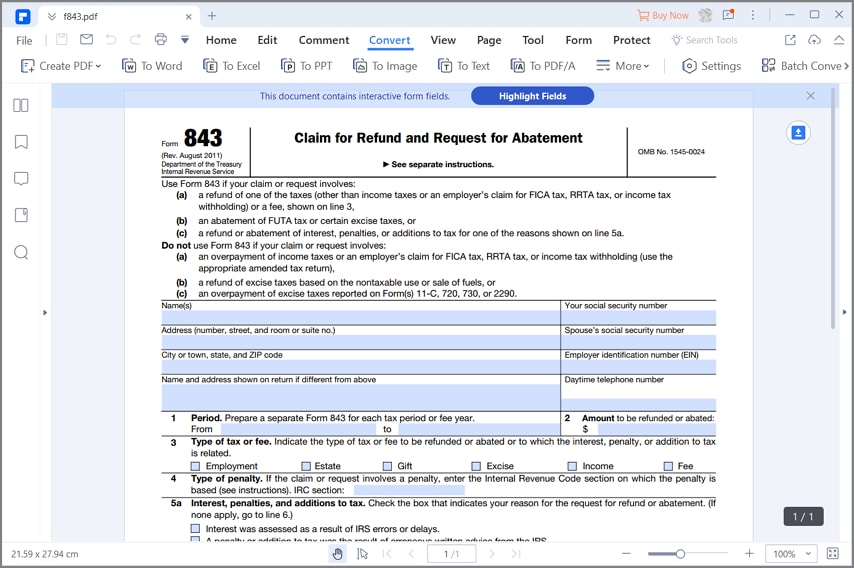

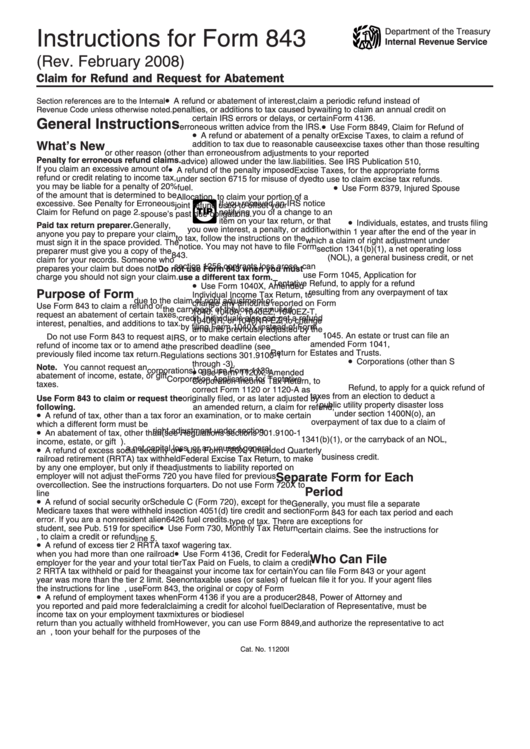

Instructions For Form 843

Instructions For Form 843 - If you fail to file the form. A copy of your visa. Web form 843 is available in the 1040, 1120, 1120s, 990, 706 and 709 packages. Web generally, form 843 must be filed within 3 years from the date that you filed the original return or 2 years from the date that you paid a tax. See where to file and branded prescription drug fee. Form question instructions question 1: Your name, address, and social security number. Indicate the dates that you were employed where medicare taxes were withheld. The service center where you would be required to file a current year tax. This form requires the following basic information:

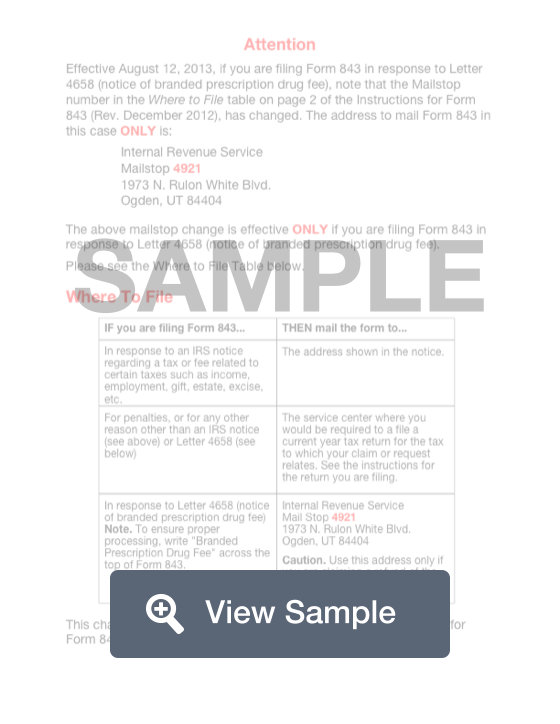

If you fail to file the form. Click on claim for refund (843). Check the box print form 843 with complete return. This form requires the following basic information: If you are filing form 843 to claim a refund of. Web the instructions for form 843 state that for penalties, the form should be mailed to: In response to letter 4658 (notice of branded prescription drug fee) note. Web see the instructions for the return you are filing. Nerdwallet users get 25% off federal and state filing costs. Web we last updated federal form 843 in february 2023 from the federal internal revenue service.

