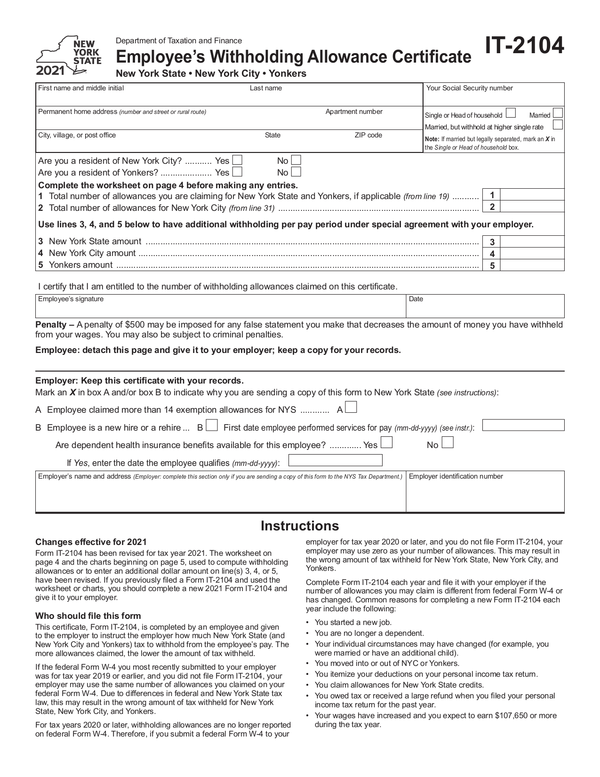

State Of Arkansas Withholding Form

State Of Arkansas Withholding Form - Enter personal information (a) first name and middle initial. The 5% withholding rate is required, and you cannot choose not to have income tax. Subtract personal tax credits from gross tax to arrive. Your withholding is subject to review by the irs. Web individual income tax section withholding branch p.o. You may find more information in department of finance and administration publication titled: Web tax free to an ira or qualified plan are subject to a flat 5% state withholding rate. Web form ar3mar is your annual reconciliation of monthly withholding. File this form with your employer. Furnish each other payee a completed form 1099.

