W-4 Form Arizona

W-4 Form Arizona - You can use your results from the. If too little is withheld, you will generally owe tax when you file your tax return. If too little is withheld, you will generally owe tax when you file your tax return. This form is for income earned in tax year 2022,. As a result, we are revising withholding percentages and are requiring. As a result, we are revising withholding percentages and are requiring. 100 n 15th ave, #301. Web employers withhold state income taxes from employee wages. It works similarly to a. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding.

Web employers withhold state income taxes from employee wages. If too little is withheld, you will generally owe tax when you file your tax return. Web adoa human resources. As a result, we are revising withholding percentages and are requiring. One difference from prior forms is the expected filing. You can use your results from the. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. As a result, we are revising withholding percentages and are requiring. Web the form has steps 1 through 5 to guide employees through it. If too little is withheld, you will generally owe tax when you file your tax return.

One difference from prior forms is the expected filing. As a result, we are revising withholding percentages and are requiring. Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. 100 n 15th ave, #301. As a result, we are revising withholding percentages and are requiring. You can use your results from the. If too little is withheld, you will generally owe tax when you file your tax return. It works similarly to a. Web adoa human resources. Web employers withhold state income taxes from employee wages.

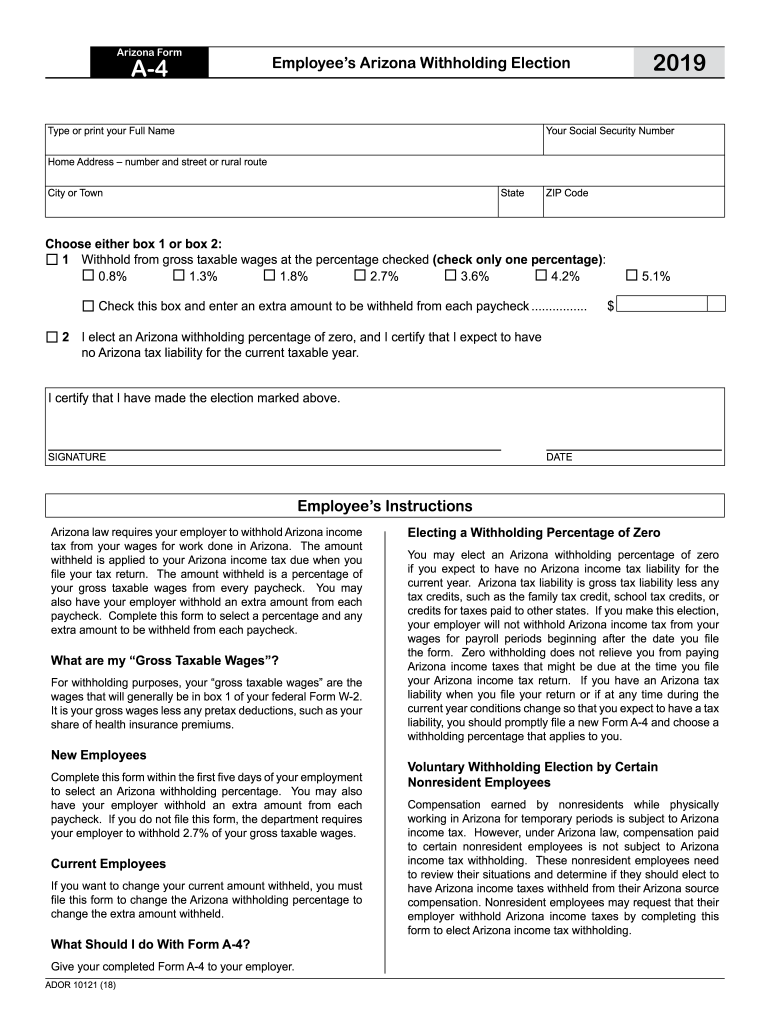

2019 Form AZ DoR A4 Fill Online, Printable, Fillable, Blank PDFfiller

Web adoa human resources. You can use your results from the. If too little is withheld, you will generally owe tax when you file your tax return. One difference from prior forms is the expected filing. As a result, we are revising withholding percentages and are requiring.