The service center where you would be required to file a current year tax. Web attach the following items to form 843: Check the box print form 843 with complete return. Claim for refund and request for abatement, and attach their rationale and evidence to support their reasonable cause. Web instructions for filling out the form 843 by question. Nerdwallet users get 25% off federal and state filing costs. If you fail to file the form. This form is for income earned in tax year 2022, with tax returns due in april. See where to file and branded prescription drug fee. Web filling out irs form 843.

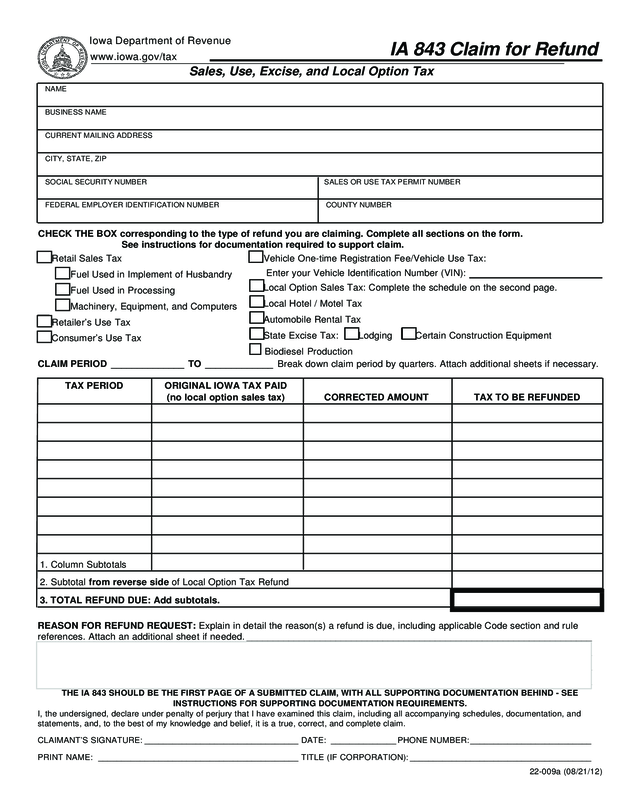

Instructions For Form 843 Claim For Refund And Request For Abatement

Web taxpayers can complete form 843: Claim for refund and request for abatement, and attach their rationale and evidence to support their reasonable cause. Web a covered entity that paid the branded prescription drug fee must file form 843 to claim a refund. This form is for income earned in tax year 2022, with tax returns due in april. Check.

Form 843 Claim for Refund and Request for Abatement Definition

To ensure proper processing, write. Form question instructions question 1: Web instructions for filling out the form 843 by question. See where to file and branded prescription drug fee. Web see the instructions for the return you are filing.

Form 843 Penalty Abatement Request & Reasonable Cause

See where to file and branded prescription drug fee. Check the instructions for form 843 for where to mail. If you are filing form 843 to claim a refund of. Web generally, form 843 must be filed within 3 years from the date that you filed the original return or 2 years from the date that you paid a tax..

Form 843 Penalty Abatement Request & Reasonable Cause

This form is for income earned in tax year 2022, with tax returns due in april. Web form 843 is available in the 1040, 1120, 1120s, 990, 706 and 709 packages. If you are filing form 843 to claim a refund of. If you fail to file the form. Click on claim for refund (843).

Formulaire 843 de l'IRS Remplissezle correctement

See where to file and branded prescription drug fee. In response to letter 4658 (notice of branded prescription drug fee) note. Web we last updated federal form 843 in february 2023 from the federal internal revenue service. Web see the instructions for the return you are filing. Web taxpayers can complete form 843:

Form 843 Refund & Abatement Request Fill Out Online PDF FormSwift

If you fail to file the form. Web the instructions for form 843 state that for penalties, the form should be mailed to: Web use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. Your name, address, and social security number. Web filling out irs form 843.

Instructions for Form 843, Claim for Refund and Request for Abatement

This form requires the following basic information: Claim for refund and request for abatement, and attach their rationale and evidence to support their reasonable cause. Form question instructions question 1: Web attach the following items to form 843: Check the instructions for form 843 for where to mail.

