Turbotax Consent Form 2023

Turbotax Consent Form 2023 - Irs commissioner danny werfel is calling for a potential early end to the employee retention credit as the number of what he called “legitimate. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Official irs email addresses look like this: Additional fees may apply for. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Commonly filed tax forms and. Web information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file. The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. The intention of this section is to. Unless authorized by law, we cannot use your tax return information for purposes.

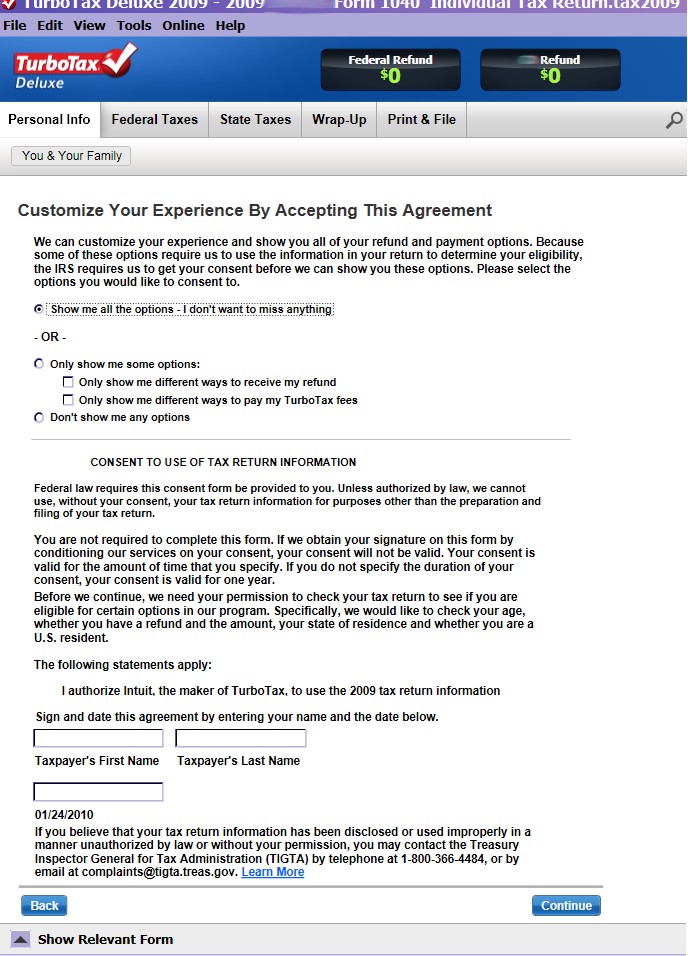

Your tax expert will amend. Web consent for use of tax return information federal law requires this consent form be provided to you. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. A simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Web confirm the irs employee’s email address, especially if you’re replying to a previous message. Web david weiss, the u.s. Web we investigate why turbo tax and h&r block ask you to give up your return’s basic federal privacy protections — and explain how to demand your data back. When setting up your account, you will review a page titled personalize your taxslayer experience with two consents (for. Web information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file.

Those returns are processed in. Web payroll tax returns. Only certain taxpayers are eligible. Web what is the consent to use of tax return information? Web unless authorized by law, we cannot use your tax return information for purposes other than the preparation and filing of your tax return without your consent. When setting up your account, you will review a page titled personalize your taxslayer experience with two consents (for. Your tax expert will amend. Web 1 best answer. Irs commissioner danny werfel is calling for a potential early end to the employee retention credit as the number of what he called “legitimate. A simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules.

form 2106 turbotax Fill Online, Printable, Fillable Blank

Web unless authorized by law, we cannot use your tax return information for purposes other than the preparation and filing of your tax return without your consent. Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. Web consent to access and.

TurboTax 2022 Which Version You Need YouTube

Web payroll tax returns. Web confirm the irs employee’s email address, especially if you’re replying to a previous message. Web what is the consent to use of tax return information? Web a simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Web the 1040 form is the official tax.

TurboTax Canadian Review Top 15 Software Features & Benefits

Web what is the consent to use of tax return information? Web consent to access and store account data. Web david weiss, the u.s. A simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Those returns are processed in.

Adoptive Child Worksheet Turbotax Worksheet Resume Examples

When setting up your account, you will review a page titled personalize your taxslayer experience with two consents (for. Web unless authorized by law, we cannot use your tax return information for purposes other than the preparation and filing of your tax return without your consent. Web concise summary the revised common rule requires that consent forms contain a concise.

What is the TurboTax consent form? YouTube

Web we investigate why turbo tax and h&r block ask you to give up your return’s basic federal privacy protections — and explain how to demand your data back. Web david weiss, the u.s. Web what is the consent to use of tax return information? Web payroll tax returns. Web confirm the irs employee’s email address, especially if you’re replying.

turbotax work from home

Web david weiss, the u.s. A simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. The consent form is just to be offered certain services later, like getting your refund on a card or paying your fees with your refund. Only certain taxpayers are eligible. Attorney for delaware who.

Warning TurboTax 2009's Fraudulent Consent to Steal Your Tax Data

A simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Unless authorized by law, we cannot use your tax return information for purposes. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Irs commissioner danny werfel is calling for a potential.

