Texas Property Tax Notice Of Protest Form

Texas Property Tax Notice Of Protest Form - If you mail your protest, please mail. To access this evidence, you. For more information about appealing your property's valuation, reference. You may protest if you disagree with the appraisal district. It is very important to file the protest on time. Web the box that corresponds to each reason for your protest may result in your inability to protest an issue that you want to pursue. Current with legislation from the 2023 regular session effective as of june 19, 2023. The deadline to file this form in texas is may 15 th of each year. This form is for use by a property owner to offer and submit evidence and/or argument for an appraisal review board (arb) protest hearing by. If you don’t know where to find it, you have two options to file this.

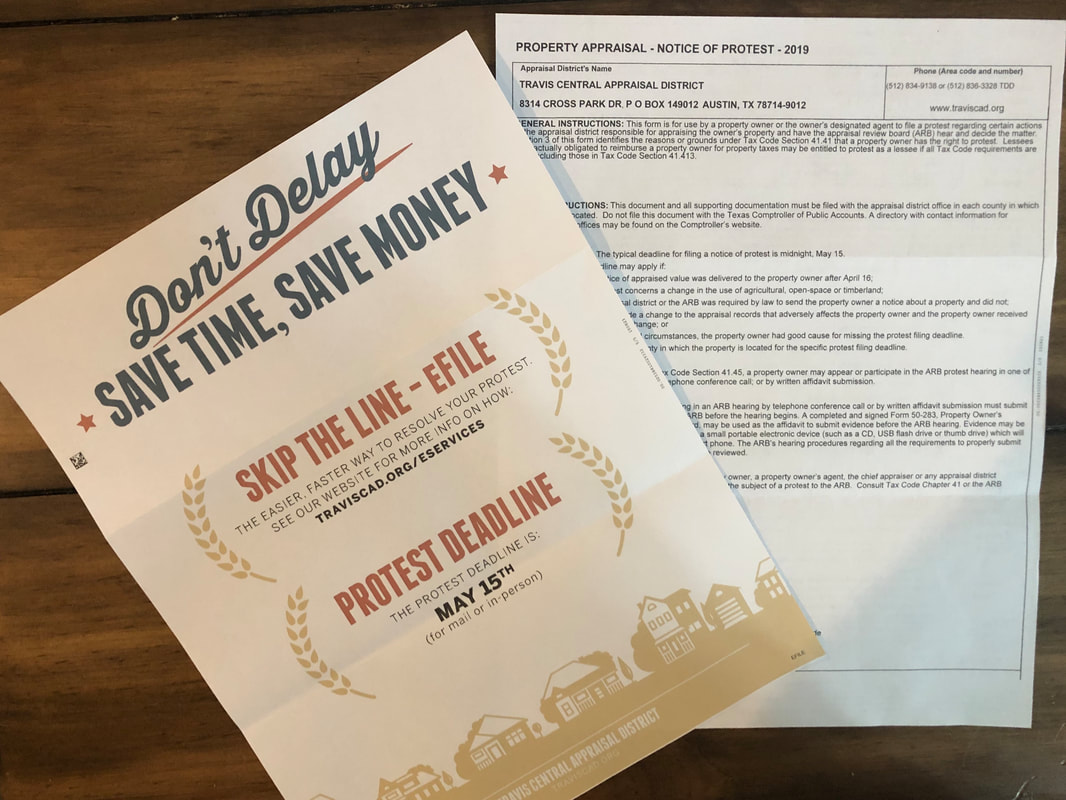

Web the deadline to file a written protest for real property for the 2023 tax year is may 22, 2023. At hcad offices located at 13013 northwest freeway. One of your most important rights as a taxpayer is your right to protest to the appraisal review board (arb). If you don’t know where to find it, you have two options to file this. Web hays central appraisal district offers property owners the option to electronically file a notice of protest as required by texas property tax code section 41.415. File your protest by may 15. Web this is the official notification to the county that you will be protesting the valuation of your property. Go to your county’s appraisal district website and look for the option to file a protest. Tax code section 41.44 notice of protest (a) This form is for use by a property owner to offer and submit evidence and/or argument for an appraisal review board (arb) protest hearing by.

