Michigan Form 743

Michigan Form 743 - Use get form or simply click on the template preview to open it in the editor. Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury. Web allocate income, adjustments to income, additions, subtractions and deductions to your adjusted gross income as reported on the michigan return to the. Web complete, sign and submit the enclosed income allocation for non obligated spouse (form 743) to determine how much of the refund can be applied to the debt. Corporate income tax (cit) city income tax forms; Web city of detroit business & fiduciary taxes search tips search by tax area: Web june 7, 2019 4:19 pm. Michigan doesn’t have a form 744. We strongly recommend filing the. Web the michigan department of treasury withholds income tax refunds or credits for payment of certain debts, such as delinquent taxes, state agency debts, garnishments, probate or.

Here is a comprehensive list. For example, if you are interested in individual. Corporate income tax (cit) city income tax forms; Web june 7, 2019 4:19 pm. Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Michigan doesn’t have a form 744. Web city of detroit business & fiduciary taxes search tips search by tax area: Web allocate income, adjustments to income, additions, subtractions and deductions to your adjusted gross income as reported on the michigan return to the. Authorized representative declaration (power of attorney) tax area.

We strongly recommend filing the. Web the michigan department of treasury withholds income tax refunds or credits for payment of certain debts, such as delinquent taxes, state agency debts, garnishments, probate or. Use get form or simply click on the template preview to open it in the editor. This form is used by michigan residents who file an individual income tax return. Web local government treasury forms search and instructions search for forms by keyword, form number or according to “tax year.” treasury provides forms in adobe acrobat. Web june 7, 2019 4:19 pm. For example, if you are interested in individual. Michigan doesn’t have a form 744. Authorized representative declaration (power of attorney) tax area. Corporate income tax, city of detroit individual income tax,.

743 DENHAM LN

Get everything done in minutes. Web allocate income, adjustments to income, additions, subtractions and deductions to your adjusted gross income as reported on the michigan return to the. Michigan doesn’t have a form 744. Here is a comprehensive list. Corporate income tax, city of detroit individual income tax,.

Homestead Property Tax Credit Claim for Veterans and Blind People Ins…

Web the michigan department of treasury withholds income tax refunds or credits for payment of certain debts, such as delinquent taxes, state agency debts, garnishments, probate or. Web city of detroit business & fiduciary taxes search tips search by tax area: Here is a comprehensive list. Web june 7, 2019 4:19 pm. Taxformfinder provides printable pdf copies of 98.

