Oklahoma Tax Exempt Form

Oklahoma Tax Exempt Form - Web pursuant to title 68 section 1358.1 of the oklahoma statutes, individuals or businesses engaged in farming or ranching for profit may qualify for an agricultural exemption. Web once you have that, you are eligible to issue a resale certificate. Web agriculture sales tax exemption. One of oklahoma farm bureau’s very first policy priorities in 1942, the state sales tax exemption on agricultural inputs is a crucial business tool for. Complete, edit or print tax forms instantly. Easily fill out pdf blank, edit, and sign them. Save or instantly send your ready documents. This letter and the following listing may be used as formal. Only sales taxes are exempt. Web in order to benefit from the exemption, attach a copy of your tax commission exemption letter/card and a statement that you are buying the goods for the exempt entity (and not.

Web you may be eligible for an exemption from paying oklahoma sales tax up to $25,000.00 per year. Royalty interest to nonresident interest owners. Web chased tax exempt with your sales tax permit and withdrawn for use by you or your business is to be included in this line. Web oklahoma tax exempt form. Forms, tax exempt forms, tax forms / united states. Web oklahoma tax exemption permit to claim sales tax exemption in the state of oklahoma. Only sales taxes are exempt. One of oklahoma farm bureau’s very first policy priorities in 1942, the state sales tax exemption on agricultural inputs is a crucial business tool for. Web pursuant to title 68 section 1358.1 of the oklahoma statutes, individuals or businesses engaged in farming or ranching for profit may qualify for an agricultural exemption. Therefore, you can complete the sales tax exemption / resale certificate form by providing your oklahoma.

Register and subscribe now to work on sales tax exemption packet & more fillable forms. Web the oklahoma tax commission does not issue sales tax exempt numbers to state entities that are exempt by statute. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the oklahoma sales tax. Web chased tax exempt with your sales tax permit and withdrawn for use by you or your business is to be included in this line. Easily fill out pdf blank, edit, and sign them. Web while the oklahoma sales tax of 4.5% applies to most transactions, there are certain items that may be exempt from taxation. Web the agriculture exemption application on oktap allows you to apply for a new exemption permit, renew an expiring or already expired permit, update information for your already. Royalty interest to nonresident interest owners. Online registration & reporting systems. This packet of information and application forms will guide you in applying for sales tax.

