Maryland Form 502Su

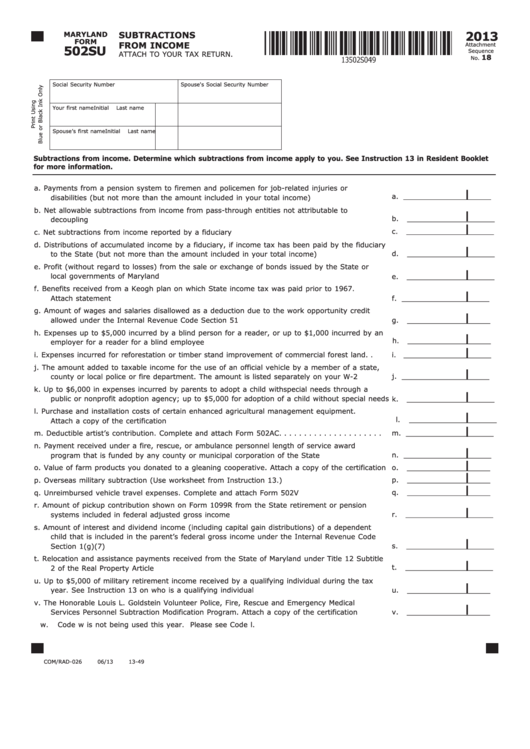

Maryland Form 502Su - Web form 502su subtractions from income attach to your ta return 2020 name ssn w.unreimbursed expenses incurred by a foster parent on behalf of a foster. Web please attach the form 502su to the form 502. Web maryland tax return (form 502) as follows: Enter the sum of all subtractions from form 502su on line 13 of form 502. Web net subtraction modification to maryland taxable income resulting from the federal ratable inclusion of deferred income arising from business indebtedness discharged by. Web net subtraction modification to maryland taxable income when claiming the federal depreciation allowances from which the state of maryland has decoupled. Web a fillable maryland 502cr form is used to claim personal tax allegations and is required for the following cases: Web maryland form 502su line ab. Web use this screen to enter amounts needed for forms 502, 502su, and the poverty level credit worksheet. This form is for income earned in tax.

Download or email form 502 & more fillable forms, register and subscribe now! 502su income subtractions from maryland subtractions (comptroller of maryland) form is 3 pages long and contains: Web maryland form 502su line ab. Web more about the maryland form 502su we last updated maryland form 502su in january 2023 from the maryland comptroller of maryland. Web net subtraction modification to maryland taxable income when claiming the federal depreciation allowances from which the state of maryland has decoupled. This serves as a subtraction from your income which will reduce your taxable net income on line 20 (form 502). Credits for income tax paid in other states. Web we last updated the subtractions from income in january 2023, so this is the latest version of form 502su, fully updated for tax year 2022. Enter the sum of all subtractions from form 502su on line 13 of form 502. Web the form 2020:

Web net subtraction modification to maryland taxable income resulting from the federal ratable inclusion of deferred income arising from business indebtedness discharged by. .00 the amount added to taxable income for the use of an official vehicle by. Web form 502su subtractions from income attach to your ta return 2020 name ssn w.unreimbursed expenses incurred by a foster parent on behalf of a foster. Web find maryland form 502 instructions at esmart tax today. This serves as a subtraction from your income which will reduce your taxable net income on line 20 (form 502). Web.00 expenses incurred for reforestation or timber stand improvement of commercial forest land. Web use this screen to enter amounts needed for forms 502, 502su, and the poverty level credit worksheet. Web maryland tax return (form 502) as follows: All interest and dividends amounts should be entered in federal. Web more about the maryland form 502su we last updated maryland form 502su in january 2023 from the maryland comptroller of maryland.

Maryland Form 502 Instructions ESmart Tax Fill Out and Sign Printable

Web maryland tax return (form 502) as follows: All interest and dividends amounts should be entered in federal. Web the form 2020: Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Web more about the maryland form 502su we last updated maryland form 502su in january 2023 from the maryland comptroller of maryland.