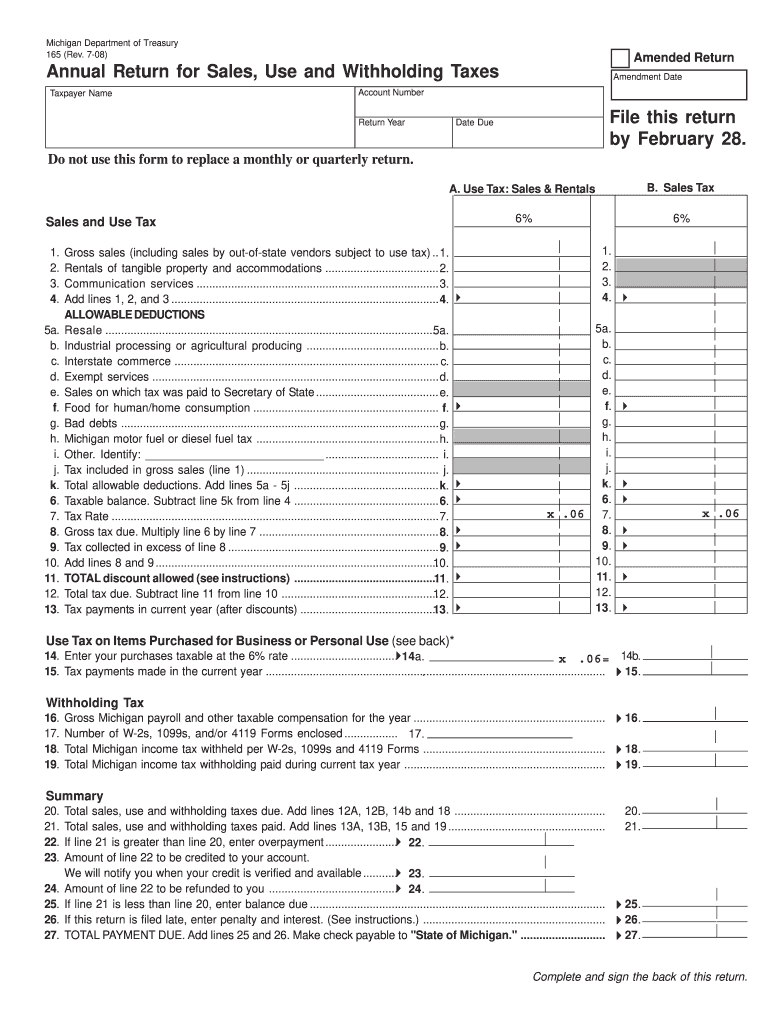

Michigan Form 165 Fill Online, Printable, Fillable, Blank pdfFiller

Corporate income tax (cit) city income tax forms; This form is used by michigan residents who file an individual income tax return. Web the michigan department of treasury withholds income tax refunds or credits for payment of certain debts, such as delinquent taxes, state agency debts, garnishments, probate or. Web city of detroit business & fiduciary taxes search tips search.

Michigan Form 3683 Fill Online, Printable, Fillable, Blank pdfFiller

We strongly recommend filing the. Here is a comprehensive list. Web city of detroit business & fiduciary taxes search tips search by tax area: For example, if you are interested in individual. Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury.

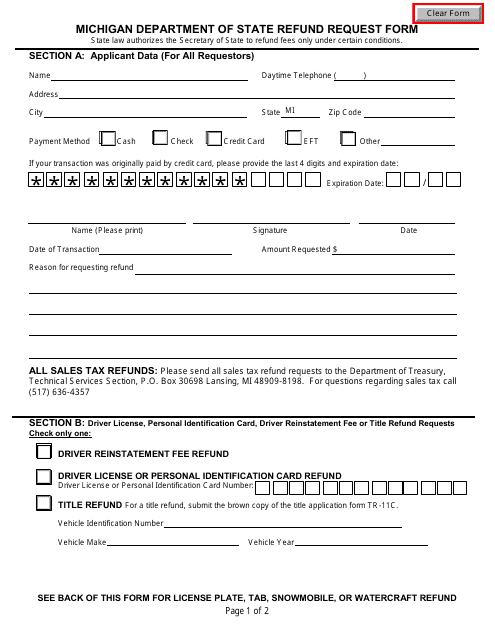

Form A226 Download Fillable PDF or Fill Online Michigan Department of

Authorized representative declaration (power of attorney) tax area. For example, if you are interested in individual. Michigan doesn’t have a form 744. We strongly recommend filing the. Corporate income tax (cit) city income tax forms;

