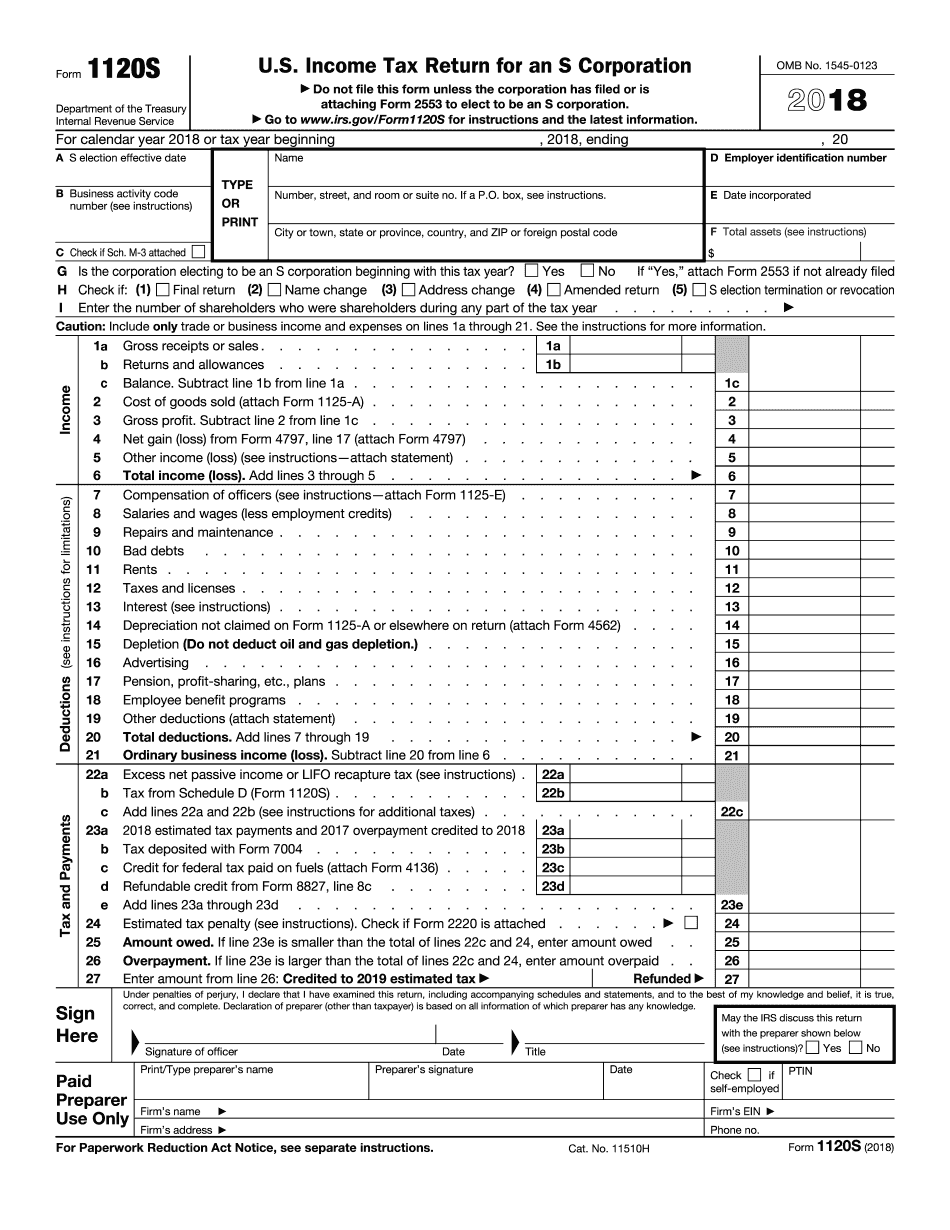

Form 1120-S Instructions

Form 1120-S Instructions - Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Support activities for agriculture and forestry. Sale of s corporation stock; This includes the names, addresses, tax identification numbers (tins), and percentage of ownership for every shareholder. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Go to www.irs.gov/form1120s for instructions and the latest information. Agriculture, forestry, fishing and hunting. Web thomson reuters tax & accounting. See faq #17 for a link to the instructions.

Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Agriculture, forestry, fishing and hunting. Go to www.irs.gov/form1120s for instructions and the latest information. Web thomson reuters tax & accounting. Web instructions for form 1120s userid: Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. Sale of s corporation stock; Web a complete list of business activity codes is found in irs’s instructions for form 1120s. See faq #17 for a link to the instructions.

Go to www.irs.gov/form1120s for instructions and the latest information. Web instructions for form 1120s userid: Support activities for agriculture and forestry. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Agriculture, forestry, fishing and hunting. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. See faq #17 for a link to the instructions. When you make an error on your s corporation ’s tax return, it’s your responsibility to correct it by filing an amended. This includes the names, addresses, tax identification numbers (tins), and percentage of ownership for every shareholder.