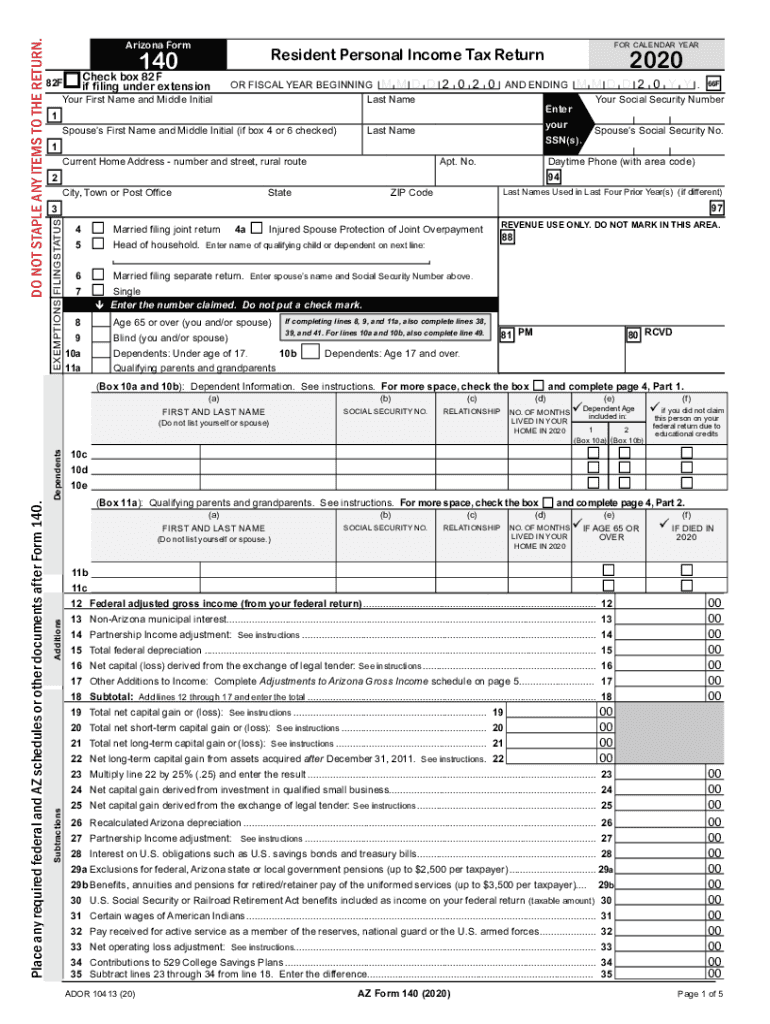

2020 AZ Form 140 Fill Online, Printable, Fillable, Blank pdfFiller

100 n 15th ave, #301. As a result, we are revising withholding percentages and are requiring. This form is for income earned in tax year 2022,. It works similarly to a. You can use your results from the.