Turbotax Form / Breanna Form 2106 Expense Type Must Be Entered

Web the 1040 form is the official tax return that taxpayers have to file with the irs each year to report taxable income and calculate their taxes due. A simple tax return is one that's filed using irs form 1040 only, without having to attach any forms or schedules. Web consent for use of tax return information federal law requires.

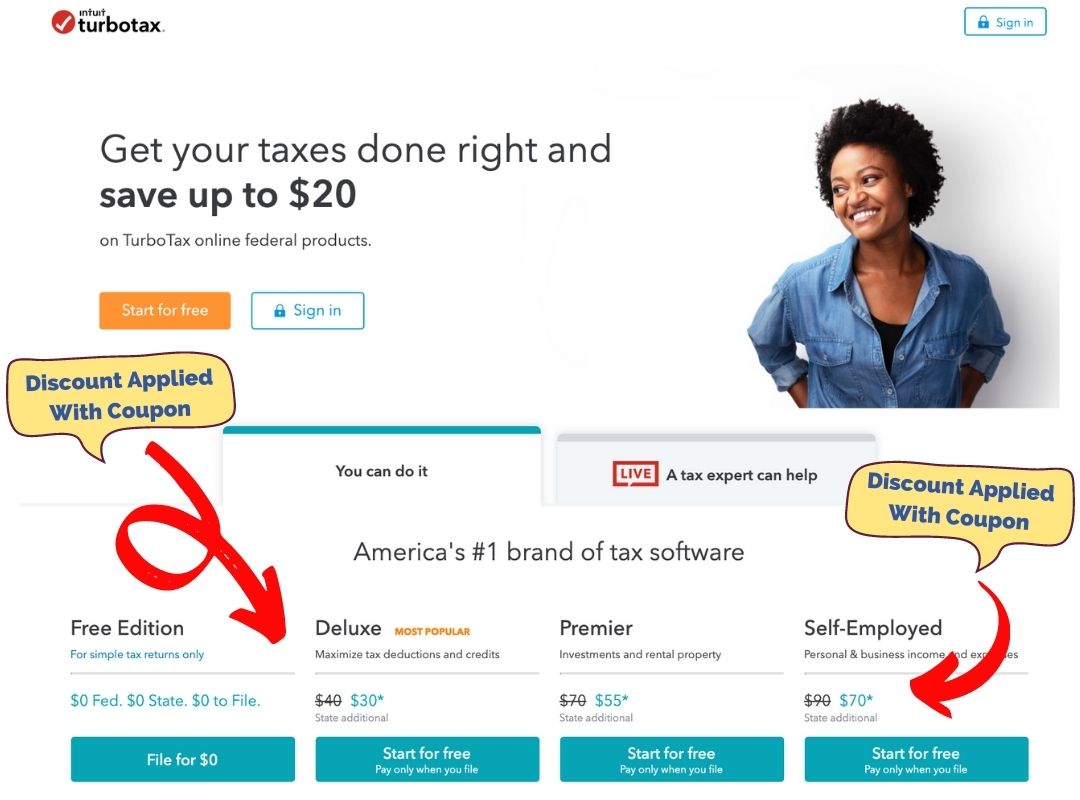

10 TurboTax Service Code & Discounts for 2023 • Up to 15 Off!

Investigators alleged haynes prepared and submitted 1,387 false forms. Web we investigate why turbo tax and h&r block ask you to give up your return’s basic federal privacy protections — and explain how to demand your data back. Web unless authorized by law, we cannot use your tax return information for purposes other than the preparation and filing of your.

TurboTax Review Pricing, Features & Alternatives in 2023

It may seem silly, but. Web tax forms included with turbotax cd/download products answer simple questions about your life, and we’ll fill out the right forms for you. As of july 13, 2023, the irs had 266,000 unprocessed forms 941, employer's quarterly federal tax return. Web payroll tax returns. Web david weiss, the u.s.

Irs Commissioner Danny Werfel Is Calling For A Potential Early End To The Employee Retention Credit As The Number Of What He Called “Legitimate.

Your tax expert will amend. Unless authorized by law, we cannot use your tax return information for purposes. Web information about form 8821, tax information authorization, including recent updates, related forms, and instructions on how to file. Web 1 best answer.

The Intention Of This Section Is To.

Web 1 day agothe teaneck man's scheme allegedly ran from november 2020 to may 2023, officials said. Official irs email addresses look like this: Web consent for use of tax return information federal law requires this consent form be provided to you. It may seem silly, but.

Those Returns Are Processed In.

Form 8821 is used to authorize certain. Web payroll tax returns. Investigators alleged haynes prepared and submitted 1,387 false forms. Web confirm the irs employee’s email address, especially if you’re replying to a previous message.

Additional Fees May Apply For.

Web unless authorized by law, we cannot use your tax return information for purposes other than the preparation and filing of your tax return without your consent. Only certain taxpayers are eligible. When setting up your account, you will review a page titled personalize your taxslayer experience with two consents (for. Web consent to access and store account data.