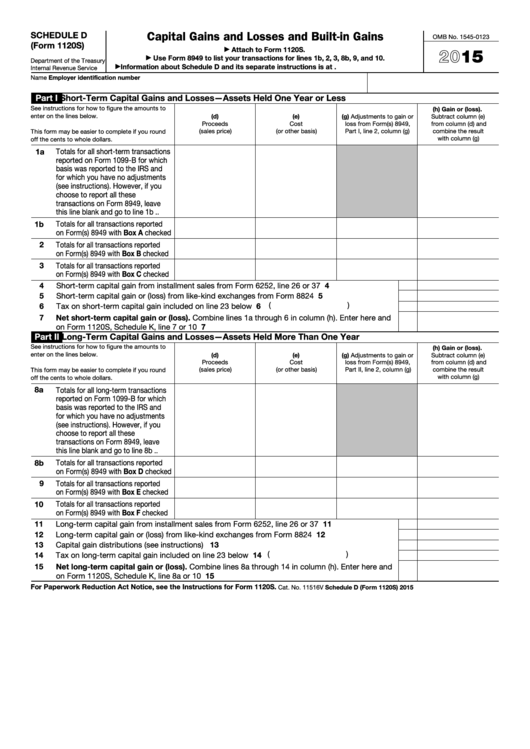

Fillable Schedule D (Form 1120s) Capital Gains And Losses And Built

Agriculture, forestry, fishing and hunting. Web a complete list of business activity codes is found in irs’s instructions for form 1120s. Web instructions for form 1120s userid: Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an Sale of s corporation stock;

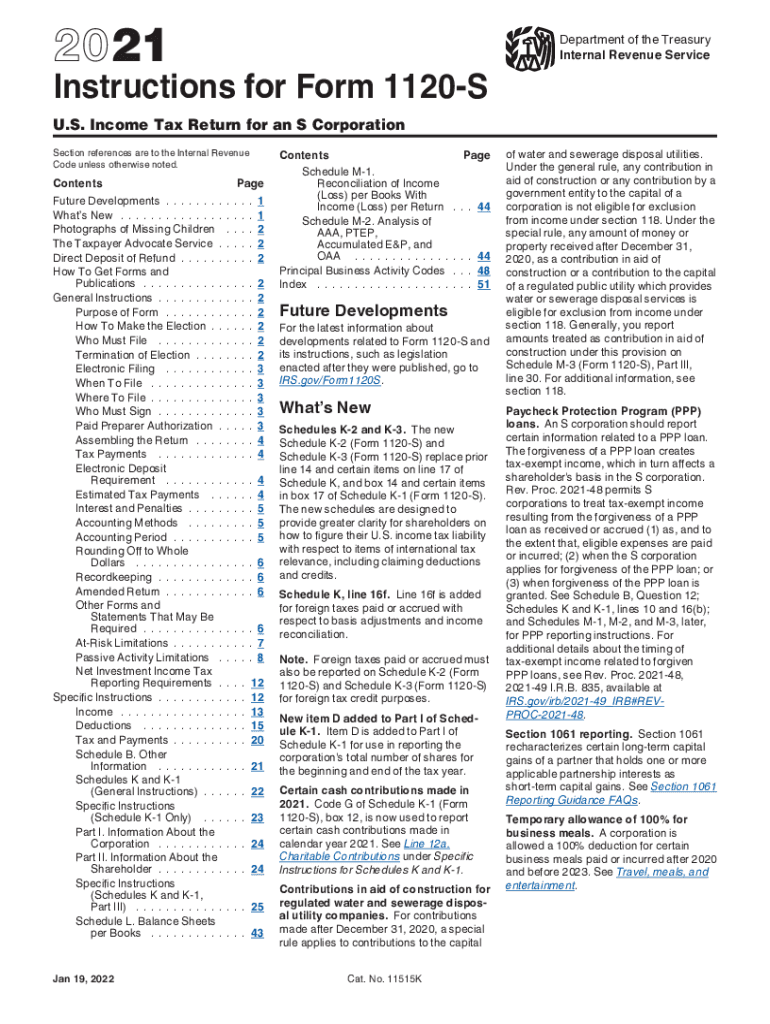

2021 Form IRS Instructions 1120S Fill Online, Printable, Fillable

Web instructions for form 1120s userid: See faq #17 for a link to the instructions. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Web a complete list of business activity codes is found in irs’s instructions for form 1120s. Go to www.irs.gov/form1120s for instructions and the.

Instructions for Form 1120 REIT, U.S. Tax Return for Real Esta…

Support activities for agriculture and forestry. Web instructions for form 1120s userid: Web a complete list of business activity codes is found in irs’s instructions for form 1120s. When you make an error on your s corporation ’s tax return, it’s your responsibility to correct it by filing an amended. Web thomson reuters tax & accounting.