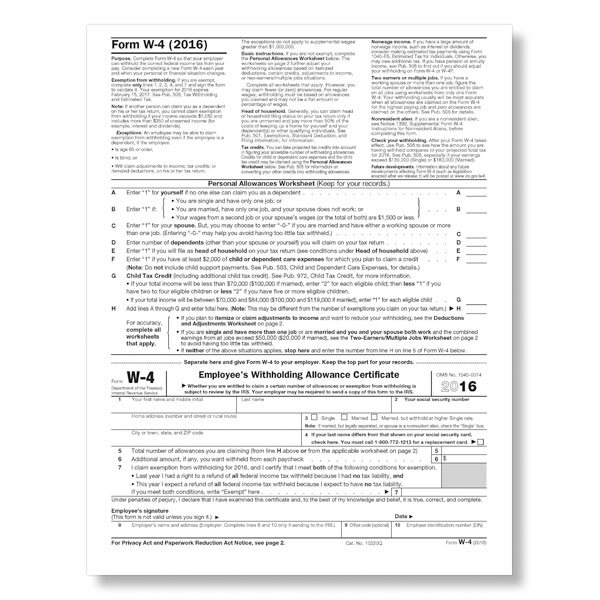

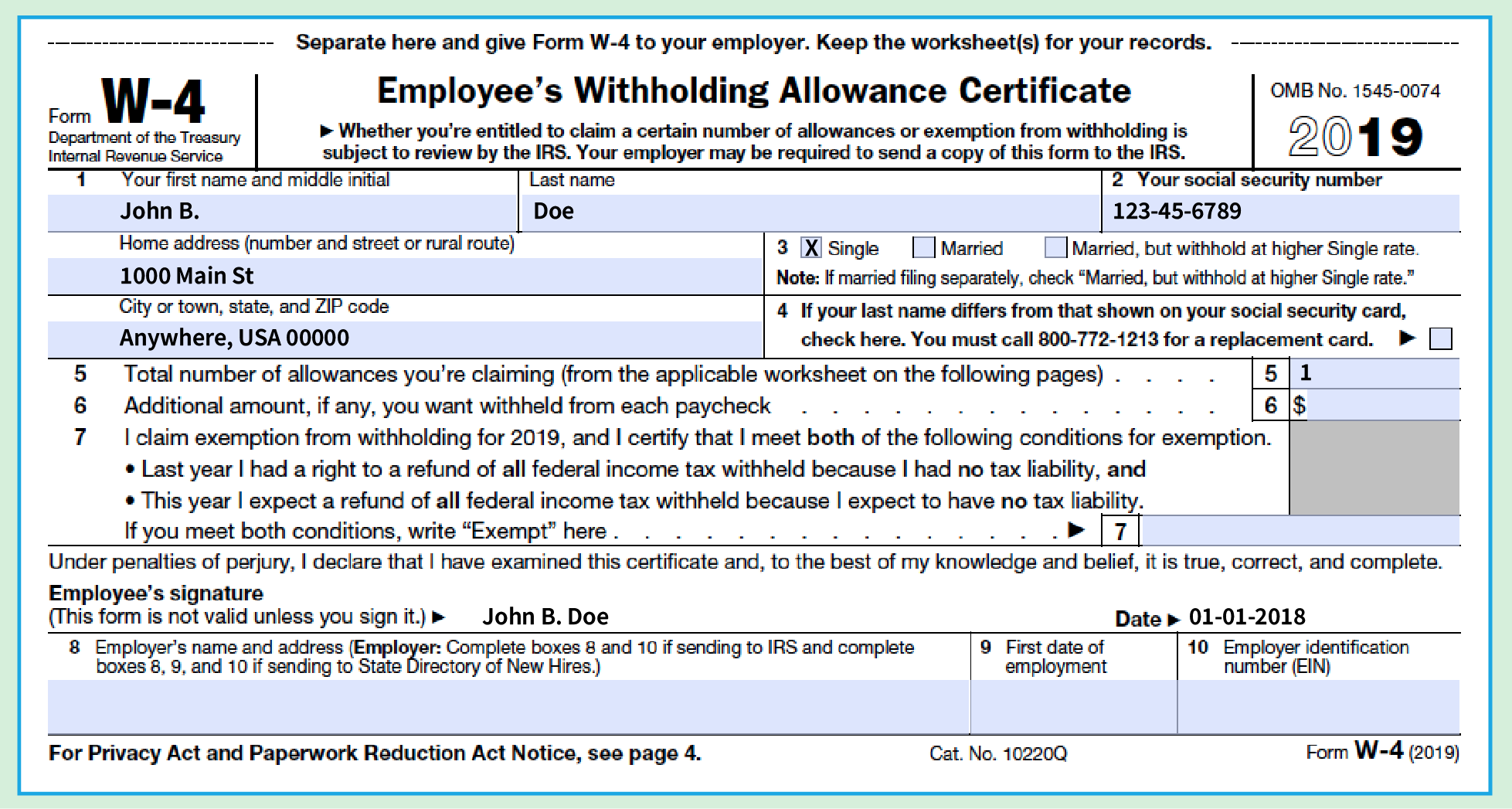

W4 Forms for New Hires New Hire Forms

Web the form has steps 1 through 5 to guide employees through it. Web adoa human resources. As a result, we are revising withholding percentages and are requiring. You can use your results from the. If too little is withheld, you will generally owe tax when you file your tax return.