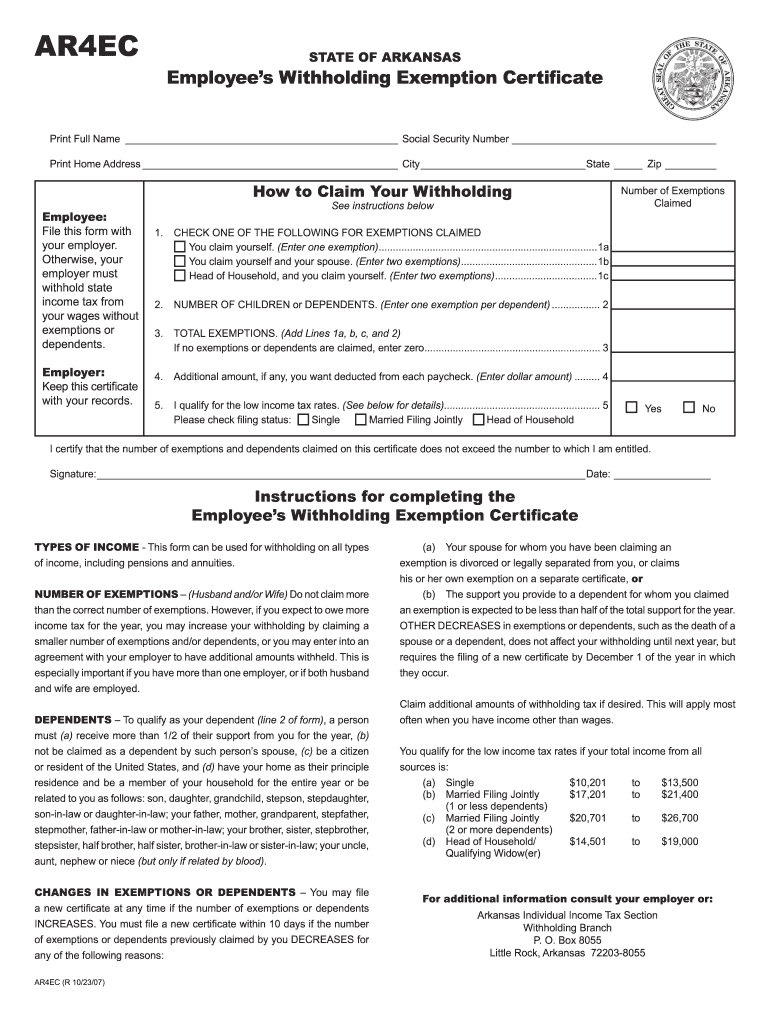

If too little is withheld, you will generally owe tax when you file your tax return. Web multiply total number of withholding exemptions claimed on form ar4ec times $20.00 to arrive at personal tax credits. Subtract personal tax credits from gross tax to arrive. Otherwise, your employer must withhold state income tax from your. To change your address or to close. Web print home address _____ city _____ state _____ zip _____ employee: File this form with your employer. If you make $70,000 a year living in arkansas you will be taxed $11,683. Web form ar3mar is your annual reconciliation of monthly withholding. Complete, edit or print tax forms instantly.

Web general where to find complete information: You may find more information in department of finance and administration publication titled: Web individual income tax section withholding branch p.o. File this form with your employer. Furnish each other payee a completed form 1099. Complete, edit or print tax forms instantly. Enter personal information (a) first name and middle initial. Subtract personal tax credits from gross tax to arrive. File this form with your employer. File this form with your employer to exempt your earnings from state income tax withholding.