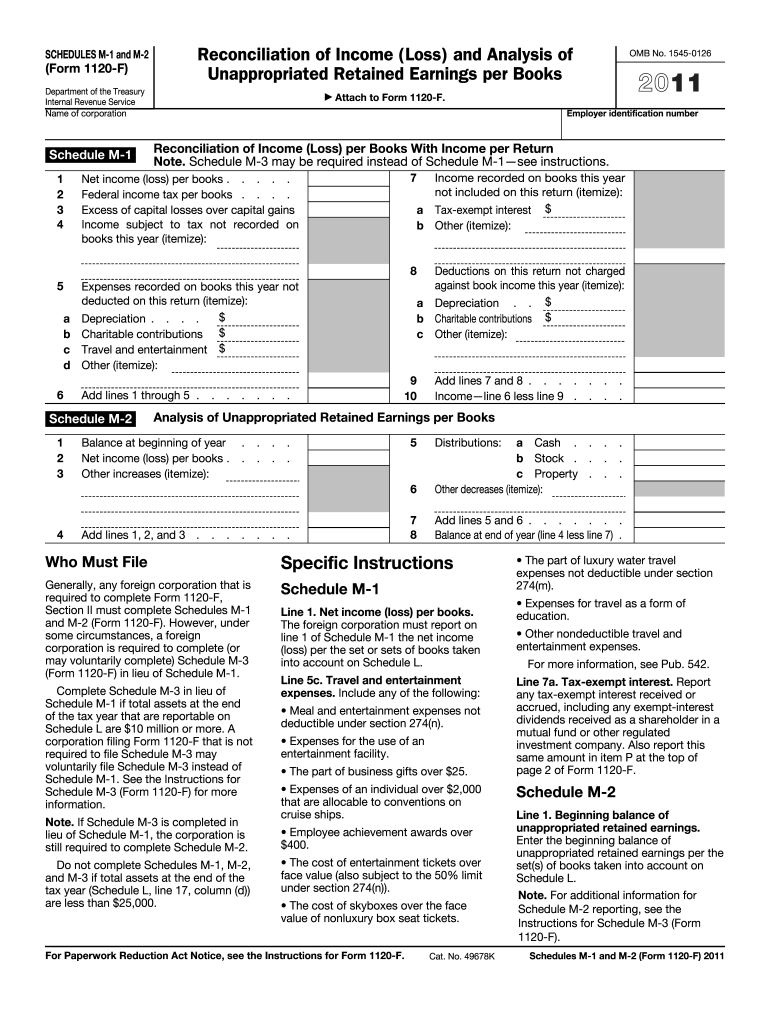

Form 1120 M 2 Fill Out and Sign Printable PDF Template signNow

Web a complete list of business activity codes is found in irs’s instructions for form 1120s. Sale of s corporation stock; Web instructions for form 1120s userid: Support activities for agriculture and forestry. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file.

3.12.217 Error Resolution Instructions for Form 1120S Internal

Support activities for agriculture and forestry. Web instructions for form 1120s userid: Sale of s corporation stock; Web a complete list of business activity codes is found in irs’s instructions for form 1120s. Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an.

2014 Form 1120s Instructions Form Resume Examples 023dOakKN5

Web thomson reuters tax & accounting. Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Sale of s corporation stock; Web instructions for form 1120s userid: Support activities for agriculture and forestry.

What is Form 1120S and How Do I File It? Ask Gusto

Corporation income tax return, to report the income, gains, losses, deductions, credits, and to figure the income tax liability of a corporation. Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Web thomson reuters tax & accounting. This includes the names, addresses, tax identification numbers (tins), and percentage of ownership for.

IRS 1120S 2022 Form Printable Blank PDF Online

When you make an error on your s corporation ’s tax return, it’s your responsibility to correct it by filing an amended. Web instructions for form 1120s userid: Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file. Income tax return for an s corporation do not file this form unless the.

Draft 2019 Form 1120S Instructions Adds New K1 Statements for §199A

When you make an error on your s corporation ’s tax return, it’s your responsibility to correct it by filing an amended. See faq #17 for a link to the instructions. Agriculture, forestry, fishing and hunting. This includes the names, addresses, tax identification numbers (tins), and percentage of ownership for every shareholder. Go to www.irs.gov/form1120s for instructions and the latest.

Form 1120S K 1 Instructions 2016 2018 Codes Line 17 —

This includes the names, addresses, tax identification numbers (tins), and percentage of ownership for every shareholder. Agriculture, forestry, fishing and hunting. When you make an error on your s corporation ’s tax return, it’s your responsibility to correct it by filing an amended. Support activities for agriculture and forestry. Sale of s corporation stock;

Corporation Income Tax Return, To Report The Income, Gains, Losses, Deductions, Credits, And To Figure The Income Tax Liability Of A Corporation.

Support activities for agriculture and forestry. Go to www.irs.gov/form1120s for instructions and the latest information. Web a complete list of business activity codes is found in irs’s instructions for form 1120s. Unless exempt under section 501, all domestic corporations (including corporations in bankruptcy) must file an

Web Thomson Reuters Tax & Accounting.

Income tax return for an s corporation do not file this form unless the corporation has filed or is attaching form 2553 to elect to be an s corporation. See faq #17 for a link to the instructions. When you make an error on your s corporation ’s tax return, it’s your responsibility to correct it by filing an amended. Sale of s corporation stock;

Agriculture, Forestry, Fishing And Hunting.

This includes the names, addresses, tax identification numbers (tins), and percentage of ownership for every shareholder. Web instructions for form 1120s userid: Income tax return for an s corporation, including recent updates, related forms, and instructions on how to file.