Irs Schedule 1 Form 2290

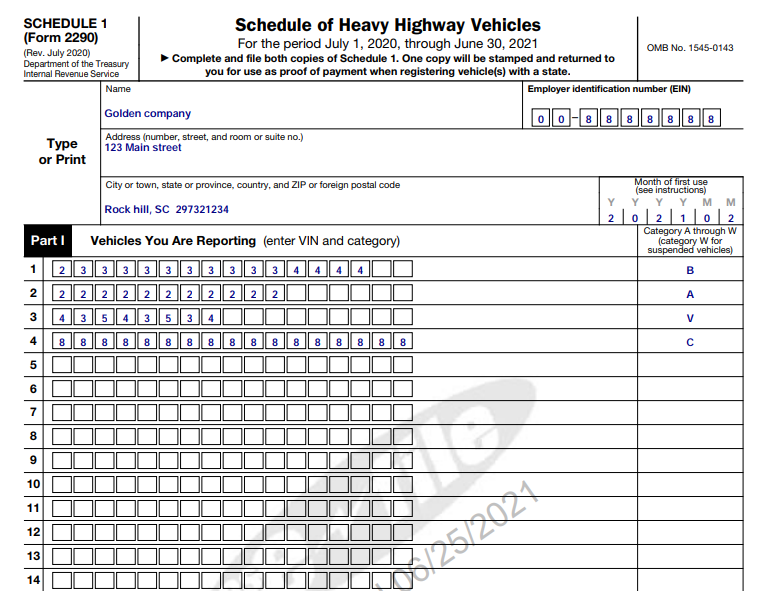

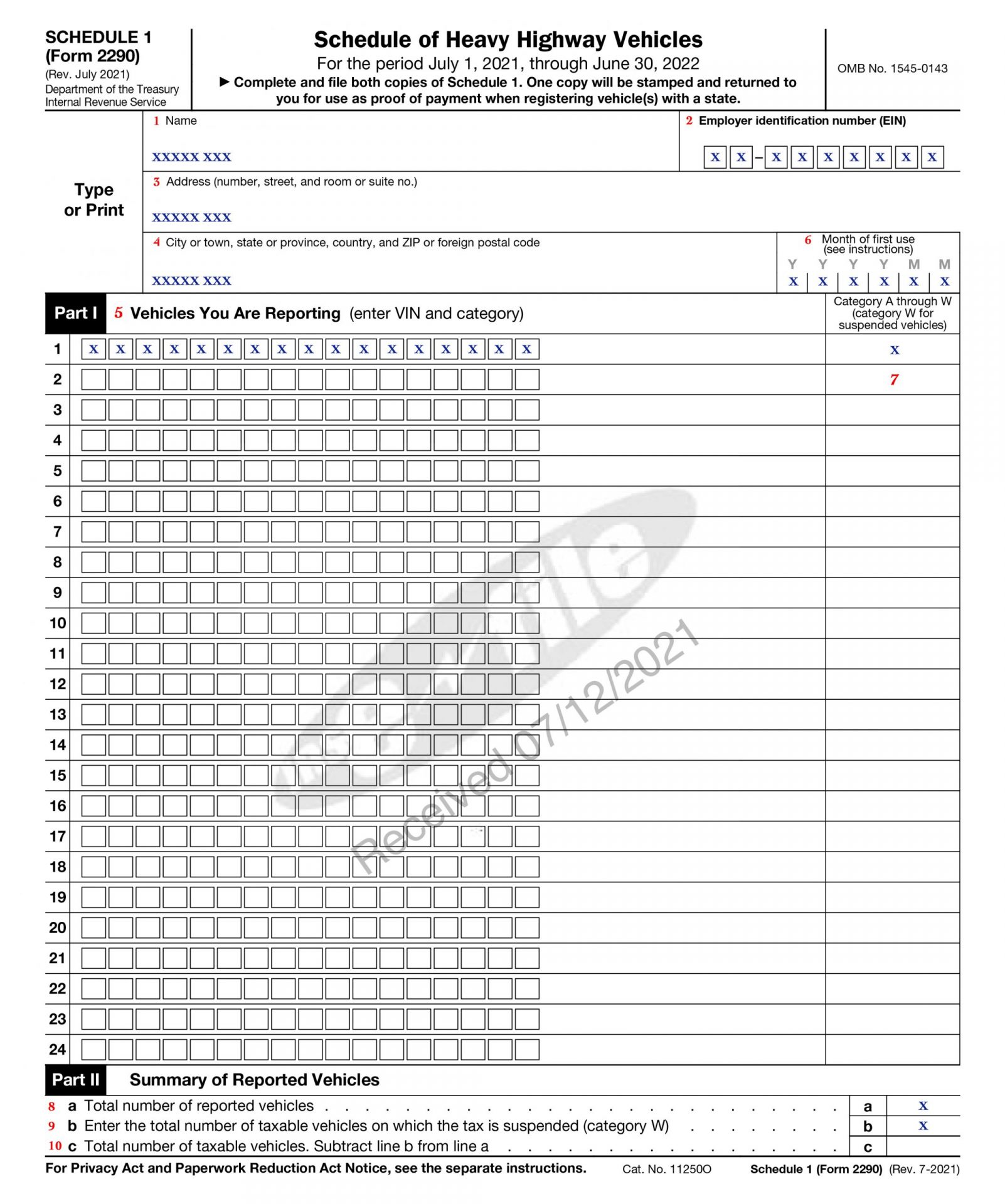

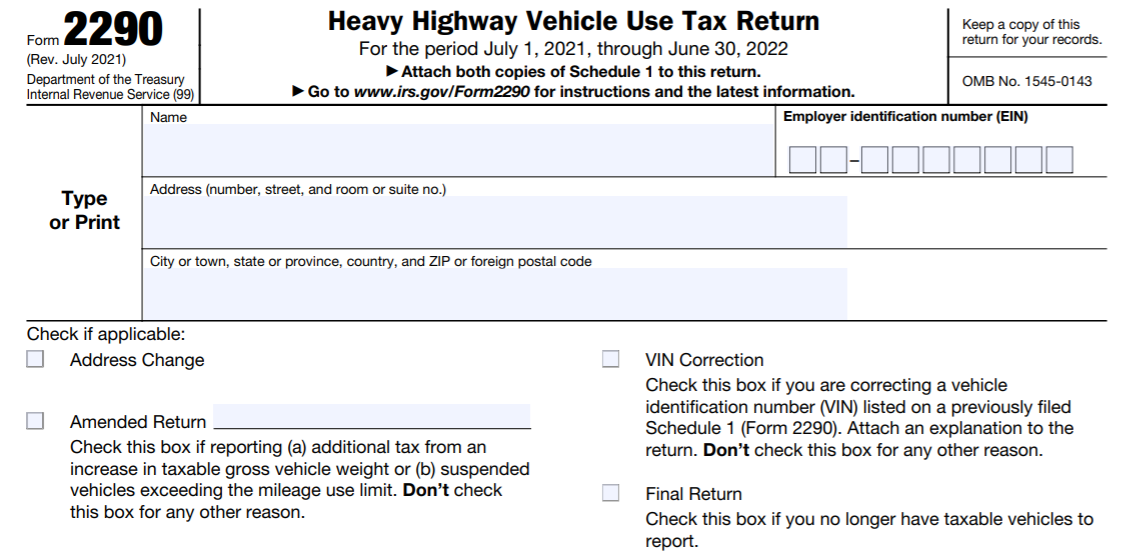

Irs Schedule 1 Form 2290 - July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through. Web experience the convenience of filing your irs form 2290 with ez2290 and get your schedule 1 now! Get schedule 1 via email, fax,. Easy, fast, secure & free to try. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022. Get expert assistance with simple 2290 @ $6.95. Web the stamped schedule 1, also known as irs form 2290 schedule 1, is a document issued by the irs to confirm that the heavy vehicle use tax has been filed for. Ad need help with irs form 2290 tax filing? Web a state shall accept as proof of payment a photocopy of the form 2290 (with the schedule 1 attached) which was filed with the internal revenue service for the vehicle being. Web a stamped form 2290 schedule 1 is proof of your heavy vehicle use tax (hvut) payment which will be sent by the irs to you once you file your form 2290.

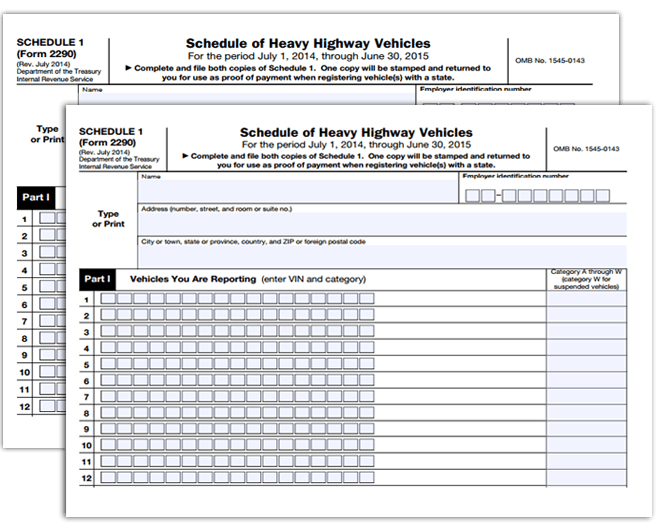