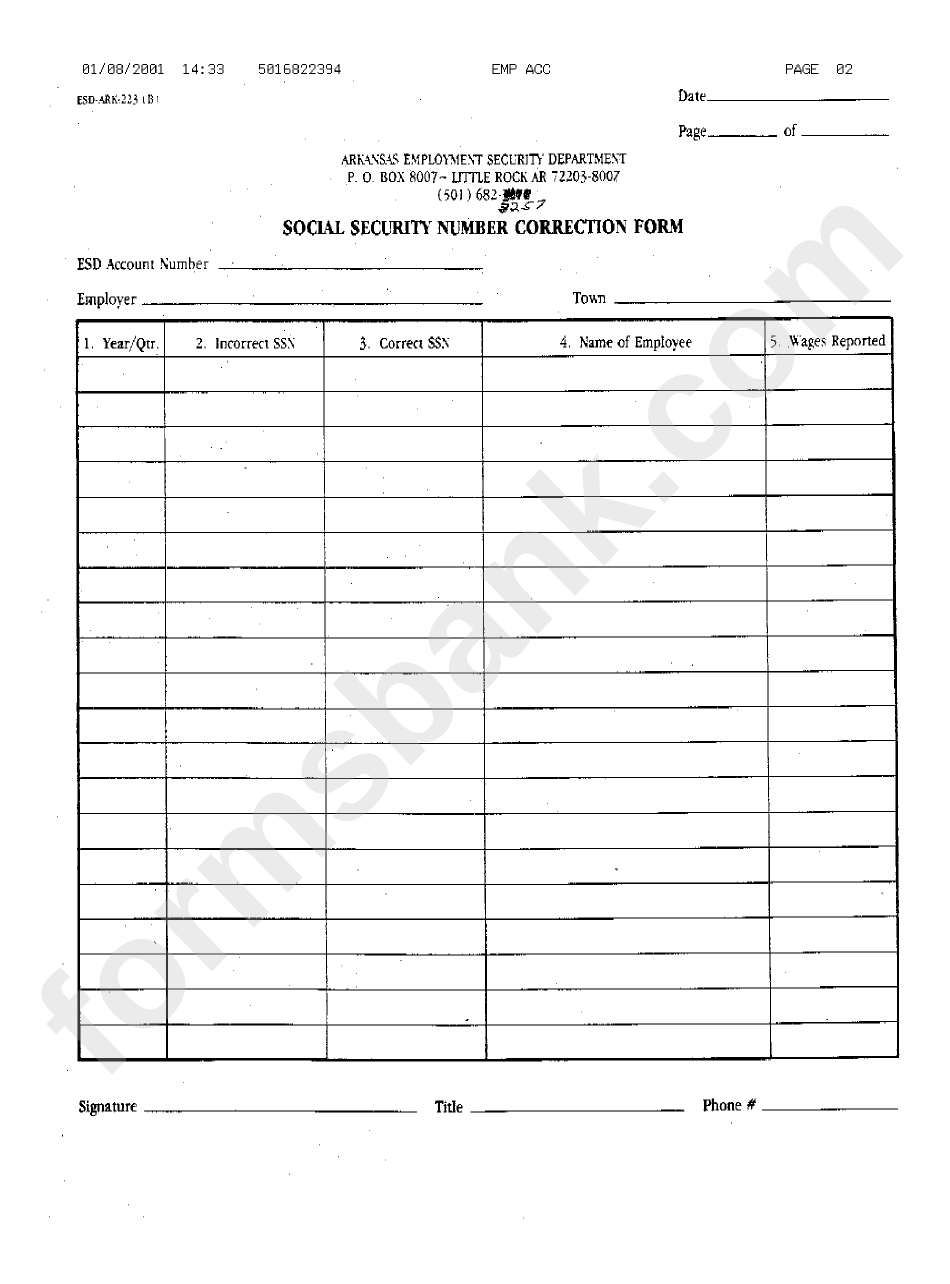

Form EsdArk 223 (B) Social Security Number Correction January 2001

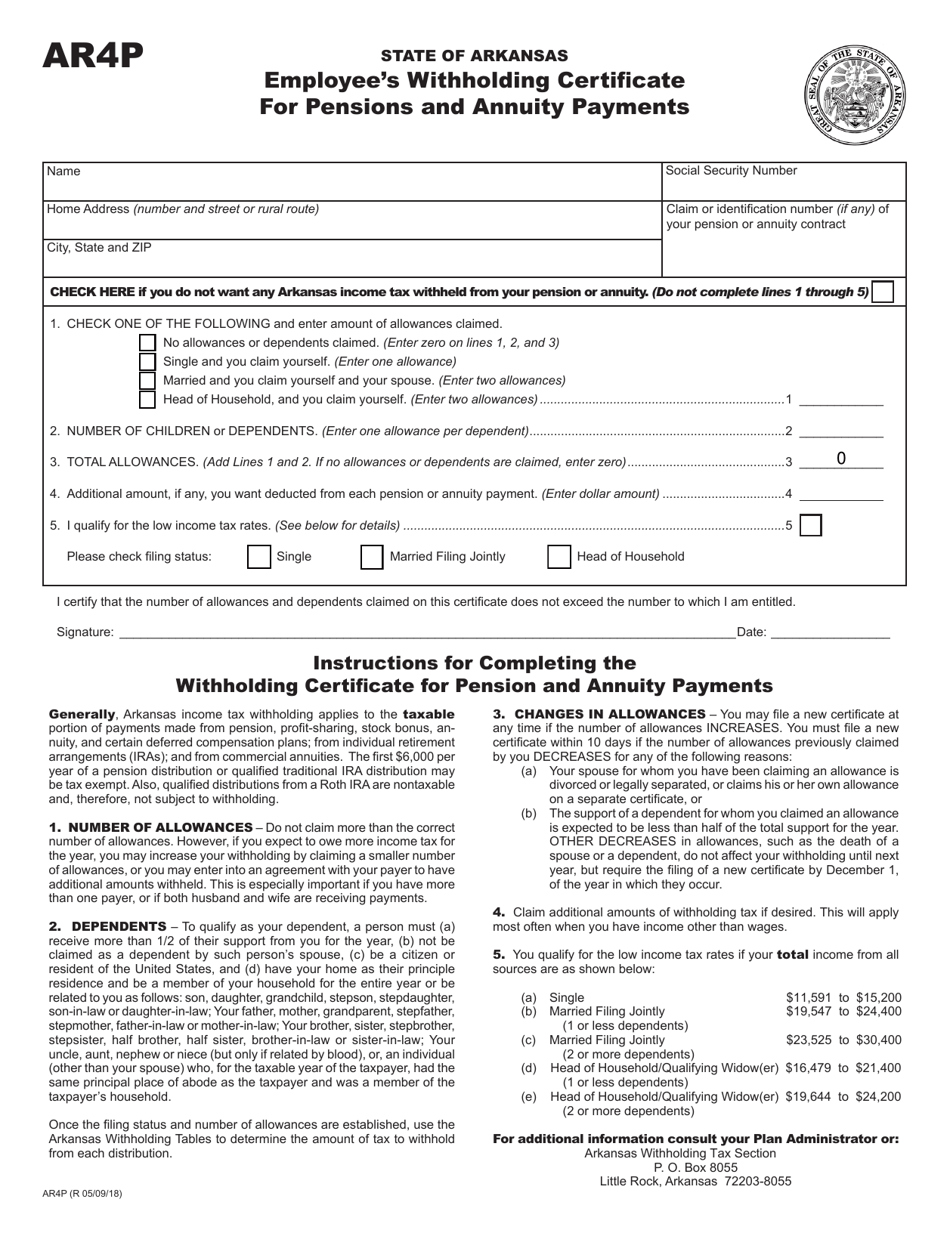

You may find more information in department of finance and administration publication titled: Keep this certificate with your records. The 5% withholding rate is required, and you cannot choose not to have income tax. Web general where to find complete information: File this form with your employer.