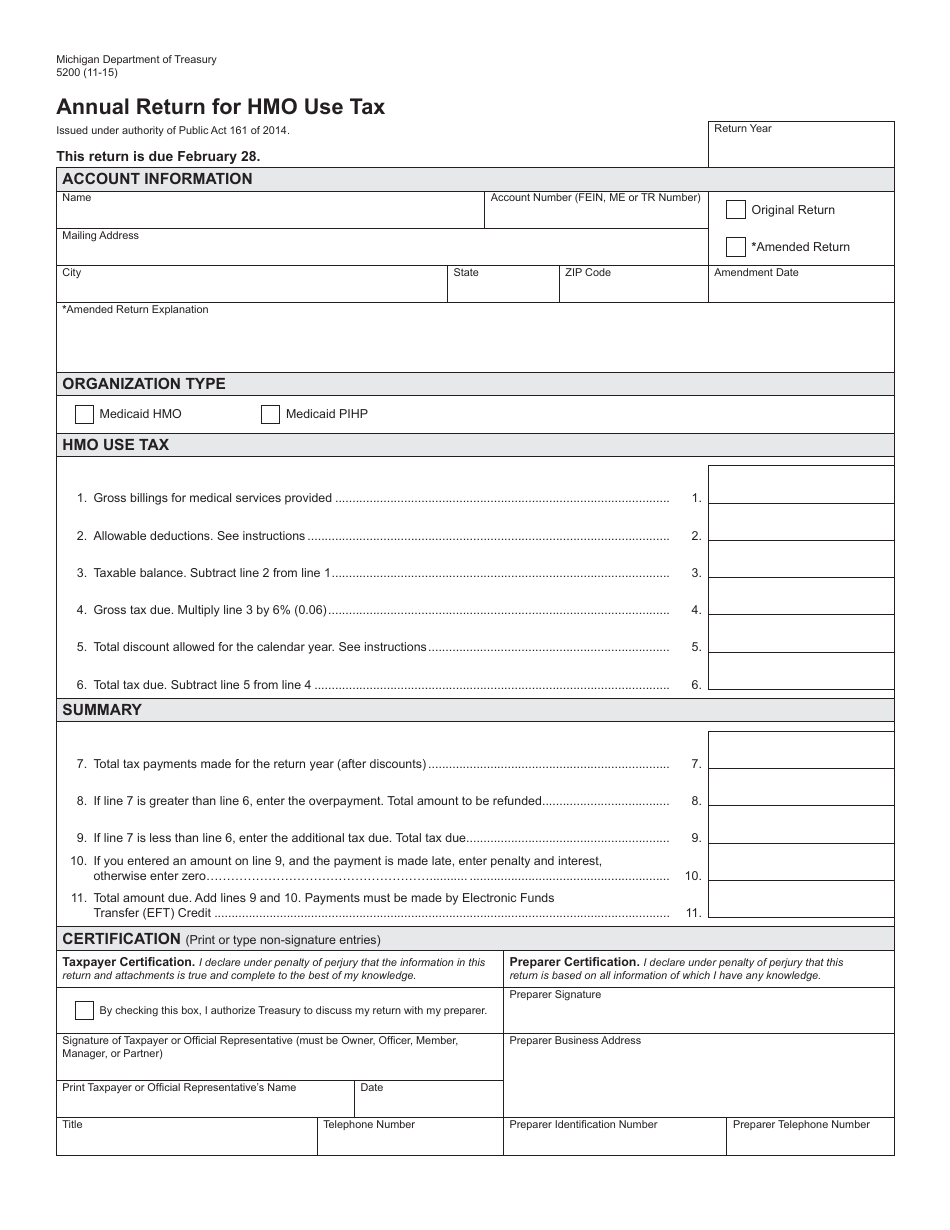

Form 5200 Download Printable PDF or Fill Online Annual Return for HMO

Michigan doesn’t have a form 744. Corporate income tax (cit) city income tax forms; For example, if you are interested in individual. Corporate income tax, city of detroit individual income tax,. Authorized representative declaration (power of attorney) tax area.

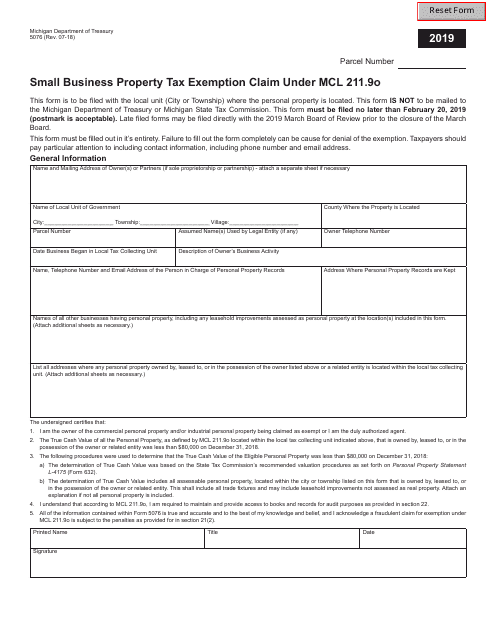

Form 5076 Download Fillable PDF or Fill Online Small Business Property

Get everything done in minutes. Use this option to browse a list of forms by tax area. Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Web june 7, 2019 4:19 pm. Authorized representative declaration (power of attorney) tax area.

743 DENHAM LN

Get everything done in minutes. Here is a comprehensive list. Taxformfinder provides printable pdf copies of 98. Web june 7, 2019 4:19 pm. Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury.

