When Is Form 1042 Due

When Is Form 1042 Due - By filing form 8809, you will get an. Web in a case in which a fatca withholding agent withholds after march 15 of the subsequent year, the fatca withholding agent should file a form 1042 (if the dividend. Web electronic filing of form 1042 is available in 2023. Source income of foreign persons go to Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Web form 1042 deadline. Source income subject to withholding, to the internal revenue service. For general information about electronic filing, see pub. The form 8804 filing deadline. Web solved•by turbotax•6089•updated january 13, 2023.

For general information about electronic filing, see pub. Web withholding agents must file form 1042 by march 15, though the filing deadline can be extended to sept. If additional time is required to file the form, an extension may be. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Source income of foreign persons go to www.irs.gov/form1042 for. Web a withholding agent shall make an income tax return on form 1042 (or such other form as the irs may prescribe) for income paid during the preceding calendar year that the. The form 8804 filing deadline. Web in a case in which a fatca withholding agent withholds after march 15 of the subsequent year, the fatca withholding agent should file a form 1042 (if the dividend. 15 following the close of the tax year, and, assuming the partnership does not furnish the schedule k. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s.

Web electronic filing of form 1042 is available in 2023. Web in a case in which a fatca withholding agent withholds after march 15 of the subsequent year, the fatca withholding agent should file a form 1042 (if the dividend. Web form 1042 deadline. Source income of foreign persons go to For general information about electronic filing, see pub. By filing form 8809, you will get an. Source income of foreign persons go to www.irs.gov/form1042 for. 15 by submitting form 7004, application for. If additional time is required to file the form, an extension may be. Web a withholding agent shall make an income tax return on form 1042 (or such other form as the irs may prescribe) for income paid during the preceding calendar year that the.