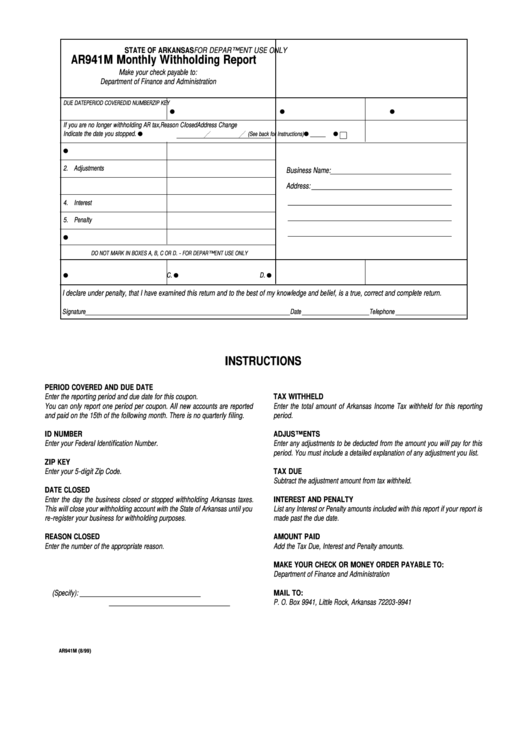

Form Ar941m State Of Arkansas Monthly Withholding Report 1999

You may find more information in department of finance and administration publication titled: Web print home address _____ city _____ state _____ zip _____ employee: Keep this certificate with your records. Web multiply total number of withholding exemptions claimed on form ar4ec times $20.00 to arrive at personal tax credits. Otherwise, your employer must withhold state income tax from your.

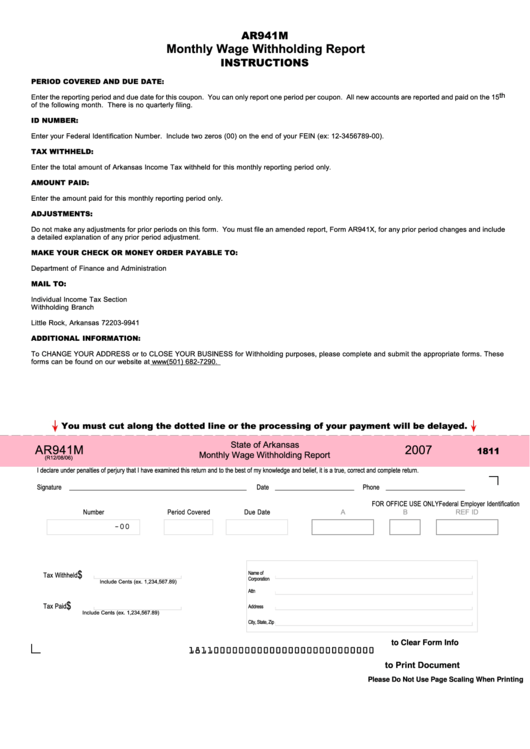

Fillable Form Ar941m State Of Arkansas Monthly Wage Withholding

Enter personal information (a) first name and middle initial. Furnish each other payee a completed form 1099. Complete, edit or print tax forms instantly. Web multiply total number of withholding exemptions claimed on form ar4ec times $20.00 to arrive at personal tax credits. Web state of arkansas employee’s special withholding exemption certificate.