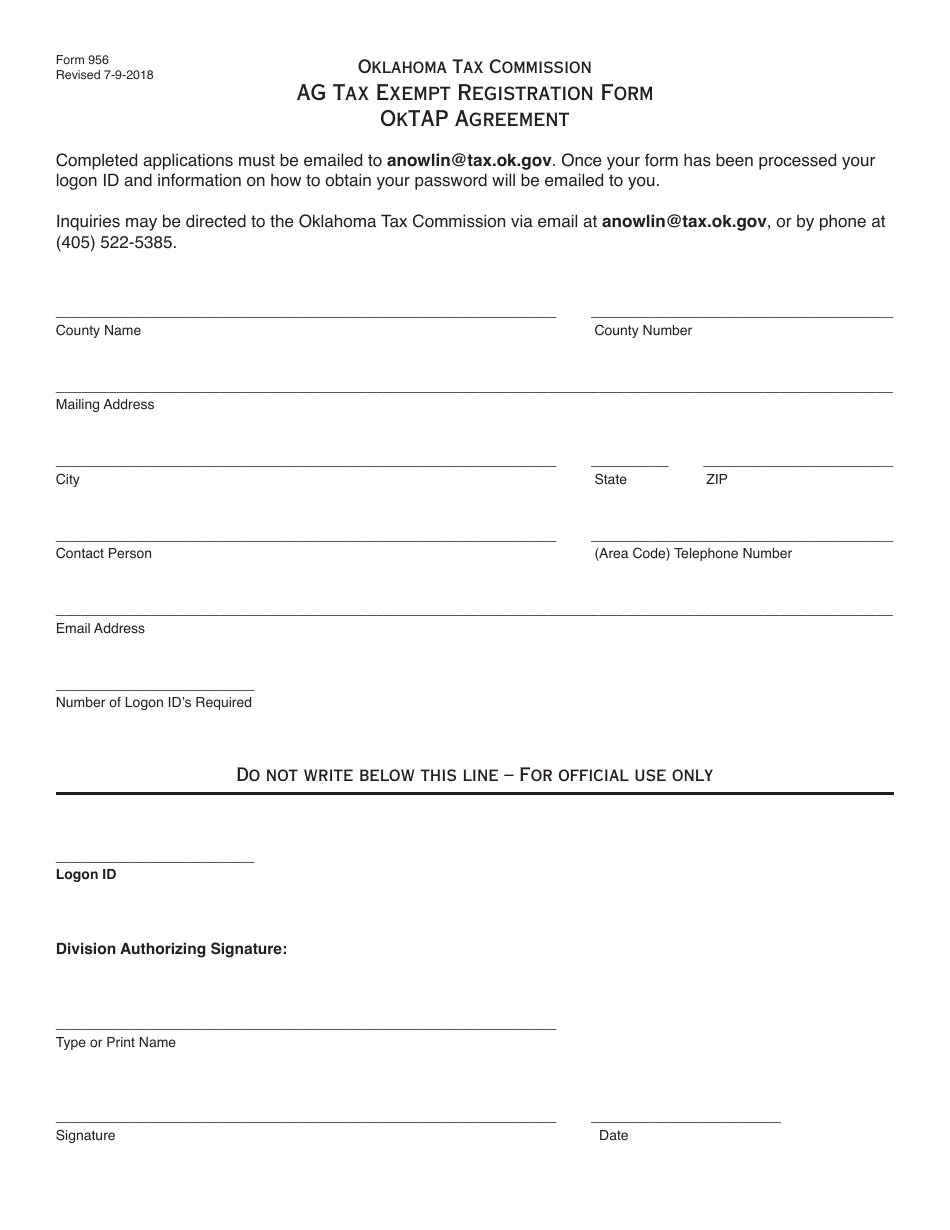

OTC Form 956 Download Fillable PDF or Fill Online Ag Tax Exempt

Register and subscribe now to work on sales tax exemption packet & more fillable forms. Web the oklahoma tax commission does not issue sales tax exempt numbers to state entities that are exempt by statute. Web are travel iba (6th digit 1, 2, 3, 4) transactions sales tax exempt? Web a sales tax exemption certificate can be used by businesses.

Louisiana Hotel Tax Exempt Form 2020 Fill and Sign Printable Template

Who do i contact if i have questions? Web pursuant to title 68 section 1358.1 of the oklahoma statutes, individuals or businesses engaged in farming or ranching for profit may qualify for an agricultural exemption. Royalty interest to nonresident interest owners. Complete, edit or print tax forms instantly. This packet of information and application forms will guide you in applying.