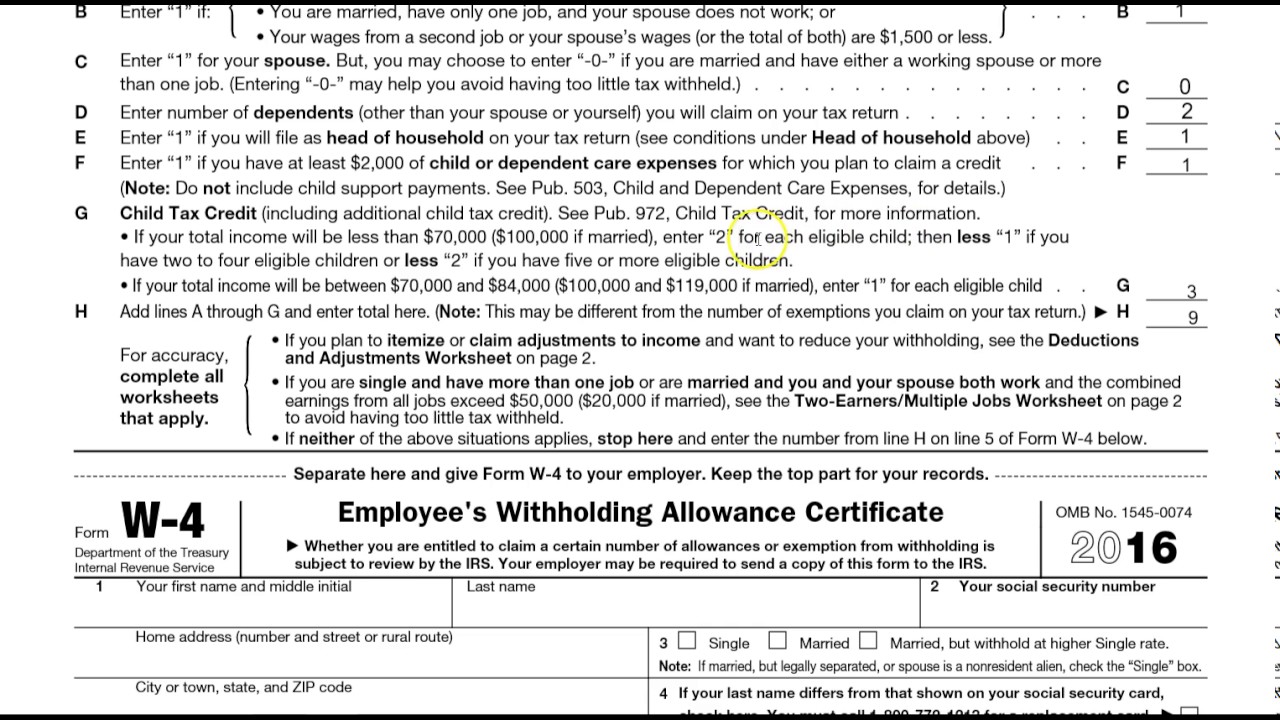

w 4 form DriverLayer Search Engine

100 n 15th ave, #301. As a result, we are revising withholding percentages and are requiring. Web employers withhold state income taxes from employee wages. If too little is withheld, you will generally owe tax when you file your tax return. As a result, we are revising withholding percentages and are requiring.

How to Fill Out a W4 Form and Decide How Much to Claim NerdWallet

It works similarly to a. Web employers withhold state income taxes from employee wages. This form is for income earned in tax year 2022,. One difference from prior forms is the expected filing. Web the form has steps 1 through 5 to guide employees through it.

Arizona W 4 2019 Printable justgoing 2020

Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. One difference from prior forms is the expected filing. Web adoa human resources. As a result, we are revising withholding percentages and are requiring. This form is for income earned in tax.