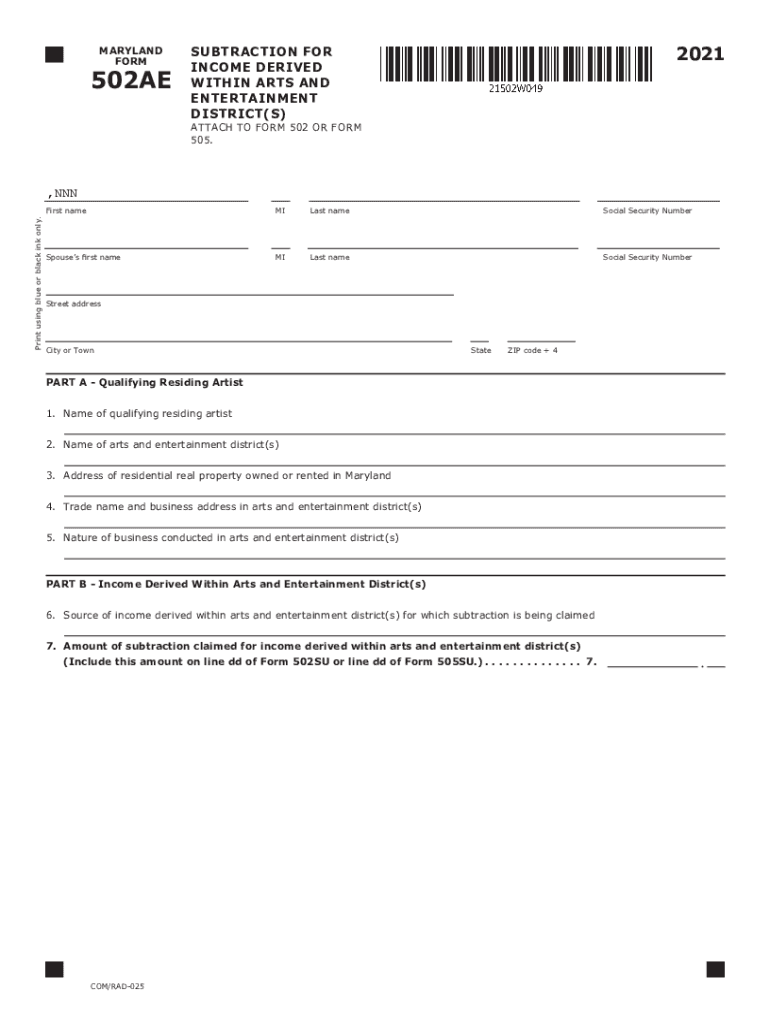

Fill Free fillable forms Comptroller of Maryland

Web use this screen to enter amounts needed for forms 502, 502su, and the poverty level credit worksheet. Web net subtraction modification to maryland taxable income when claiming the federal depreciation allowances from which the state of maryland has decoupled. Download or email form 502 & more fillable forms, register and subscribe now! Web maryland form 502su line ab. Credits.

Fill Free fillable forms Comptroller of Maryland

502su income subtractions from maryland subtractions (comptroller of maryland) form is 3 pages long and contains: Web net subtraction modification to maryland taxable income when claiming the federal depreciation allowances from which the state of maryland has decoupled. This serves as a subtraction from your income which will reduce your taxable net income on line 20 (form 502). Enter the.