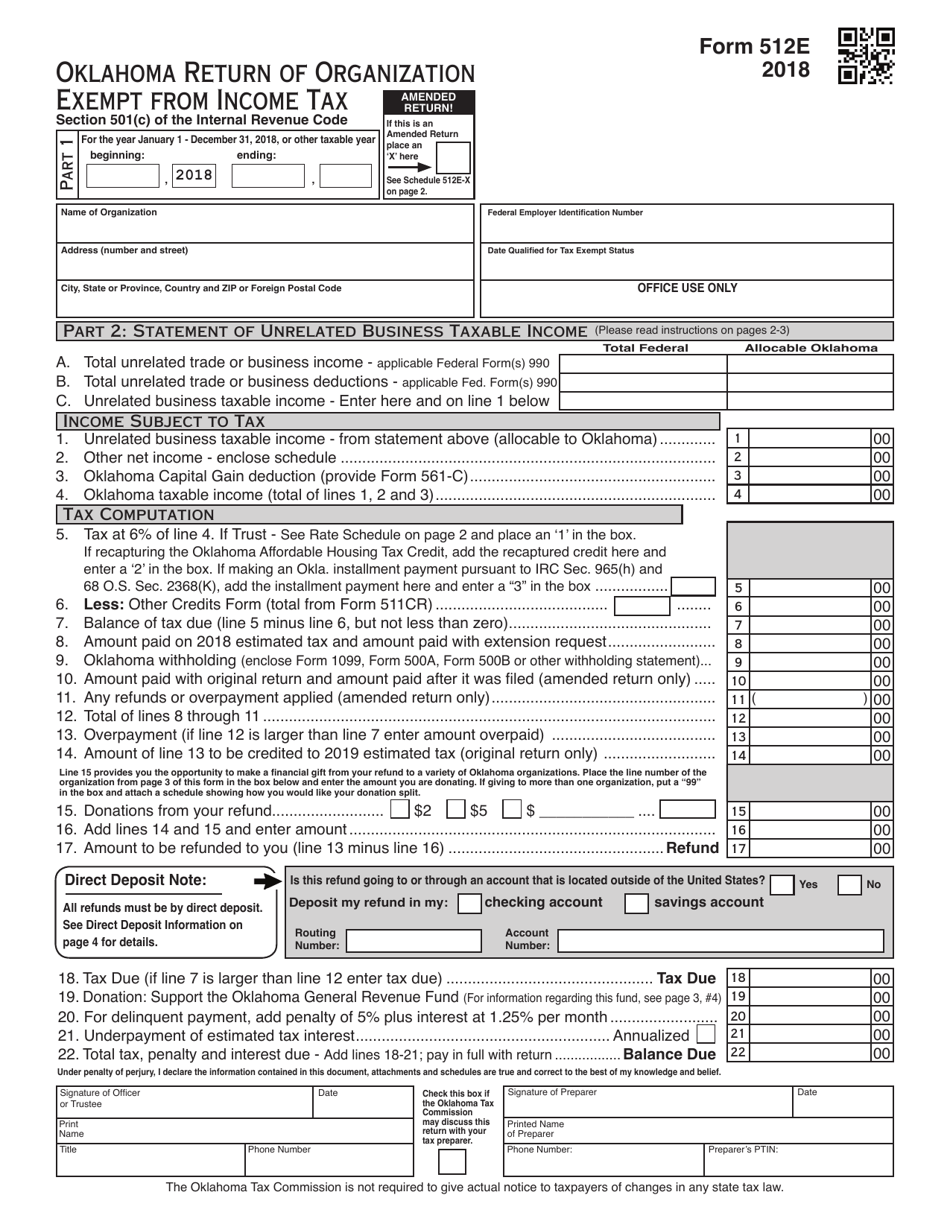

OTC Form 512E Download Fillable PDF or Fill Online Oklahoma Return of

This letter and the following listing may be used as formal. Web while the oklahoma sales tax of 4.5% applies to most transactions, there are certain items that may be exempt from taxation. Save or instantly send your ready documents. Online registration & reporting systems. Easily fill out pdf blank, edit, and sign them.

