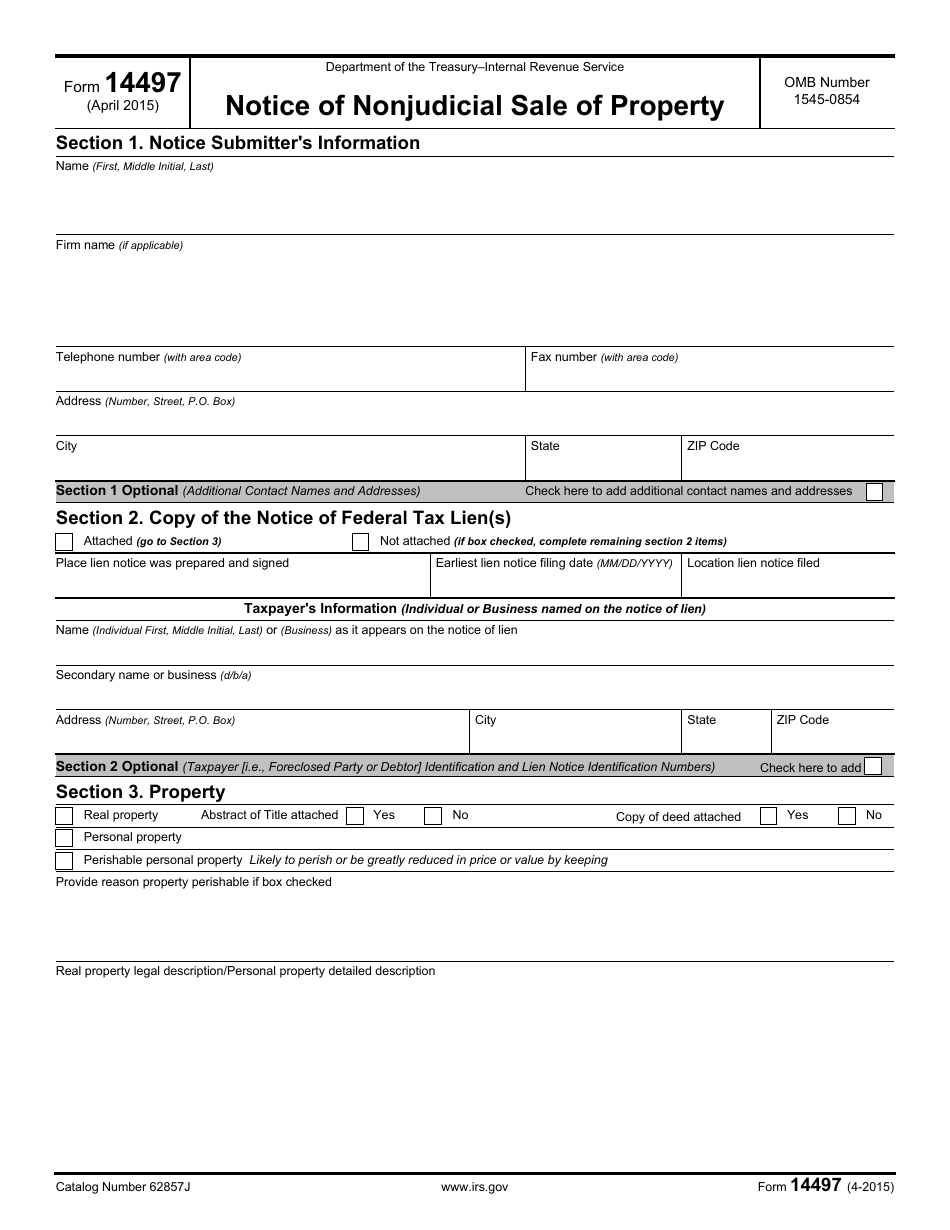

IRS Form 14497 Download Fillable PDF or Fill Online Notice of

Of the estate or trust. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d. Enter the description of property. Web it is common in an estate to sell the home of the decedent through the probate action. Web form 1041 is an irs tax return to report income generated by assets held.

This Article Will Walk You Through Entering A Sale Of Home In The.

If it's within 6 months of the date of death, than you can. Web the fiduciary of a domestic decedent's estate, trust, or bankruptcy estate files form 1041 to report: • the overall capital gains and. Complete form 8949 before you complete line 1b, 2, 3, 8b, 9, or 10 of schedule d.

Web Instead, A Schedule Is Attached To The Form 1041 Showing Each Stock Transaction Separately And In The Same Detail As John Doe (Grantor And Owner) Will Need To Report These.

He passed away in 2019 at which time the living trust became an. Don’t complete for a simple trust or a pooled income fund. However, the estate gets step up of basis to fmv at the time of death, so there should be no gain to report on the. Web use form 8949 to report the sale or exchange of a capital asset (defined later) not reported on another form or schedule.

Of The Estate Or Trust.

If one or more of the beneficiaries of the domestic estate are nonresident aliens,. Web home how do i enter a sale of home in a 1041 return using interview forms? Form 1041 shows the income, losses, capital. Web form 1041 is an irs tax return to report income generated by assets held in an estate or trust.

Web Assuming No Family Member Lived In It, And It's Just Being Sold In The Estate To Distribute, Then You'd Need To Report The Sale.

Web use the following procedure to report the sale of a personal residence with a section 121 exclusion for an estate/trust. Web to report a gain or loss from sale on a fiduciary return: Solved • by intuit • 156 • updated july 14, 2022. Go to screen 22, dispositions.