What Is Form 7200

What Is Form 7200 - Add / subtract a percentage. Department of the treasury internal revenue service. For instructions and the latest information. Credits and advance request details click here to learn more about form 7200 line by line instructions get started now! Web what is irs form 7200? Qualified sick and family leave wages. (form 7200, instructions) delay in processing advance payments. There are two reasons why taxpayers would need to complete this 7200 form. Document is not used to report income or tax liability. Web what is form 7200?

The first is if the ratepayer bought a u.s. Max verstappen is toying with. There are two reasons why taxpayers would need to complete this 7200 form. Department of the treasury internal revenue service. Qualified sick and family leave wages. Credits and advance request details click here to learn more about form 7200 line by line instructions get started now! Web what is form 7200? Add / subtract a percentage. Treasury security for a foreign person. Web what is irs form 7200?

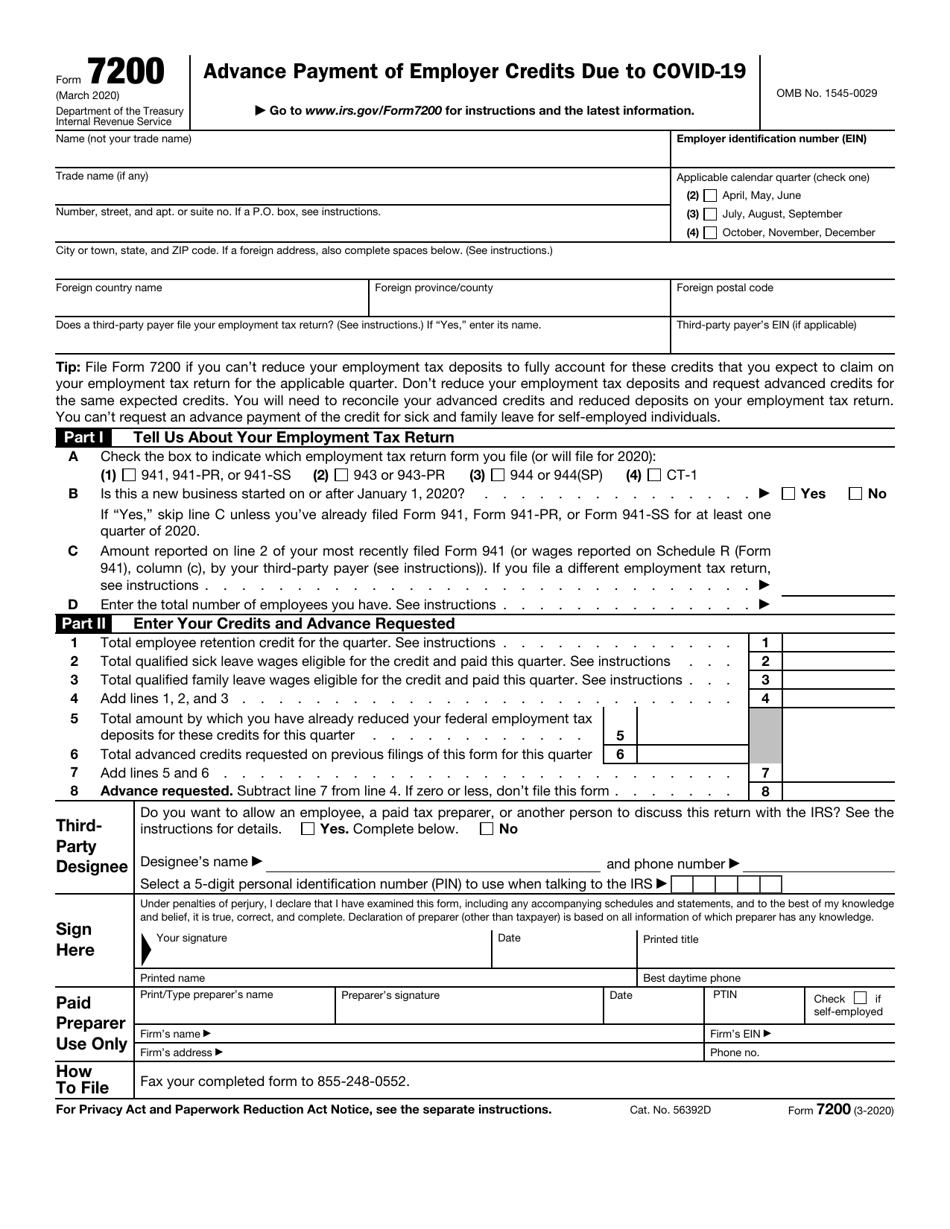

Percentage (% of) percentage change. Form 7200 covers claims on different employment tax returns, including quarterly employment tax, form 941, and employer relief credits on qualified sick and family leave. Web the purpose of this form 7200 irs is to make the process of filing taxes easier for the taxpayer. Name, ein, and address 2. 'cheeky' verstappen toys with rivals as title looms. The first is if the ratepayer bought a u.s. Web form 7200 is used by eligible employers and small employers to request advance payment of the employee retention credit and the ffcra credits that an employer claims on employment tax returns such as form 941, employers quarterly federal tax return. For instructions and the latest information. Who can file form 7200? Web form 7200 is an official irs document that allows employers to request advance payment on employer credits for:

File Form 7200 (Advance Payment of Employer Credits Due to COVID19

Document is not used to report income or tax liability. Web form 7200 is an official irs document that allows employers to request advance payment on employer credits for: Web the purpose of this form 7200 irs is to make the process of filing taxes easier for the taxpayer. Form 7200 remains on irs.gov only as a historical item at.

IRS Form 7200 2022 IRS Forms

Document is not used to report income or tax liability. There are two reasons why taxpayers would need to complete this 7200 form. Web after he led luton back to the top flight, bbc sport talks to those who have played under manager rob edwards. Treasury security for a foreign person. (form 7200, instructions) delay in processing advance payments.

IRS Form 7200 Advance of Employer Credits Due to COVID19

Percentage (% of) percentage change. Web how to write 7200 in standard form. Add / subtract a percentage. Web form 7200 is an official irs document that allows employers to request advance payment on employer credits for: Treasury security for a foreign person.

Avoid These Common Mistakes When Filing Your IRS Form 7200 Blog

Web how to write 7200 in standard form. Web form 7200 is an official irs document that allows employers to request advance payment on employer credits for: Web paid preparer just follow the instructions below to complete and file your form 7200 successfully to the irs. Name, ein, and address 2. Qualified sick and family leave wages.