To report all vehicles for which you are reporting tax (including an increase in taxable gross weight) and those. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through. Get schedule 1 via email, fax,. Do your truck tax online & have it efiled to the irs! Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Web form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Get automatic updates via email or text.

Form 2290 stamped schedule 1 is a proof of payment for the heavy vehicle use tax (hvut) that is paid annually by truckers operating. Web a stamped form 2290 schedule 1 is proof of your heavy vehicle use tax (hvut) payment which will be sent by the irs to you once you file your form 2290. Web what is form 2290 stamped schedule 1? Easy, fast, secure & free to try. Do your truck tax online & have it efiled to the irs! Web form 2290 or heavy vehicle used tax [hvut] has to be used to report heavy truck tax to the irs. Web whether you are an owner, limited liability company (llc), corporation, partnership, or other type of organisation (including nonprofits, educational institutions,. Get automatic updates via email or text. Ad need help with irs form 2290 tax filing? Get schedule 1 via email, fax,.

IRS_Form_2290_Schedule_1 by steve sanders Issuu

July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through. Web information about form 2290, heavy highway vehicle use tax return, including recent updates, related forms, and instructions on how to file. Ad access irs tax forms. Easy, fast, secure & free to try. Get.

IRS Schedule 1 Form 2290 Get Stamped Schedule 1 in minutes

Web form 2290 or heavy vehicle used tax [hvut] has to be used to report heavy truck tax to the irs. Web what is form 2290 stamped schedule 1? Complete, edit or print tax forms instantly. Simple & secure service for filing form 2290 online. Web whether you are an owner, limited liability company (llc), corporation, partnership, or other type.

2017 Form IRS 2290 Fill Online, Printable, Fillable, Blank pdfFiller

Get expert assistance with simple 2290 @ $6.95. Get ready for tax season deadlines by completing any required tax forms today. Even if your vehicle is. Web form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first used during the tax period. Form 2290 filers must.