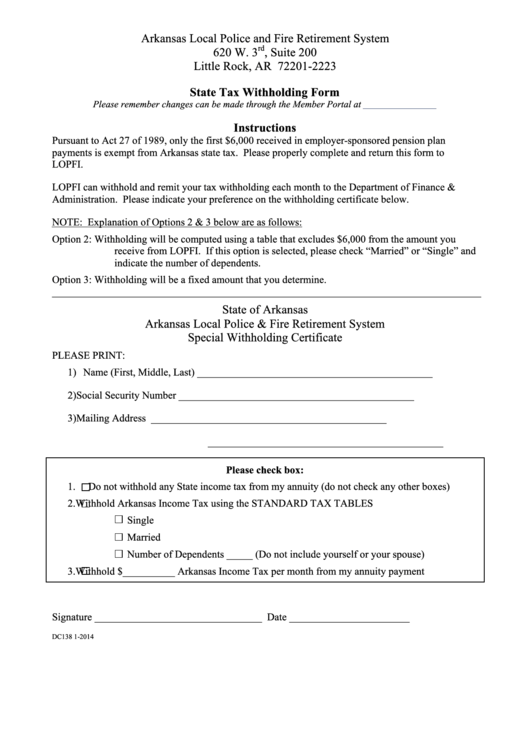

Fillable Arkansas State Tax Withholding Form printable pdf download

File this form with your employer. Complete, edit or print tax forms instantly. Furnish each other payee a completed form 1099. Web individual income tax section withholding branch p.o. Every employer with one (1) or more employees must file form.

Arkansas State Withholdings Form

You may find more information in department of finance and administration publication titled: Your withholding is subject to review by the irs. Otherwise, your employer must withhold state income tax from your. Every employer with one (1) or more employees must file form. Web print home address _____ city _____ state _____ zip _____ employee:

Arkansas State Withholding Form 2022

File this form with your employer. To change your address or to close. Web individual income tax section withholding branch p.o. The 5% withholding rate is required, and you cannot choose not to have income tax. Your withholding is subject to review by the irs.

Form AR4P Download Fillable PDF or Fill Online Employee's Withholding

Every employer with one (1) or more employees must file form. Furnish each other payee a completed form 1099. The 5% withholding rate is required, and you cannot choose not to have income tax. Web multiply total number of withholding exemptions claimed on form ar4ec times $20.00 to arrive at personal tax credits. Web individual income tax section withholding branch.

Ar4ec Form Fill Online, Printable, Fillable, Blank pdfFiller

Complete, edit or print tax forms instantly. File this form with your employer to exempt your earnings from state income tax withholding. Web tax free to an ira or qualified plan are subject to a flat 5% state withholding rate. To change your address or to close. Otherwise, your employer must withhold state income tax from your.

Arkansas State Tax Withholding Forms

You may find more information in department of finance and administration publication titled: Web multiply total number of withholding exemptions claimed on form ar4ec times $20.00 to arrive at personal tax credits. File this form with your employer to exempt your earnings from state income tax withholding. Subtract personal tax credits from gross tax to arrive. Furnish each other payee.

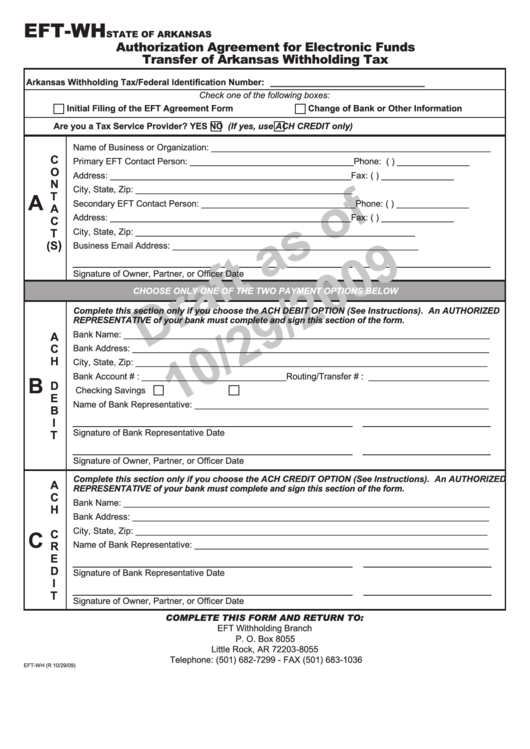

Form EftWh Draft Authorization Agreement For Electronic Funds

Web general where to find complete information: Every employer with one (1) or more employees must file form. Your withholding is subject to review by the irs. Complete, edit or print tax forms instantly. To change your address or to close.

Enter Personal Information (A) First Name And Middle Initial.

Web print home address _____ city _____ state _____ zip _____ employee: Web state of arkansas employee’s special withholding exemption certificate. Otherwise, your employer must withhold state income tax from your. If you make $70,000 a year living in arkansas you will be taxed $11,683.