Web 850 east anderson lane austin, tx 78752 all property owners who file a protest will have access to tcad’s evidence packet via the online portal. Web the box that corresponds to each reason for your protest may result in your inability to protest an issue that you want to pursue. Current with legislation from the 2023 regular session effective as of june 19, 2023. Web the deadline to file a written protest for real property for the 2023 tax year is may 22, 2023. Complete, edit or print tax forms instantly. The deadline to file this form in texas is may 15 th of each year. Web this is the official notification to the county that you will be protesting the valuation of your property. This form is for use by a property owner to offer and submit evidence and/or argument for an appraisal review board (arb) protest hearing by. You may protest if you disagree with the appraisal district. Tax code section 41.44 notice of protest (a)

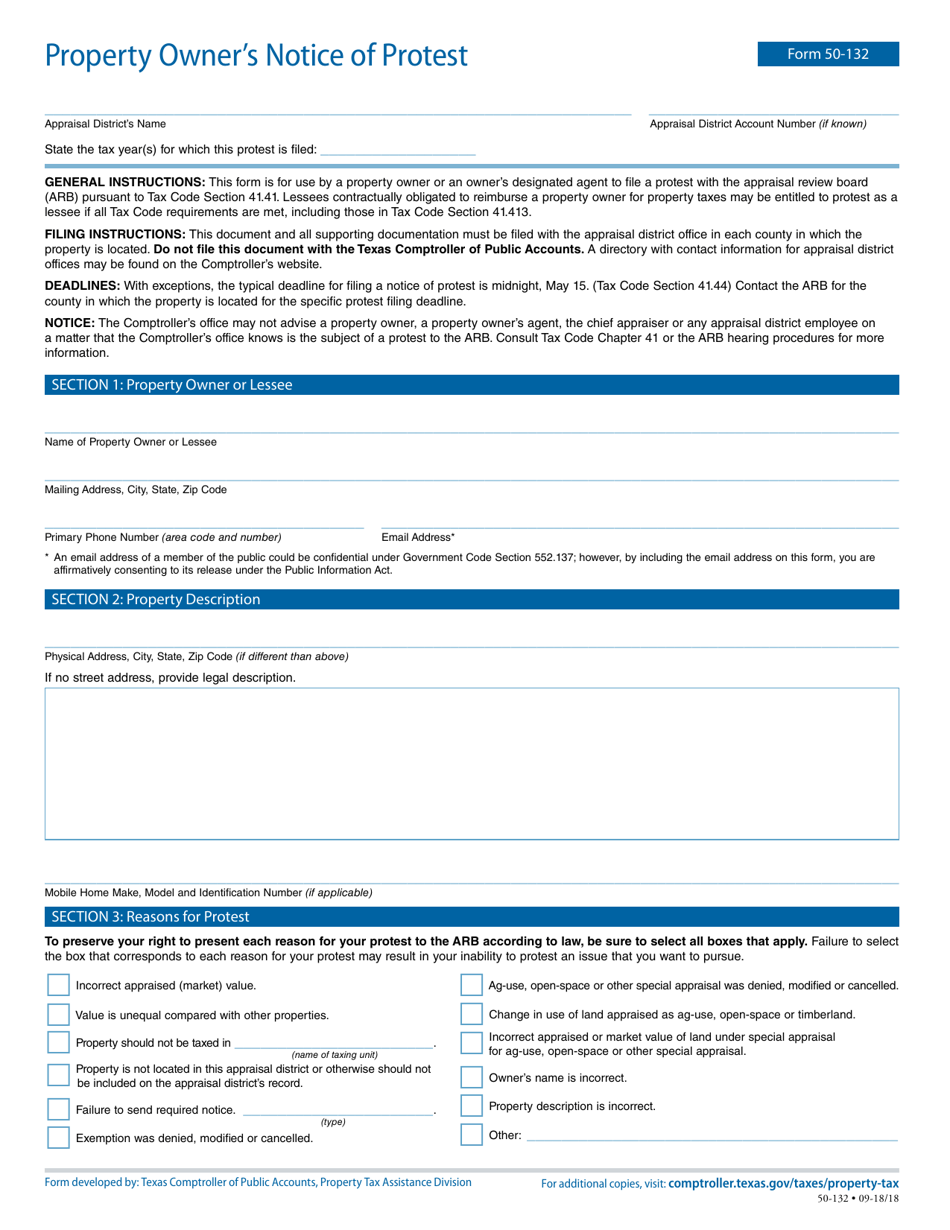

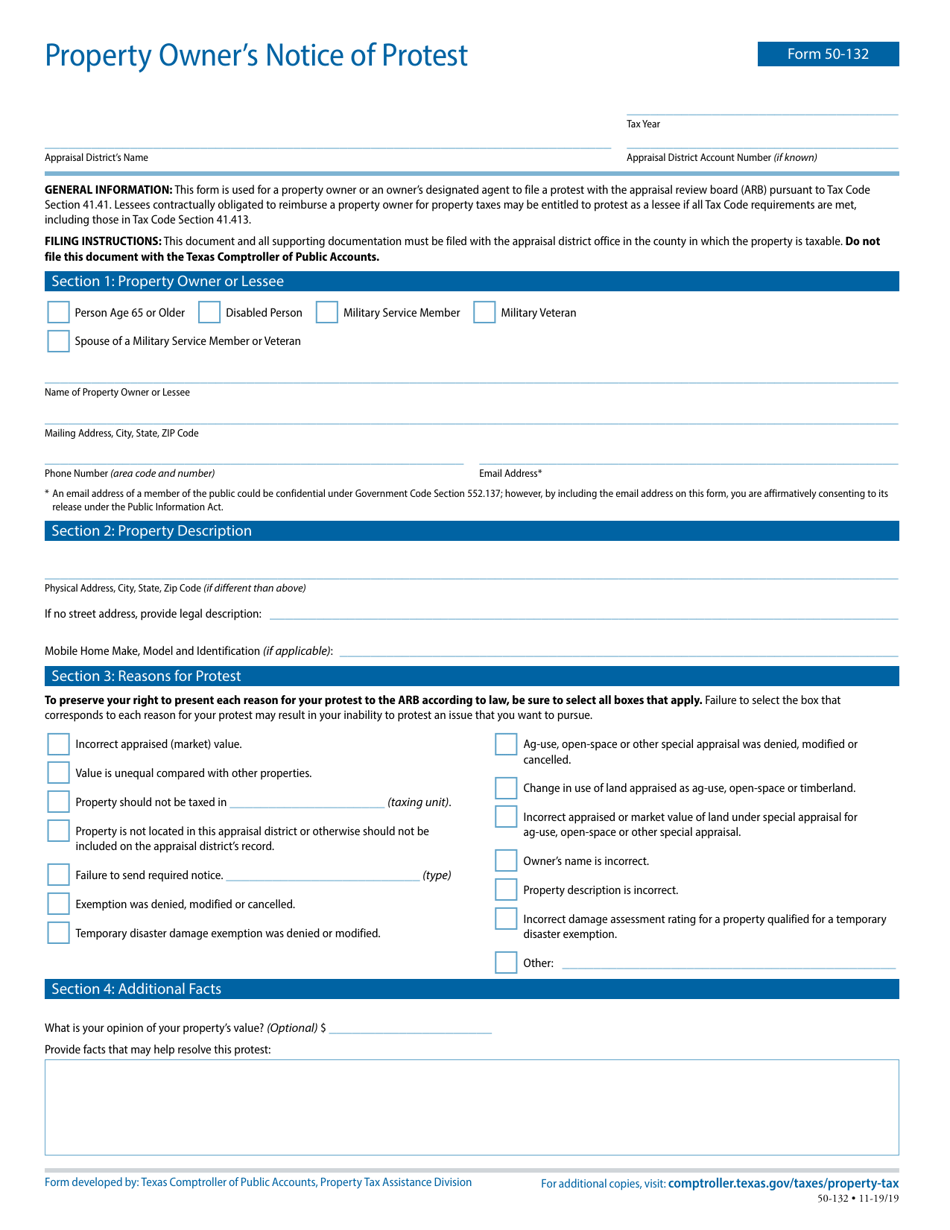

Form 50132 Download Fillable PDF or Fill Online Property Owner's

Web the box that corresponds to each reason for your protest may result in your inability to protest an issue that you want to pursue. Current with legislation from the 2023 regular session effective as of june 19, 2023. File your protest by may 15. For more information about appealing your property's valuation, reference. This form is for use by.

Form 50132 Download Fillable PDF or Fill Online Property Owner's