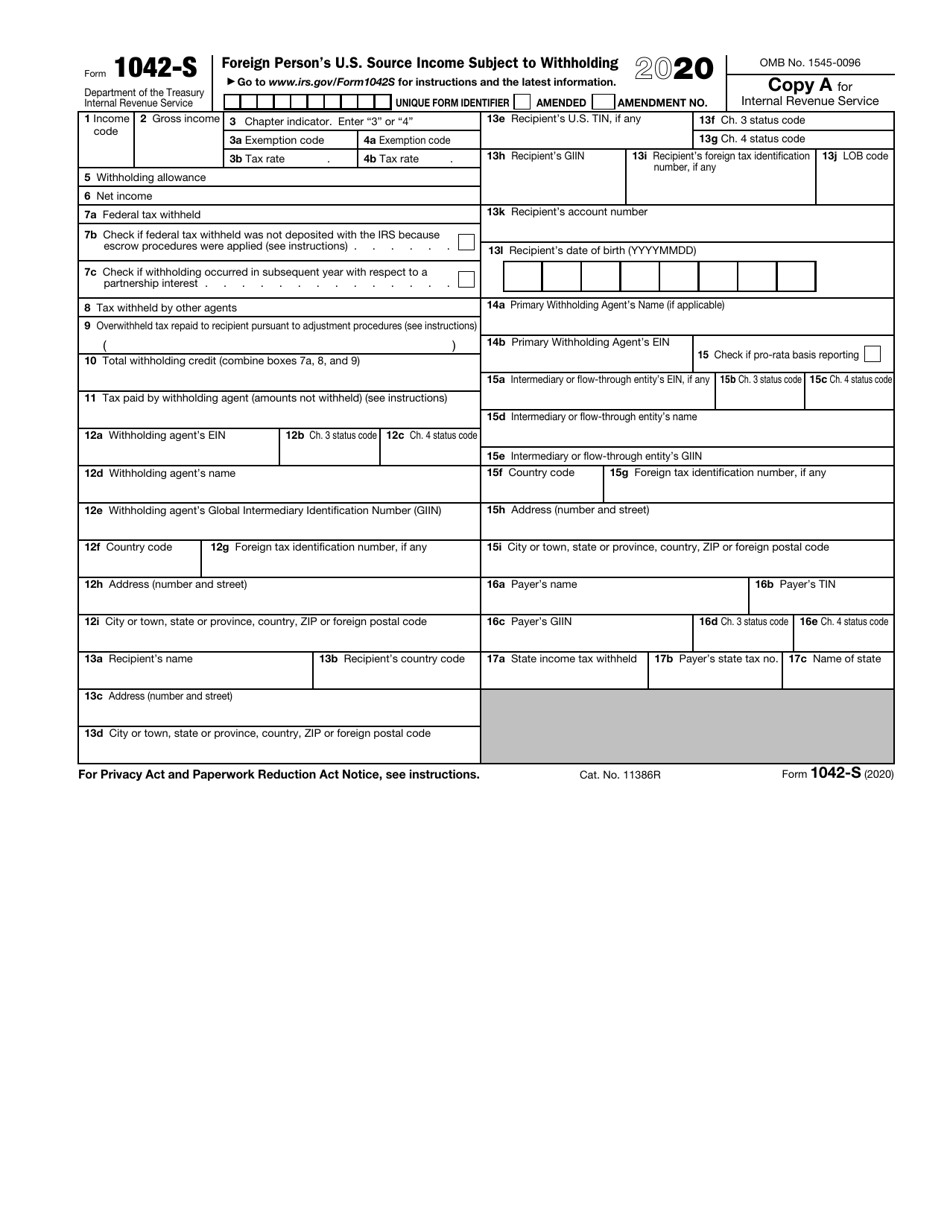

Instructions for IRS Form 1042S How to Report Your Annual

The irs will accept an amended return up to three years after the date you filed the original return or within. 15 following the close of the tax year, and, assuming the partnership does not furnish the schedule k. The form 8804 filing deadline. Source income of foreign persons go to www.irs.gov/form1042 for. Web form 1042 department of the treasury.

1042 S Form slideshare

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Source income of foreign persons go to www.irs.gov/form1042 for. Web solved•by turbotax•6089•updated january 13, 2023. Source income subject to withholding, to the internal revenue service. If additional time is required to file the form, an extension may be.

Form 1042 S 2017 Beautiful Wo A1 Heteroaryl Derivatives as Sepiapterin

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Web a withholding agent shall make an income tax return on form 1042 (or such other form as the irs may prescribe) for income paid during the preceding calendar year that the. Web withholding agents must file form 1042 by march 15, though the.

Formulario 1042S skuylahhu 2

For general information about electronic filing, see pub. Web solved•by turbotax•6089•updated january 13, 2023. Web in a case in which a fatca withholding agent withholds after march 15 of the subsequent year, the fatca withholding agent should file a form 1042 (if the dividend. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s..

Form 1042 S 2017 Beautiful form Part 5

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. Source income of foreign persons go to If additional time is required to file the form, an extension may be. Web in a case in which a fatca withholding agent withholds after march 15 of the subsequent year, the fatca withholding agent should file.

FORM 1042S 2014 PDF

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. The irs will accept an amended return up to three years after the date you filed the original return or within. Web in a case in which a fatca withholding agent withholds after march 15 of the subsequent year, the fatca withholding agent should.

2018 2019 IRS Form 1042 Fill Out Digital PDF Sample

Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. 15 by submitting form 7004, application for. 15 following the close of the tax year, and, assuming the partnership does not furnish the schedule k. Web electronic filing of form 1042 is available in 2023. Web in a case in which a fatca withholding.

Form 1042 S 2017 Awesome form 1042 S

15 following the close of the tax year, and, assuming the partnership does not furnish the schedule k. If additional time is required to file the form, an extension may be. Web solved•by turbotax•6089•updated january 13, 2023. Source income of foreign persons go to www.irs.gov/form1042 for. Web a withholding agent shall make an income tax return on form 1042 (or.

Form 1042S USEReady

Source income of foreign persons go to By filing form 8809, you will get an. Source income subject to withholding, to the internal revenue service. Web solved•by turbotax•6089•updated january 13, 2023. Web form 1042 deadline.

Web Electronic Filing Of Form 1042 Is Available In 2023.

Web withholding agents must file form 1042 by march 15, though the filing deadline can be extended to sept. The form 8804 filing deadline. If additional time is required to file the form, an extension may be. Source income of foreign persons go to www.irs.gov/form1042 for.

Web Form 1042 Department Of The Treasury Internal Revenue Service Annual Withholding Tax Return For U.s.

By filing form 8809, you will get an. 15 following the close of the tax year, and, assuming the partnership does not furnish the schedule k. For general information about electronic filing, see pub. Web a withholding agent shall make an income tax return on form 1042 (or such other form as the irs may prescribe) for income paid during the preceding calendar year that the.

Web Solved•By Turbotax•6089•Updated January 13, 2023.

Web in a case in which a fatca withholding agent withholds after march 15 of the subsequent year, the fatca withholding agent should file a form 1042 (if the dividend. Web form 1042 deadline. Web form 1042 department of the treasury internal revenue service annual withholding tax return for u.s. 15 by submitting form 7004, application for.

The Irs Will Accept An Amended Return Up To Three Years After The Date You Filed The Original Return Or Within.

Source income of foreign persons go to Source income subject to withholding, to the internal revenue service.