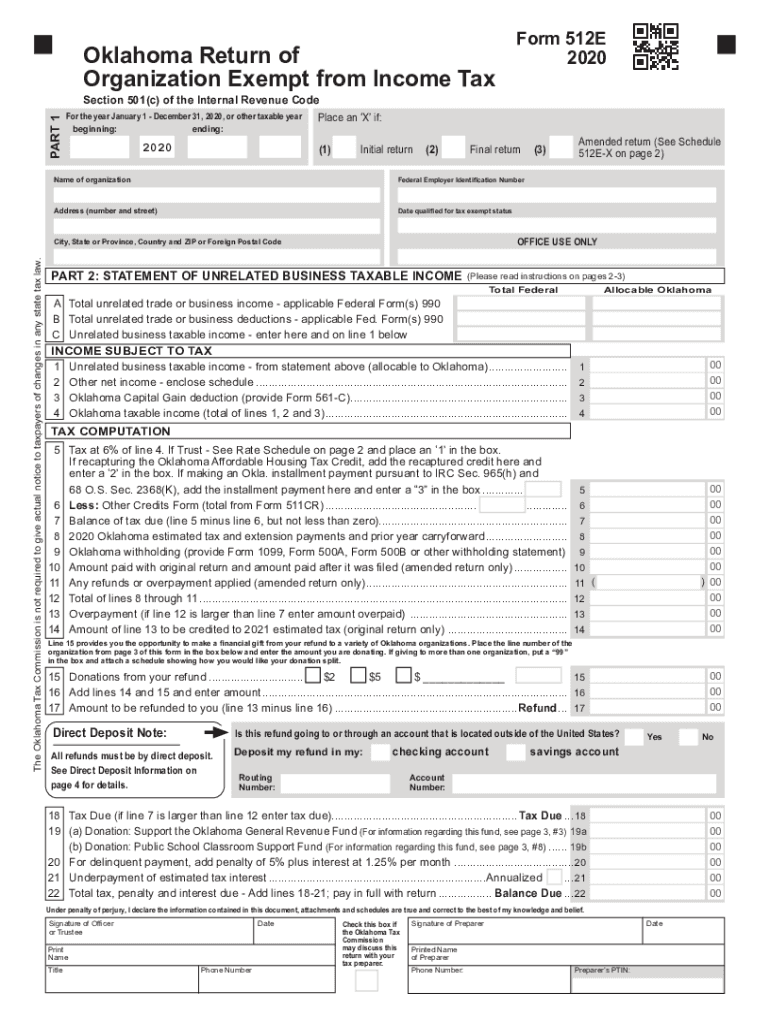

2020 Form OK OTC 512E Fill Online, Printable, Fillable, Blank pdfFiller

One of oklahoma farm bureau’s very first policy priorities in 1942, the state sales tax exemption on agricultural inputs is a crucial business tool for. This page discusses various sales tax exemptions in. Web in order to benefit from the exemption, attach a copy of your tax commission exemption letter/card and a statement that you are buying the goods for.