Get Form 2290 Schedule 1 in Minutes HVUT Proof of Payment

Web a stamped form 2290 schedule 1 is proof of your heavy vehicle use tax (hvut) payment which will be sent by the irs to you once you file your form 2290. Web the irs 2290 schedule 1 is the proof of highway tax payment that contains the digital irs watermark stamp. Web whether you are an owner, limited liability.

Ssurvivor 2290 Tax Form Printable

Do your truck tax online & have it efiled to the irs! Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. Complete, edit or print tax forms instantly. Web experience the convenience of filing your irs.

File IRS Form 2290 Online Heavy Vehicle Use Tax (HVUT) Return

Web form 2290 or heavy vehicle used tax [hvut] has to be used to report heavy truck tax to the irs. Complete, edit or print tax forms instantly. Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the.

IRS Form 2290 Printable for 202122 Download 2290 for 6.90

Web a state shall accept as proof of payment a photocopy of the form 2290 (with the schedule 1 attached) which was filed with the internal revenue service for the vehicle being. Ad need help with irs form 2290 tax filing? Even if your vehicle is. Web schedule 1 (form 2290)—month of first use. Ad access irs tax forms.

Schedule 1 2290 IRS Form 2290 Schedule 1 eForm 2290

Web what is form 2290 stamped schedule 1? Get automatic updates via email or text. Web form 2290 or heavy vehicle used tax [hvut] has to be used to report heavy truck tax to the irs. Web schedule 1 (form 2290)—month of first use. Web whether you are an owner, limited liability company (llc), corporation, partnership, or other type of.

Form 2290 The Trucker's Bookkeeper

Web form 2290 or heavy vehicle used tax [hvut] has to be used to report heavy truck tax to the irs. Our online platform is designed with your needs in mind, making it. Complete, edit or print tax forms instantly. Web a state shall accept as proof of payment a photocopy of the form 2290 (with the schedule 1 attached).

File Tax 2290 File 2290 Online 2290 Tax Form

Ad access irs tax forms. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022. Get automatic updates via email or text. Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june.

Web Whether You Are An Owner, Limited Liability Company (Llc), Corporation, Partnership, Or Other Type Of Organisation (Including Nonprofits, Educational Institutions,.

Web form 2290 schedule 1 is a document issued by the internal revenue service (irs) that serves as proof of payment for the heavy vehicle use tax (hvut). Ad get schedule 1 in minutes, your form 2290 is efiled directly to the irs. July 2021) heavy highway vehicle use tax return department of the treasury internal revenue service (99) for the period july 1, 2021, through june 30, 2022. Web a state shall accept as proof of payment a photocopy of the form 2290 (with the schedule 1 attached) which was filed with the internal revenue service for the vehicle being.

Easy, Fast, Secure & Free To Try.

Web schedule 1 (form 2290)—month of first use. Web the irs 2290 schedule 1 is the proof of highway tax payment that contains the digital irs watermark stamp. Get ready for tax season deadlines by completing any required tax forms today. If the gross taxable weight is from 55,000 to 75,000 pounds, the hvut is $100, plus $22.

Web A Stamped Form 2290 Schedule 1 Is Proof Of Your Heavy Vehicle Use Tax (Hvut) Payment Which Will Be Sent By The Irs To You Once You File Your Form 2290.

Web what is form 2290 stamped schedule 1? Web experience the convenience of filing your irs form 2290 with ez2290 and get your schedule 1 now! Web you must file form 2290 and schedule 1 for the tax period beginning on july 1, 2023, and ending on june 30, 2024, if a taxable highway motor vehicle (defined below) is. July 2020) departrnent of the treasury internal revenue service (99) name heavy highway vehicle use tax return for the period july 1 , 2020, through.

Complete, Edit Or Print Tax Forms Instantly.

Every truck holder must pay the heavy vehicle use tax. Form 2290 filers must enter the month of first use in schedule 1 to indicate when the vehicles included in schedule 1 were first. To report all vehicles for which you are reporting tax (including an increase in taxable gross weight) and those. Even if your vehicle is.