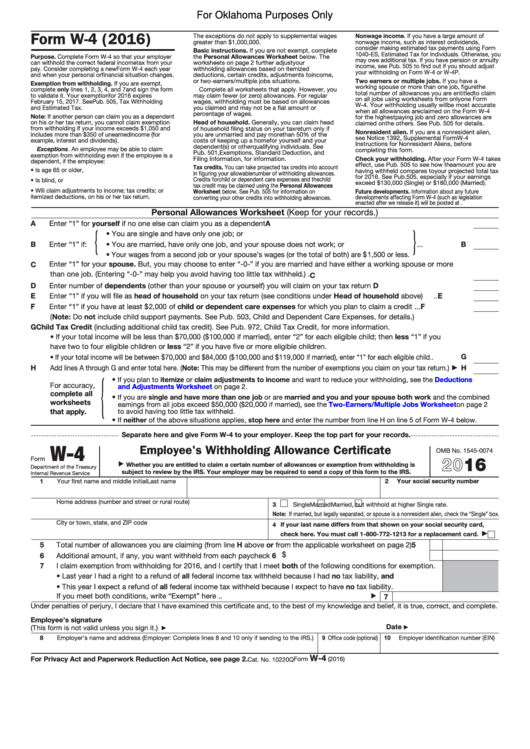

Form W4 Employee'S Withholding Allowance Certificate (Oklahoma

If too little is withheld, you will generally owe tax when you file your tax return. Web employers withhold state income taxes from employee wages. Web the form has steps 1 through 5 to guide employees through it. If too little is withheld, you will generally owe tax when you file your tax return. You can use your results from.

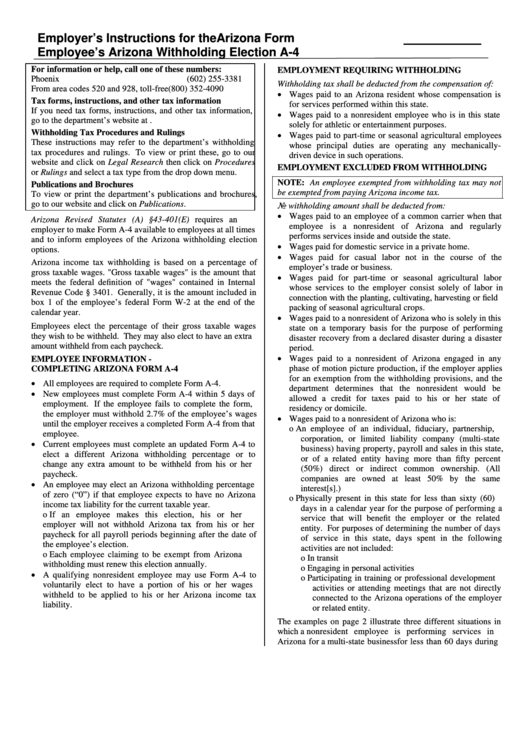

Arizona Form A4 Employer'S Instructions For The Employee'S Arizona

Web the form has steps 1 through 5 to guide employees through it. As a result, we are revising withholding percentages and are requiring. This form is for income earned in tax year 2022,. 100 n 15th ave, #301. If too little is withheld, you will generally owe tax when you file your tax return.

Il W 4 2020 2022 W4 Form

Web the form has steps 1 through 5 to guide employees through it. As a result, we are revising withholding percentages and are requiring. 100 n 15th ave, #301. You can use your results from the. If too little is withheld, you will generally owe tax when you file your tax return.

Michigan W4 Form and Instructions for Nonresident Aliens University

This form is for income earned in tax year 2022,. It works similarly to a. Web adoa human resources. As a result, we are revising withholding percentages and are requiring. As a result, we are revising withholding percentages and are requiring.

100 N 15Th Ave, #301.

Web to compute the amount of tax to withhold from compensation paid to employees for services performed in arizona, all new employees subject to arizona income tax withholding. It works similarly to a. Web the form has steps 1 through 5 to guide employees through it. Web employers withhold state income taxes from employee wages.

If Too Little Is Withheld, You Will Generally Owe Tax When You File Your Tax Return.

This form is for income earned in tax year 2022,. You can use your results from the. If too little is withheld, you will generally owe tax when you file your tax return. Web adoa human resources.

As A Result, We Are Revising Withholding Percentages And Are Requiring.

As a result, we are revising withholding percentages and are requiring. One difference from prior forms is the expected filing.