Web 850 east anderson lane austin, tx 78752 all property owners who file a protest will have access to tcad’s evidence packet via the online portal. At hcad offices located at 13013 northwest freeway. Web the deadline to file a written protest for real property for the 2023 tax year is may 22, 2023. Web notice of protest form. If.

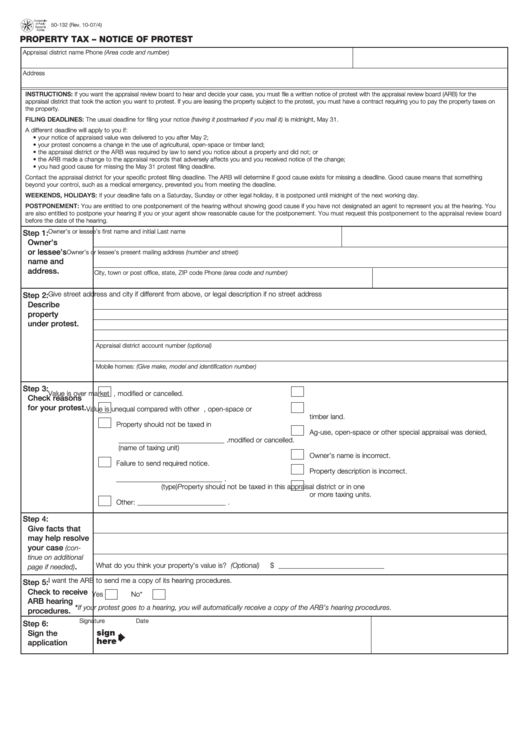

Fillable Form 50132 Property Tax Notice Of Protest printable pdf

For more information about appealing your property's valuation, reference. Web notice of protest form. To access this evidence, you. Web hays central appraisal district offers property owners the option to electronically file a notice of protest as required by texas property tax code section 41.415. It is very important to file the protest on time.