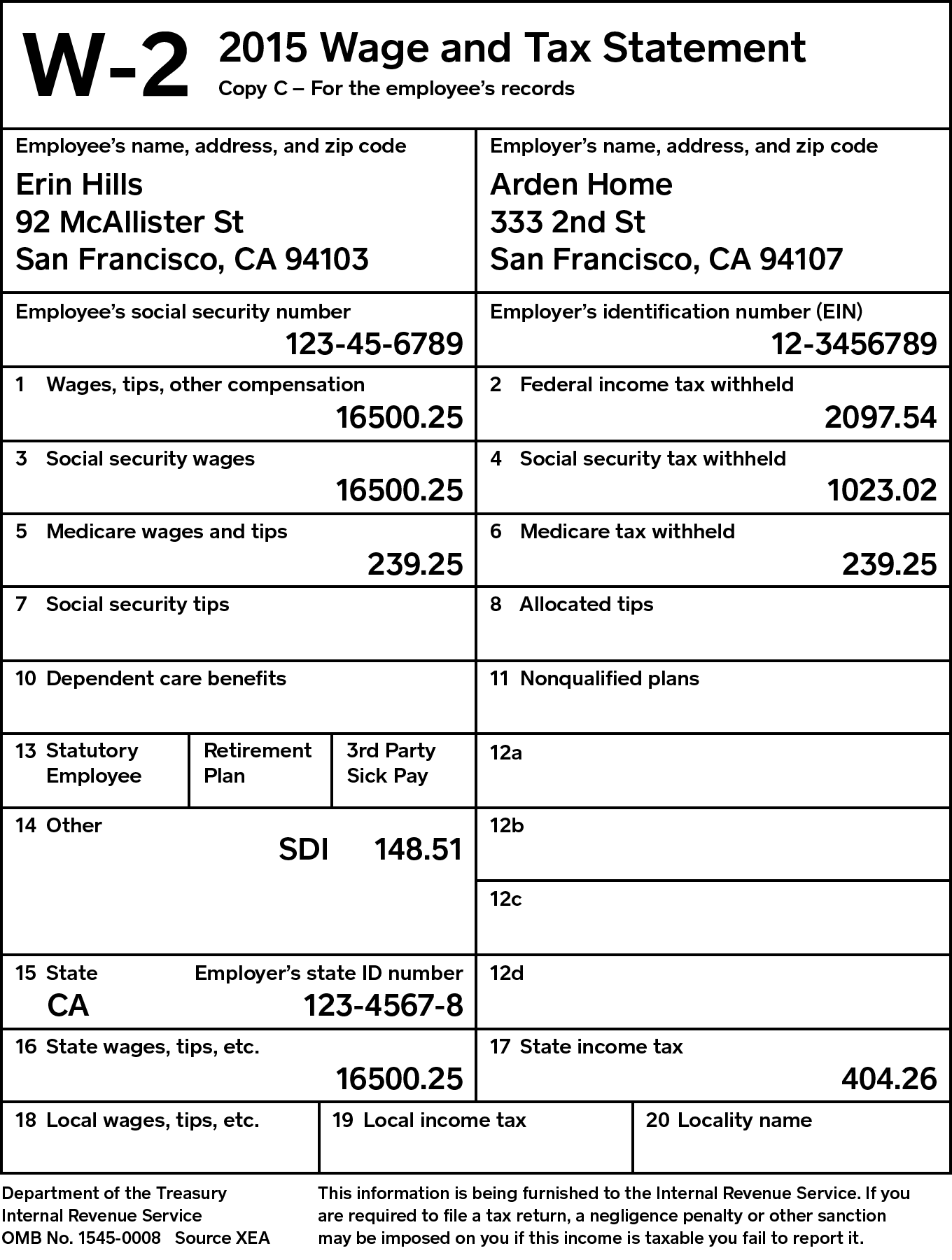

Your Withholding Is Subject To Review By The Irs.

Web general where to find complete information: Web form ar3mar is your annual reconciliation of monthly withholding. Furnish each other payee a completed form 1099. To change your address or to close.

The 5% Withholding Rate Is Required, And You Cannot Choose Not To Have Income Tax.

Subtract personal tax credits from gross tax to arrive. Every employer with one (1) or more employees must file form. Complete, edit or print tax forms instantly. Keep this certificate with your records.

If Too Little Is Withheld, You Will Generally Owe Tax When You File Your Tax Return.

File this form with your employer. Web tax free to an ira or qualified plan are subject to a flat 5% state withholding rate. File this form with your employer. Web multiply total number of withholding exemptions claimed on form ar4ec times $20.00 to arrive at personal tax credits.