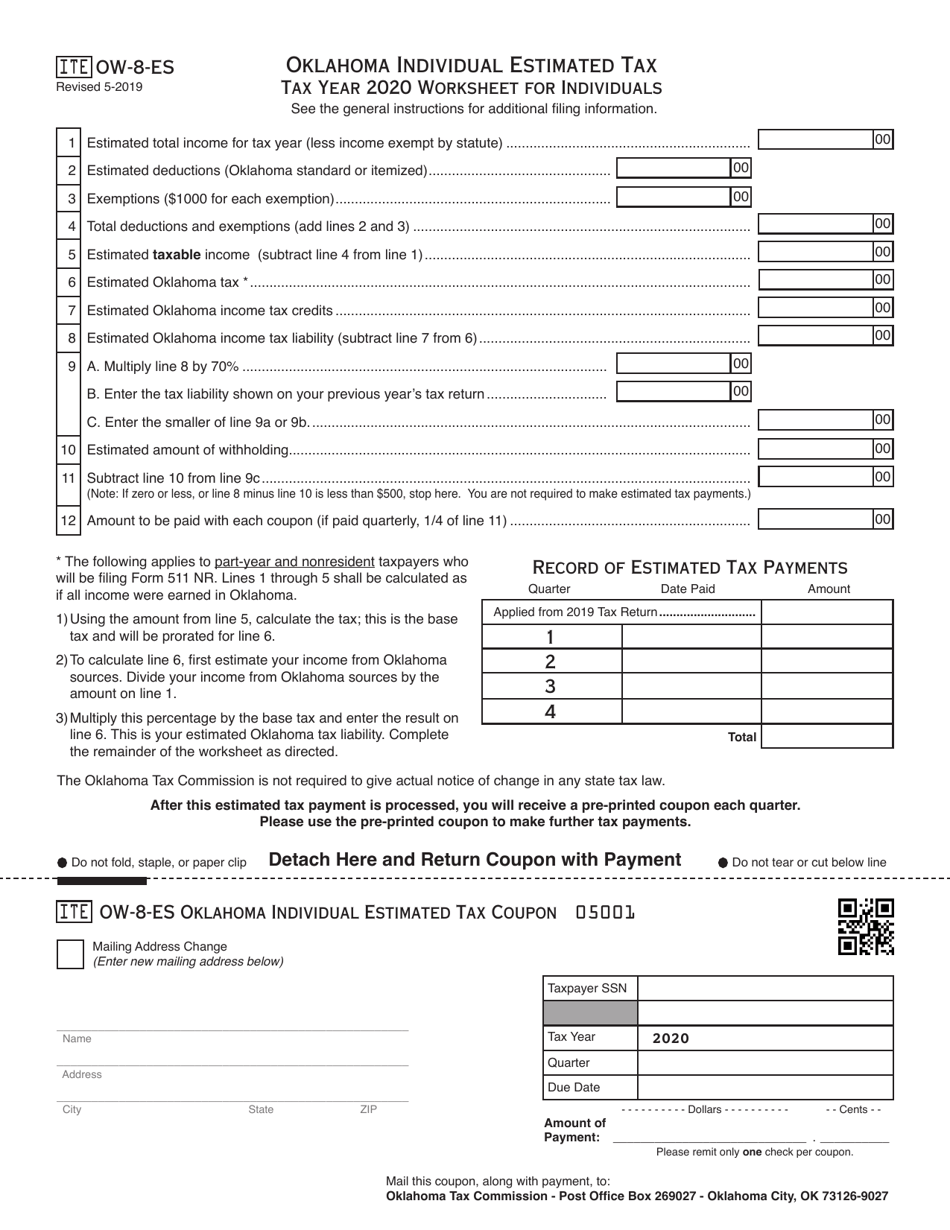

Form OW8ES Download Fillable PDF or Fill Online Oklahoma Individual

This letter and the following listing may be used as formal. Register and subscribe now to work on sales tax exemption packet & more fillable forms. Web pursuant to title 68 section 1358.1 of the oklahoma statutes, individuals or businesses engaged in farming or ranching for profit may qualify for an agricultural exemption. Web while the oklahoma sales tax of.

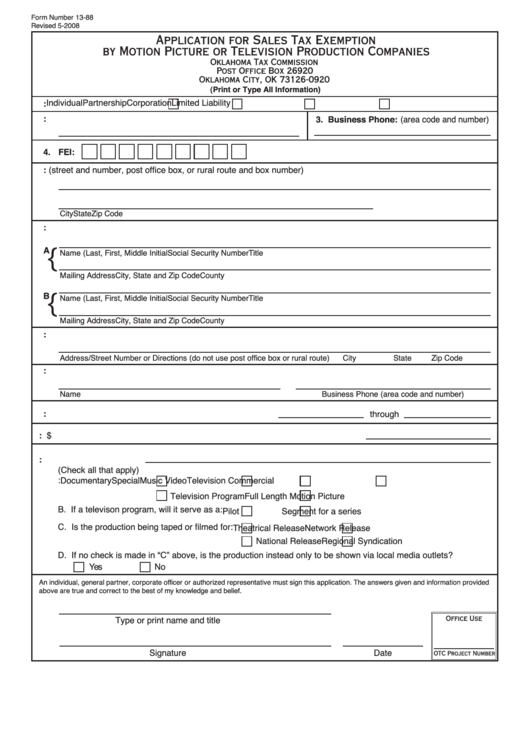

Fillable Form 1388 Application For Sales Tax Exemption By Motion

Web pursuant to title 68 section 1358.1 of the oklahoma statutes, individuals or businesses engaged in farming or ranching for profit may qualify for an agricultural exemption. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the oklahoma sales tax. Web while the oklahoma sales.