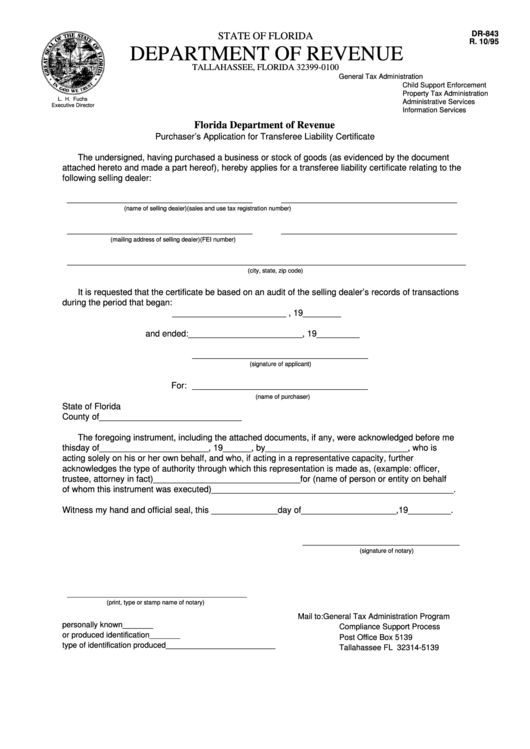

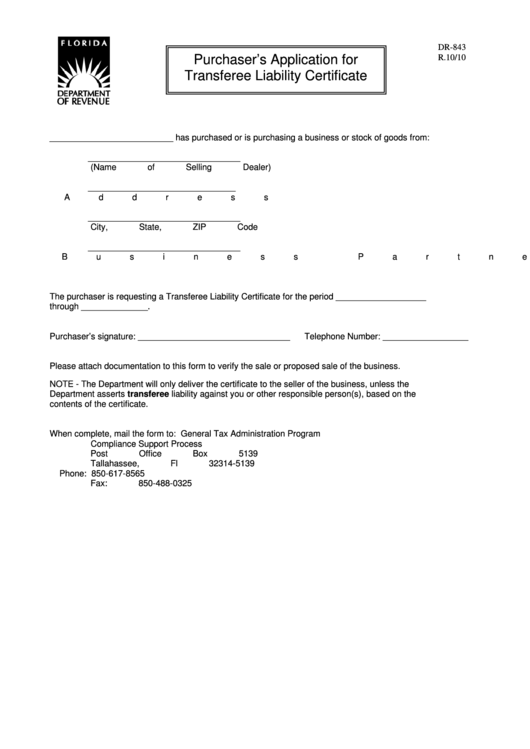

Fillable Form Dr843 Purchaser'S Application For Transferee Liability

To ensure proper processing, write. Web a covered entity that paid the branded prescription drug fee must file form 843 to claim a refund. Web form 843 is available in the 1040, 1120, 1120s, 990, 706 and 709 packages. If you are filing form 843 to claim a refund of. Web attach the following items to form 843:

Form Dr843 Purchaser'S Application For Transferee Liability

This form is for income earned in tax year 2022, with tax returns due in april. Claim for refund and request for abatement, and attach their rationale and evidence to support their reasonable cause. Your name, address, and social security number. A copy of your visa. Web go to the input return tab.

Web We Last Updated Federal Form 843 In February 2023 From The Federal Internal Revenue Service.

Web the instructions for form 843 state that for penalties, the form should be mailed to: Indicate the dates that you were employed where medicare taxes were withheld. This form requires the following basic information: To ensure proper processing, write.

Web Form 843 Is Available In The 1040, 1120, 1120S, 990, 706 And 709 Packages.

Form question instructions question 1: This form is for income earned in tax year 2022, with tax returns due in april. Web filling out irs form 843. Web generally, form 843 must be filed within 3 years from the date that you filed the original return or 2 years from the date that you paid a tax.

Click On Claim For Refund (843).

Claim for refund and request for abatement, and attach their rationale and evidence to support their reasonable cause. Web see the instructions for the return you are filing. The service center where you would be required to file a current year tax. Your name, address, and social security number.

Web Taxpayers Can Complete Form 843:

Web a covered entity that paid the branded prescription drug fee must file form 843 to claim a refund. Web use form 843 to claim a refund or request an abatement of certain taxes, interest, penalties, fees, and additions to tax. In response to letter 4658 (notice of branded prescription drug fee) note. A copy of your visa.

:max_bytes(150000):strip_icc()/843-ClaimforRefundandRequestforAbatement-f50c59124198404abb88bc50a5f81fc4.png)