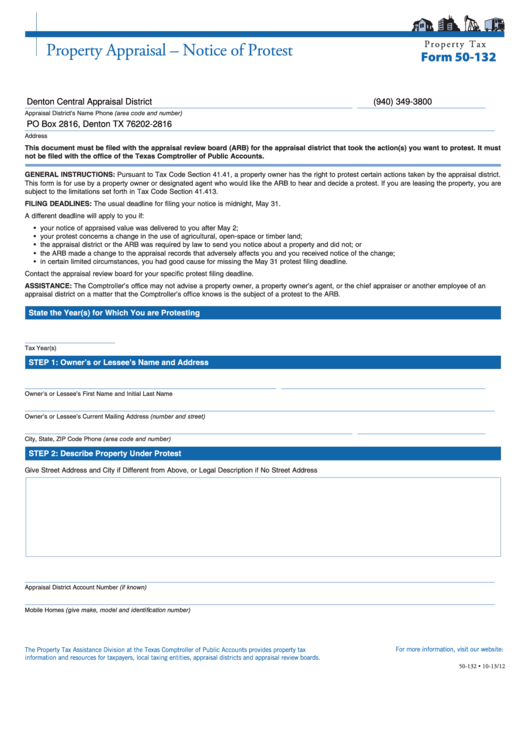

Fillable Form 50132 Property Appraisal Notice Of Protest printable

Web hays central appraisal district offers property owners the option to electronically file a notice of protest as required by texas property tax code section 41.415. Tax code section 41.44 notice of protest (a) Complete, edit or print tax forms instantly. Web the deadline to file a written protest for real property for the 2023 tax year is may 22,.

Blog ERAE REALTY

If you mail your protest, please mail. At hcad offices located at 13013 northwest freeway. Web this is the official notification to the county that you will be protesting the valuation of your property. It is very important to file the protest on time. For more information about appealing your property's valuation, reference.

How to Protest Your Dallas County Property Taxes

Web hays central appraisal district offers property owners the option to electronically file a notice of protest as required by texas property tax code section 41.415. You may protest if you disagree with the appraisal district. At hcad offices located at 13013 northwest freeway. Tax code section 41.44 notice of protest (a) The deadline to file this form in texas.

Hcad Org Forms Fill Online, Printable, Fillable, Blank pdfFiller

For more information about appealing your property's valuation, reference. If you mail your protest, please mail. Web 850 east anderson lane austin, tx 78752 all property owners who file a protest will have access to tcad’s evidence packet via the online portal. Complete, edit or print tax forms instantly. Web this is the official notification to the county that you.

Universal Form To File A Tax Protest & O'Connor & Associates

You may protest if you disagree with the appraisal district. Web notice of protest form. File your protest by may 15. Web 850 east anderson lane austin, tx 78752 all property owners who file a protest will have access to tcad’s evidence packet via the online portal. Tax code section 41.44 notice of protest (a)

Property tax appraisal protest and process to appeal in Texas

Go to your county’s appraisal district website and look for the option to file a protest. Web the box that corresponds to each reason for your protest may result in your inability to protest an issue that you want to pursue. Current with legislation from the 2023 regular session effective as of june 19, 2023. File your protest by may.

Texas Property Tax Protest Made Easy Save Money on Taxes

To access this evidence, you. Tax code section 41.44 notice of protest (a) Web hays central appraisal district offers property owners the option to electronically file a notice of protest as required by texas property tax code section 41.415. This form is for use by a property owner to offer and submit evidence and/or argument for an appraisal review board.

One Of Your Most Important Rights As A Taxpayer Is Your Right To Protest To The Appraisal Review Board (Arb).

This form is for use by a property owner to offer and submit evidence and/or argument for an appraisal review board (arb) protest hearing by. For more information about appealing your property's valuation, reference. If you mail your protest, please mail. The deadline to file this form in texas is may 15 th of each year.

You May Protest If You Disagree With The Appraisal District.

Current with legislation from the 2023 regular session effective as of june 19, 2023. Go to your county’s appraisal district website and look for the option to file a protest. Complete, edit or print tax forms instantly. Web hays central appraisal district offers property owners the option to electronically file a notice of protest as required by texas property tax code section 41.415.

Web The Deadline To File A Written Protest For Real Property For The 2023 Tax Year Is May 22, 2023.

File your protest by may 15. Tax code section 41.44 notice of protest (a) Web this is the official notification to the county that you will be protesting the valuation of your property. If you don’t know where to find it, you have two options to file this.

At Hcad Offices Located At 13013 Northwest Freeway.

Web notice of protest form. To access this evidence, you. It is very important to file the protest on time. Notice of protest local review tex.