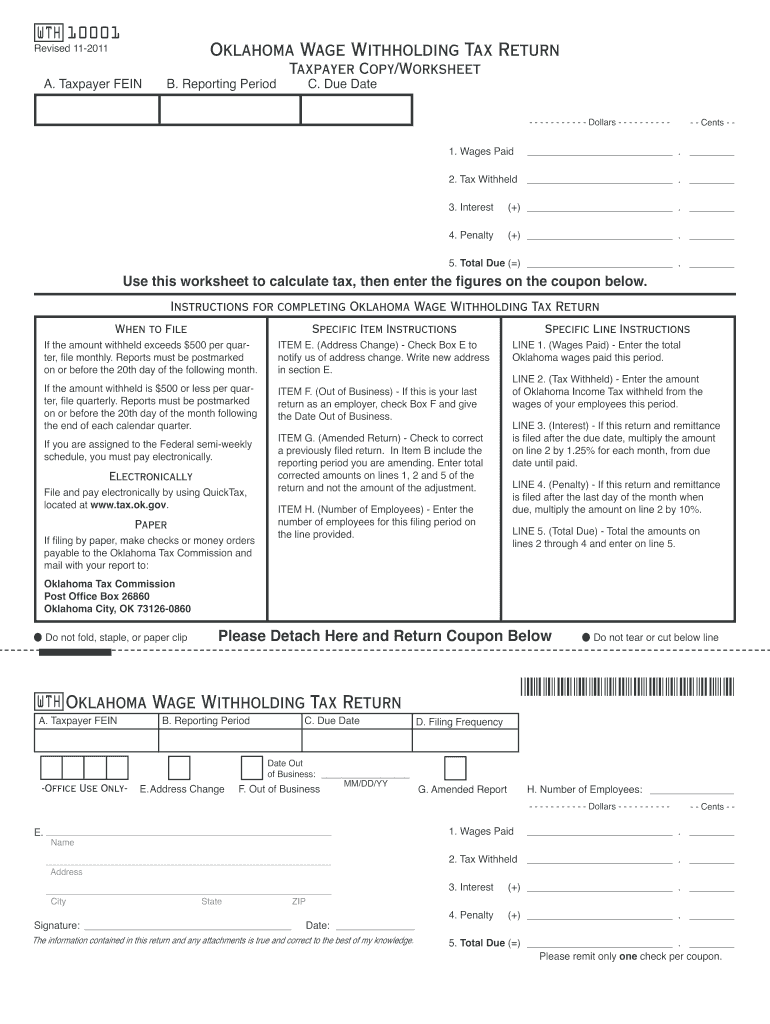

2011 Form OK OTC WTH 10001 Fill Online, Printable, Fillable, Blank

Web in order to benefit from the exemption, attach a copy of your tax commission exemption letter/card and a statement that you are buying the goods for the exempt entity (and not. Save or instantly send your ready documents. Web you may be eligible for an exemption from paying oklahoma sales tax up to $25,000.00 per year. Web while the.