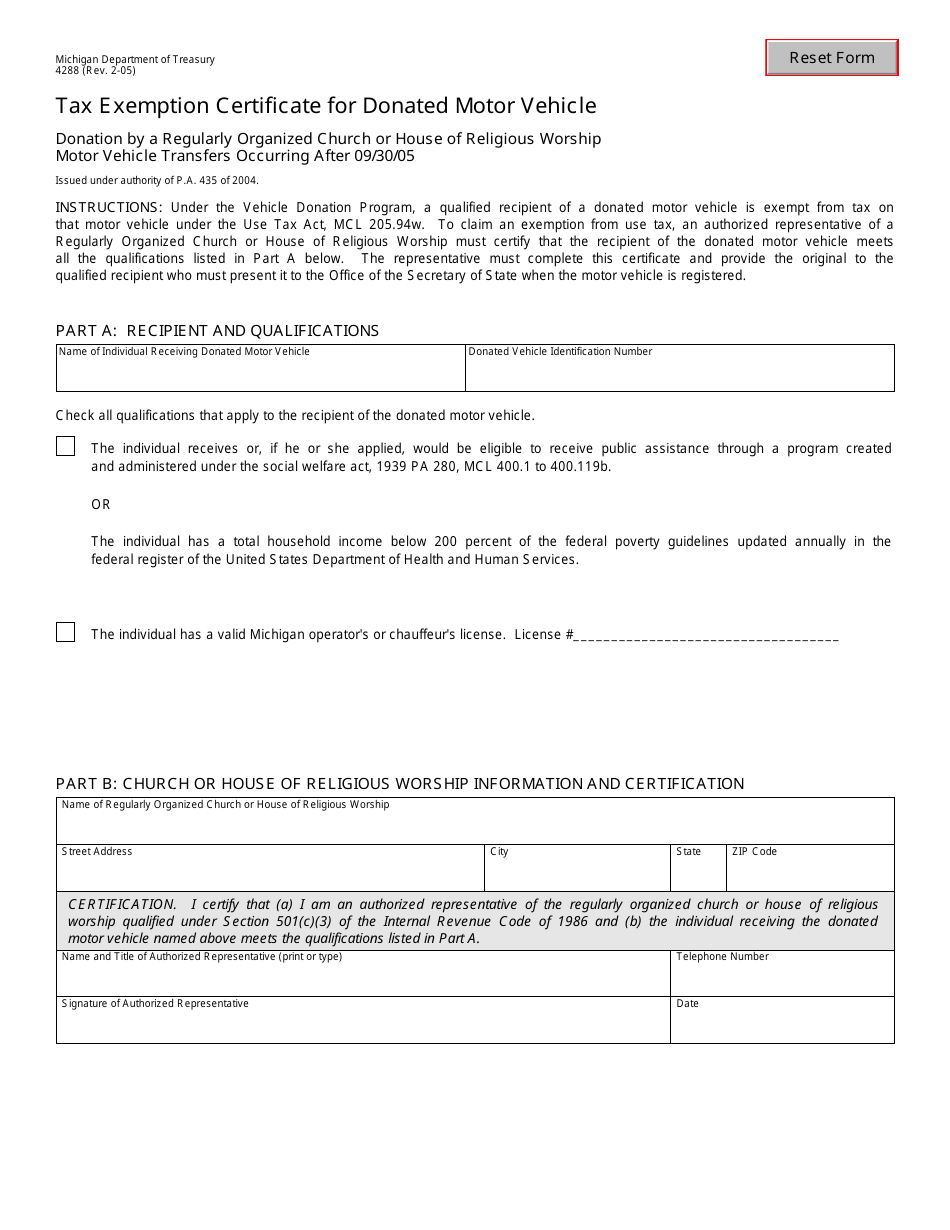

Form 4288 Download Fillable PDF or Fill Online Tax Exemption

Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury. Web allocate income, adjustments to income, additions, subtractions and deductions to your adjusted gross income as reported on the michigan return to the. Authorized representative declaration (power of attorney) tax area. Here is a comprehensive list. Michigan doesn’t have a form.

743 N Michigan Ave, Greensburg, IN 3 Bed, 1 Bath SingleFamily Home

Corporate income tax (cit) city income tax forms; Web local government treasury forms search and instructions search for forms by keyword, form number or according to “tax year.” treasury provides forms in adobe acrobat. Get everything done in minutes. Web complete, sign and submit the enclosed income allocation for non obligated spouse (form 743) to determine how much of the.

Web June 7, 2019 4:19 Pm.

Michigan has a flat state income tax of 4.25% , which is administered by the michigan department of treasury. Taxformfinder provides printable pdf copies of 98. Web the michigan department of treasury withholds income tax refunds or credits for payment of certain debts, such as delinquent taxes, state agency debts, garnishments, probate or. Web allocate income, adjustments to income, additions, subtractions and deductions to your adjusted gross income as reported on the michigan return to the.

Web Local Government Treasury Forms Search And Instructions Search For Forms By Keyword, Form Number Or According To “Tax Year.” Treasury Provides Forms In Adobe Acrobat.

Check out how easy it is to complete and esign documents online using fillable templates and a powerful editor. Michigan doesn’t have a form 744. This form is used by michigan residents who file an individual income tax return. Corporate income tax (cit) city income tax forms;

Here Is A Comprehensive List.

Authorized representative declaration (power of attorney) tax area. Web city of detroit business & fiduciary taxes search tips search by tax area: Use this option to browse a list of forms by tax area. Get everything done in minutes.

For Example, If You Are Interested In Individual.

Corporate income tax, city of detroit individual income tax,. We strongly recommend filing the. Use get form or simply click on the template preview to open it in the editor. Web complete, sign and submit the enclosed income allocation for non obligated spouse (form 743) to determine how much of the refund can be applied to the debt.