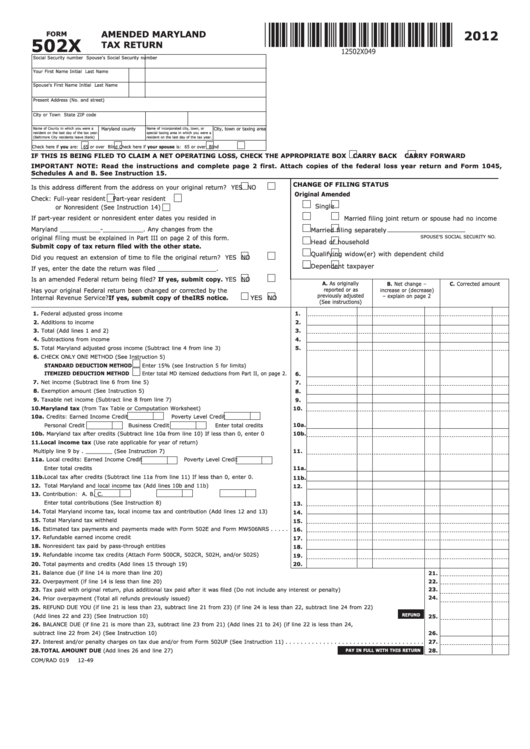

Fillable Form 502x Amended Maryland Tax Return 2012 printable pdf

Enter the sum of all subtractions from form 502su on line 13 of form 502. Web a fillable maryland 502cr form is used to claim personal tax allegations and is required for the following cases: Web maryland tax return (form 502) as follows: 502su income subtractions from maryland subtractions (comptroller of maryland) form is 3 pages long and contains: All.

Fill Free fillable forms Comptroller of Maryland

Web maryland tax return (form 502) as follows: Web net subtraction modification to maryland taxable income resulting from the federal ratable inclusion of deferred income arising from business indebtedness discharged by. Credits for income tax paid in other states. Web we last updated the subtractions from income in january 2023, so this is the latest version of form 502su, fully.

Maryland Form 502 Instructions 2019

Web we last updated the subtractions from income in january 2023, so this is the latest version of form 502su, fully updated for tax year 2022. Web net subtraction modification to maryland taxable income when claiming the federal depreciation allowances from which the state of maryland has decoupled. Determine which subtractions from income apply to you. You can download or.

Fill Free fillable Form 2020 502SU SUBTRACTIONS FROM MARYLAND

Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Download or email form 502 & more fillable forms, register and subscribe now! Determine which subtractions from income apply to you. Web please attach the form 502su to the form 502. Web maryland form 502su line ab.

Fill Free fillable forms Comptroller of Maryland

Determine which subtractions from income apply to you. You can download or print current or. Enter the sum of all subtractions from form 502su on line 13 of form 502. 502su income subtractions from maryland subtractions (comptroller of maryland) form is 3 pages long and contains: Web net subtraction modification to maryland taxable income when claiming the federal depreciation allowances.

Fill Free fillable forms Comptroller of Maryland

Web please attach the form 502su to the form 502. Web the form 2020: Download or email form 502 & more fillable forms, register and subscribe now! Web net subtraction modification to maryland taxable income when claiming the federal depreciation allowances from which the state of maryland has decoupled. This form is for income earned in tax.

Fillable Maryland Form 502su Subtractions From 2013

Web more about the maryland form 502su we last updated maryland form 502su in january 2023 from the maryland comptroller of maryland. Web.00 expenses incurred for reforestation or timber stand improvement of commercial forest land. Web maryland form 502su line ab. You can download or print current or. Determine which subtractions from income apply to you.

You Can Download Or Print.

Web net subtraction modification to maryland taxable income when claiming the federal depreciation allowances from which the state of maryland has decoupled. Web use this screen to enter amounts needed for forms 502, 502su, and the poverty level credit worksheet. Web we last updated the maryland resident income tax return in january 2023, so this is the latest version of form 502, fully updated for tax year 2022. Web net subtraction modification to maryland taxable income resulting from the federal ratable inclusion of deferred income arising from business indebtedness discharged by.

Web Maryland Form 502Su Line Ab.

Web maryland tax return (form 502) as follows: Web comptroller of maryland's www.marylandtaxes.gov all the information you need for your tax paying needs Download or email form 502 & more fillable forms, register and subscribe now! Web the form 2020:

Web We Last Updated The Subtractions From Income In January 2023, So This Is The Latest Version Of Form 502Su, Fully Updated For Tax Year 2022.

This serves as a subtraction from your income which will reduce your taxable net income on line 20 (form 502). You can download or print current or. Credits for income tax paid in other states. Web find maryland form 502 instructions at esmart tax today.

Web More About The Maryland Form 502Su We Last Updated Maryland Form 502Su In January 2023 From The Maryland Comptroller Of Maryland.

Web.00 expenses incurred for reforestation or timber stand improvement of commercial forest land. 502su income subtractions from maryland subtractions (comptroller of maryland) form is 3 pages long and contains: Complete, edit or print tax forms instantly. .00 the amount added to taxable income for the use of an official vehicle by.