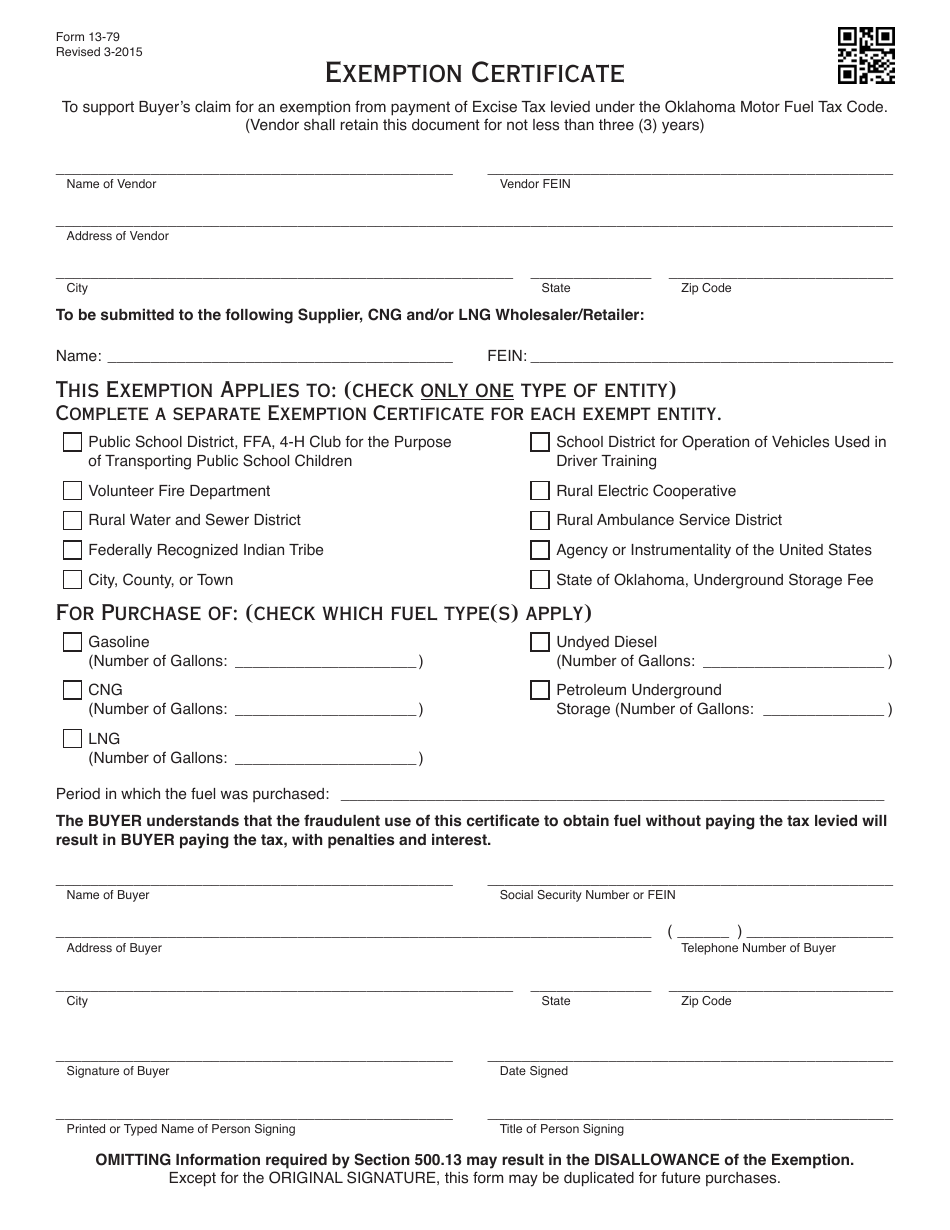

OTC Form 1379 Download Fillable PDF or Fill Online Exemption

Web are travel iba (6th digit 1, 2, 3, 4) transactions sales tax exempt? Web you may be eligible for an exemption from paying oklahoma sales tax up to $25,000.00 per year. Who do i contact if i have questions? Complete, edit or print tax forms instantly. Web the agriculture exemption application on oktap allows you to apply for a.

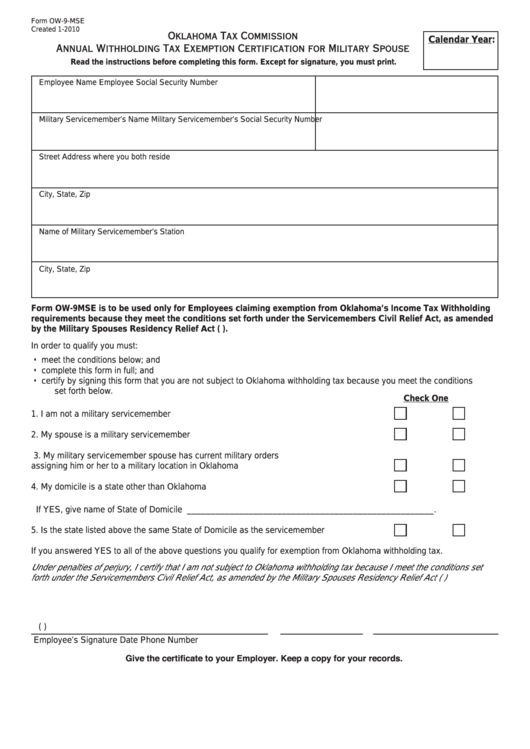

Fillable Form Ow9Mse Oklahoma Tax Commission Annual Withholding Tax

Web while the oklahoma sales tax of 4.5% applies to most transactions, there are certain items that may be exempt from taxation. This letter and the following listing may be used as formal. Web oklahoma tax exemption permit to claim sales tax exemption in the state of oklahoma. This packet of information and application forms will guide you in applying.

Oklahoma tax exempt form Docs & forms

Therefore, you can complete the sales tax exemption / resale certificate form by providing your oklahoma. Web oklahoma tax exempt form. Forms, tax exempt forms, tax forms / united states. Register and subscribe now to work on sales tax exemption packet & more fillable forms. Web pursuant to title 68 section 1358.1 of the oklahoma statutes, individuals or businesses engaged.

This Page Discusses Various Sales Tax Exemptions In.

This packet of information and application forms will guide you in applying for sales tax. Register and subscribe now to work on sales tax exemption packet & more fillable forms. Save or instantly send your ready documents. Only sales taxes are exempt.

Therefore, You Can Complete The Sales Tax Exemption / Resale Certificate Form By Providing Your Oklahoma.

Online registration & reporting systems. Who do i contact if i have questions? Web the oklahoma tax commission does not issue sales tax exempt numbers to state entities that are exempt by statute. Web once you have that, you are eligible to issue a resale certificate.

Web Chased Tax Exempt With Your Sales Tax Permit And Withdrawn For Use By You Or Your Business Is To Be Included In This Line.

Also include amounts for purchases for which you. Web while the oklahoma sales tax of 4.5% applies to most transactions, there are certain items that may be exempt from taxation. Easily fill out pdf blank, edit, and sign them. Web oklahoma tax exempt form.

Web Agriculture Sales Tax Exemption.

Web oklahoma tax exemption permit to claim sales tax exemption in the state of oklahoma. Web in order to benefit from the exemption, attach a copy of your tax commission exemption letter/card and a statement that you are buying the goods for the exempt entity (and not. Web a sales tax exemption certificate can be used by businesses (or in some cases, individuals) who are making purchases that are exempt from the oklahoma sales tax. Forms, tax exempt forms, tax forms / united states.