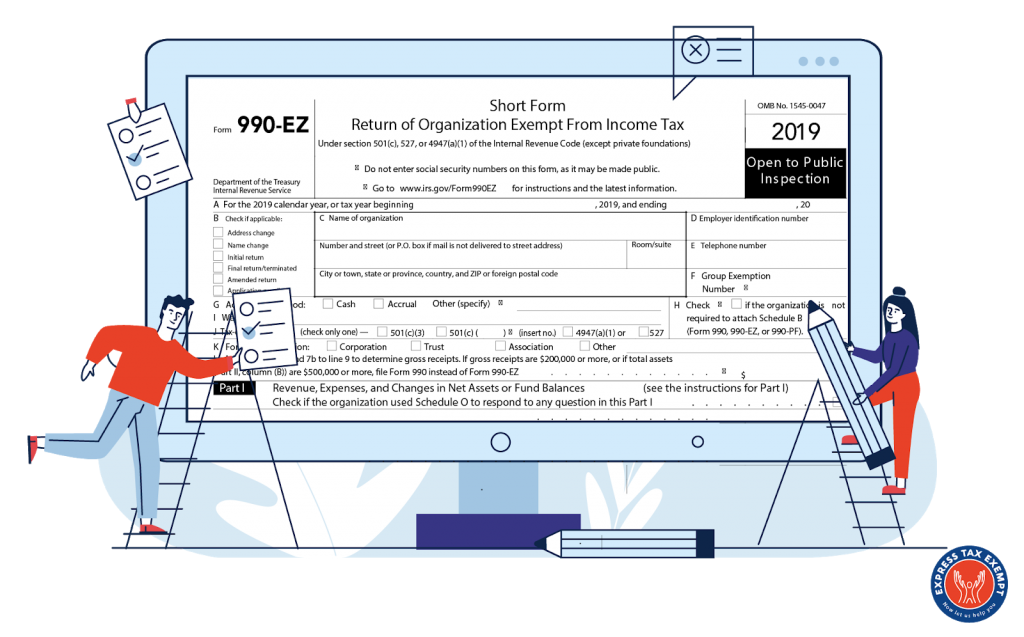

990-Ez Form

990-Ez Form - An organization that is exempt from income tax under section 501 (a). Ad access irs tax forms. Section 509 (a) (3) supporting organizations. Ad access irs tax forms. Tips and irs instructions embedded within forms. Name of organization address change name change number and street (or p.o. Box if mail is not delivered to street address) room/suite initial return final return/terminated Supports form 990 schedules a through r. Get ready for tax season deadlines by completing any required tax forms today. Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or.