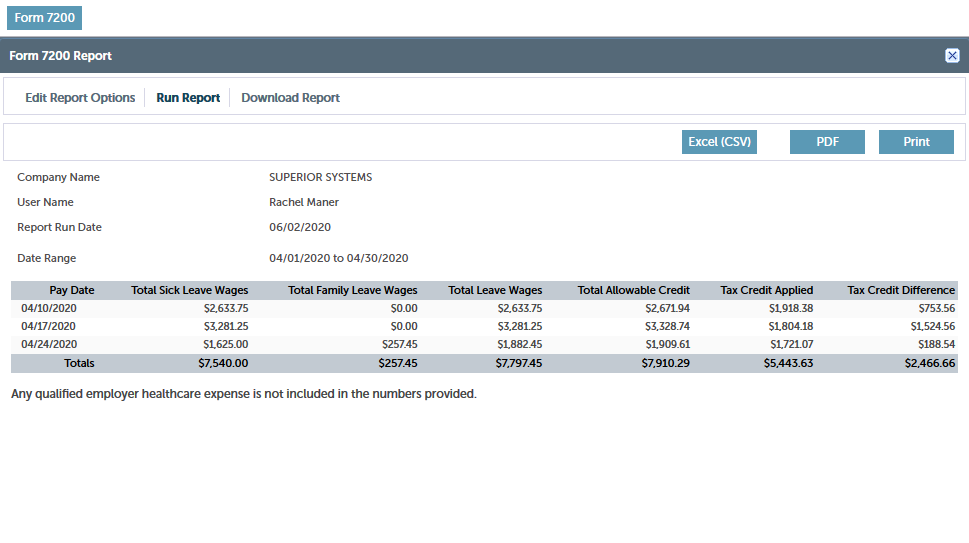

APS Releases Form 7200 Report, COVID19 Credits APS Payroll

Add / subtract a percentage. Web form 7200 is used by eligible employers and small employers to request advance payment of the employee retention credit and the ffcra credits that an employer claims on employment tax returns such as form 941, employers quarterly federal tax return. Web the purpose of this form 7200 irs is to make the process of.

Why File Form 7200? How Does This Form Work? Blog TaxBandits

Web the purpose of this form 7200 irs is to make the process of filing taxes easier for the taxpayer. Web what is form 7200? Document is not used to report income or tax liability. Web after he led luton back to the top flight, bbc sport talks to those who have played under manager rob edwards. Credits and advance.

What Is The Form 7200, How Do I File It? Blog TaxBandits

Web the purpose of this form 7200 irs is to make the process of filing taxes easier for the taxpayer. Form 7200 covers claims on different employment tax returns, including quarterly employment tax, form 941, and employer relief credits on qualified sick and family leave. Web file form 7200 if you can’t reduce your employment tax deposits to fully account.

IRS Form 7200 Download Fillable PDF or Fill Online Advance Payment of

Web how to write 7200 in standard form. Treasury security for a foreign person. Web form 7200 is an official irs document that allows employers to request advance payment on employer credits for: Irs form 7200 allows employers to request an advanced payment of their employee retention credit. Add / subtract a percentage.

StepbyStep Guide Form 7200 Advance Employment Credits BerniePortal

Name, ein, and address 2. Form 7200 covers claims on different employment tax returns, including quarterly employment tax, form 941, and employer relief credits on qualified sick and family leave. Web what is form 7200? Qualified sick and family leave wages. When employers deduct these credits from their deposits in anticipation of these credits.

How to file Form 7200? YouTube

There are two reasons why taxpayers would need to complete this 7200 form. Who can file form 7200? Web file form 7200 if you can’t reduce your employment tax deposits to fully account for these credits that you expect to claim on your employment tax return for the applicable quarter. When employers deduct these credits from their deposits in anticipation.

Add / Subtract A Percentage.

Percentage (% of) percentage change. Web form 7200 is used by eligible employers and small employers to request advance payment of the employee retention credit and the ffcra credits that an employer claims on employment tax returns such as form 941, employers quarterly federal tax return. Web the purpose of this form 7200 irs is to make the process of filing taxes easier for the taxpayer. Credits and advance request details click here to learn more about form 7200 line by line instructions get started now!

Form 7200 Remains On Irs.gov Only As A Historical Item At Www.irs.gov/Allforms.

'cheeky' verstappen toys with rivals as title looms. Web what is form 7200? Form 7200 covers claims on different employment tax returns, including quarterly employment tax, form 941, and employer relief credits on qualified sick and family leave. For instructions and the latest information.

(Form 7200, Instructions) Delay In Processing Advance Payments.

Web form 7200 is an official irs document that allows employers to request advance payment on employer credits for: When employers deduct these credits from their deposits in anticipation of these credits. Web file form 7200 if you can’t reduce your employment tax deposits to fully account for these credits that you expect to claim on your employment tax return for the applicable quarter. Web what information is required to complete covid19 form 7200 for 2021?

Web After He Led Luton Back To The Top Flight, Bbc Sport Talks To Those Who Have Played Under Manager Rob Edwards.

Irs form 7200 allows employers to request an advanced payment of their employee retention credit. The first is if the ratepayer bought a u.s. There are two reasons why taxpayers would need to complete this 7200 form. Department of the treasury internal revenue service.