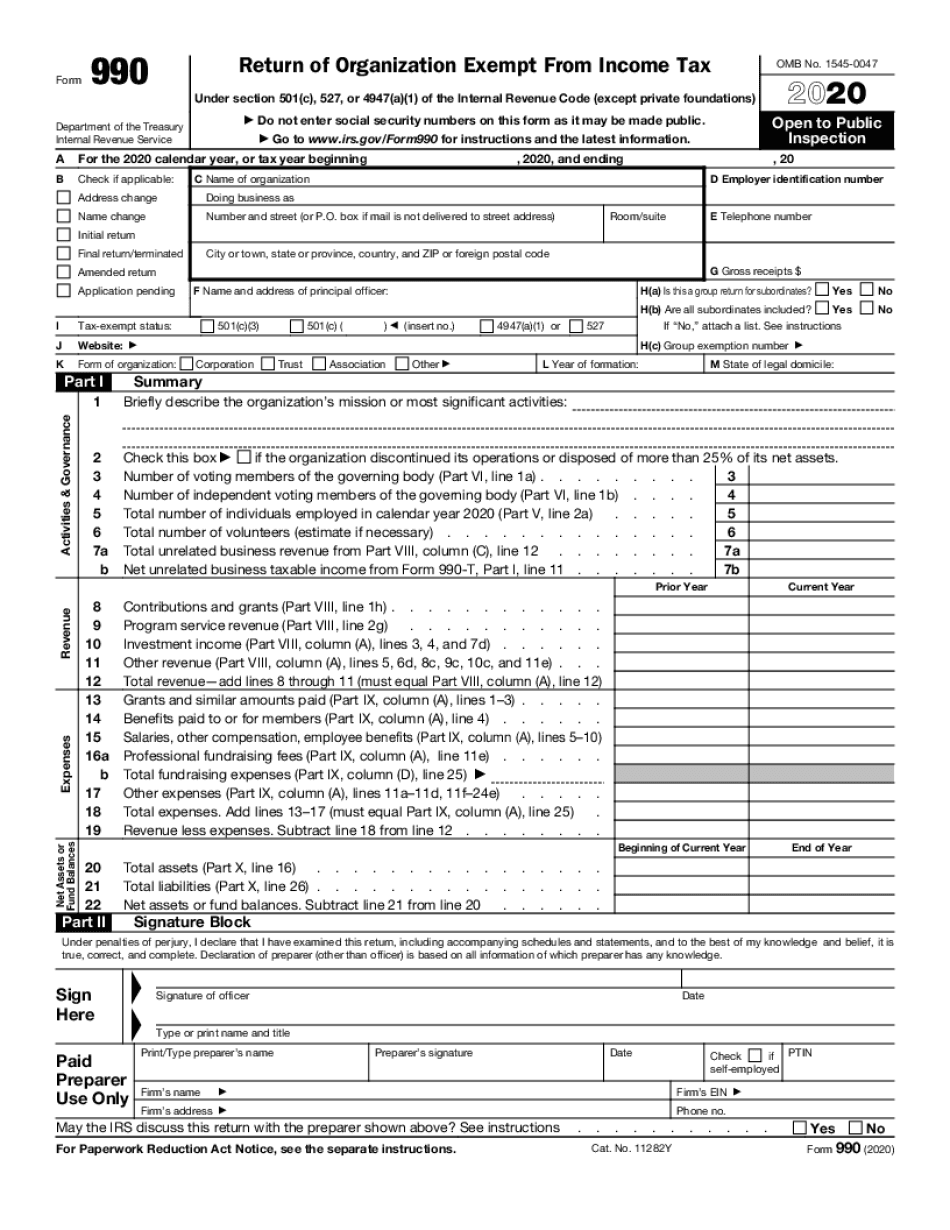

Sponsoring organizations of donor advised funds. Section 501 (c) (7) and 501 (c) (15) organizations. Short form return of organization exempt from income tax. Complete, edit or print tax forms instantly. Get ready for tax season deadlines by completing any required tax forms today. Supports form 990 schedules a through r. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Ad access irs tax forms. Complete, edit or print tax forms instantly. Copies data from year to year.

Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Short form return of organization exempt from income tax. Get ready for tax season deadlines by completing any required tax forms today. Complete, edit or print tax forms instantly. Verification routines ensure your return is accurate and complete.

How Do I Complete The Form 990EZ?

Get ready for tax season deadlines by completing any required tax forms today. Get ready for tax season deadlines by completing any required tax forms today. Section 501 (c) (7) and 501 (c) (15) organizations. Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. Verification routines ensure your return.

Irs Form 990 Ez Online Universal Network

Organizations that operate a hospital facility. Section 501 (c) (7) and 501 (c) (15) organizations. Complete, edit or print tax forms instantly. Tips and irs instructions embedded within forms. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public.

IRS Form 990EZ 2018 2019 Printable & Fillable Sample in PDF

Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly.

Irs Forms 990 Ez Form Resume Examples emVKvWnYrX

Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Get ready for tax season deadlines by completing any required tax forms today. Organizations that operate a hospital facility. Complete, edit or print tax forms instantly.

Form 990EZ Short Form Return of Organization Exempt from Tax

Copies data from year to year. An organization that is exempt from income tax under section 501 (a). Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or. Ad access irs tax forms. Name of organization address change name change number and street (or p.o.

990 ez form Fill Online, Printable, Fillable Blank

Ad access irs tax forms. Name of organization address change name change number and street (or p.o. Department of the treasury internal revenue service. Complete, edit or print tax forms instantly. Copies data from year to year.

Form 990EZ Instructions 2021 Form 990EZ Filing instructions

Ad access irs tax forms. Ad access irs tax forms. Department of the treasury internal revenue service. Tips and irs instructions embedded within forms. Section 509 (a) (3) supporting organizations.

Form 990 or 990EZ (Sch N) Liquidation, Termination, Dissolution, or

Name of organization address change name change number and street (or p.o. Under section 501(c), 527, or 4947(a)(1) of the internal revenue code (except private foundations) do not enter social security numbers on this form, as it may be made public. Section 501 (c) (7) and 501 (c) (15) organizations. Ad access irs tax forms. Get ready for tax season.

Form 990EZ Reporting for Smaller TaxExempt Organizations

Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms. Complete, edit or print tax forms instantly. Complete, edit or print tax forms instantly. Organizations that operate a hospital facility.

Irs Form 990 Ez 2017 Form Resume Examples a6Yn6mOYBg

Get ready for tax season deadlines by completing any required tax forms today. Tips and irs instructions embedded within forms. Section 501 (c) (7) and 501 (c) (15) organizations. An organization that is exempt from income tax under section 501 (a). Get ready for tax season deadlines by completing any required tax forms today.

Under Section 501(C), 527, Or 4947(A)(1) Of The Internal Revenue Code (Except Private Foundations) Do Not Enter Social Security Numbers On This Form, As It May Be Made Public.

Ad access irs tax forms. Tips and irs instructions embedded within forms. Sponsoring organizations of donor advised funds. Short form return of organization exempt from income tax.

An Organization That Is Exempt From Income Tax Under Section 501 (A).

Get ready for tax season deadlines by completing any required tax forms today. Supports form 990 schedules a through r. Get ready for tax season deadlines by completing any required tax forms today. Ad access irs tax forms.

Box If Mail Is Not Delivered To Street Address) Room/Suite Initial Return Final Return/Terminated

Copies data from year to year. Verification routines ensure your return is accurate and complete. Complete, edit or print tax forms instantly. Its gross receipts are normally $50,000 or less, it is within the class of organizations affiliated with a church or.

Section 501 (C) (7) And 501 (C) (15) Organizations.

Get ready for tax season deadlines by completing any required tax forms today. Organizations that operate a hospital facility. Ad access irs tax forms. Section 509 (a) (3) supporting organizations.