Md 1099 Form

Md 1099 Form - Maryland requires a 1099g, 1099r, 1099s and w. The fastest way to obtain a. Web the comptroller of maryland is required by federal law to notify you that the state tax refund you received last year may have to be reported on your 2019 federal income tax. While there were no changes to the record layout in either publication, forms must be filed online by employers with at least 25 forms and the office no longer accepts. A copy of the 1099 is sent to the taxpayer. Web submit your completed form along with a copy of your photo identification by email to: Ad success starts with the right supplies. Web the state of maryland requires additional forms to be submitted with 1099s. If you file 1099s by paper, you must submit form mw508 (annual employer withholding reconciliation. Please retain a copy of this form and to be able present.

Ad get ready for tax season deadlines by completing any required tax forms today. Web submit your completed form along with a copy of your photo identification by email to: Ad success starts with the right supplies. Find them all in one convenient place. Complete, edit or print tax forms instantly. While there were no changes to the record layout in either publication, forms must be filed online by employers with at least 25 forms and the office no longer accepts. Maryland requires a 1099g, 1099r, 1099s and w. If you file 1099s by paper, you must submit form mw508 (annual employer withholding reconciliation. Web form 1099g is a report of income you received from your maryland state taxes as a refund, offset or credit. 7 by the state comptroller’s office.

Find them all in one convenient place. This refund, offset or credit may be taxable income. If you received a maryland income tax refund last year, we're required by federal law to send you form 1099g to. Please retain a copy of this form and to be able present. Web maryland’s 2022 form 1099 filing specifications were released nov. Web maryland department of labor 7 by the state comptroller’s office. Additionally, retirees who turnedage 59 ½ in calendar. Web the comptroller of maryland is required by federal law to notify you that the state tax refund you received last year may have to be reported on your 2019 federal income tax. It is not a bill.

What is a 1099 & 5498? uDirect IRA Services, LLC

Please retain a copy of this form and to be able present. This refund, offset or credit may be taxable income. Ad success starts with the right supplies. Maryland requires a 1099g, 1099r, 1099s and w. Web the state of maryland requires additional forms to be submitted with 1099s.

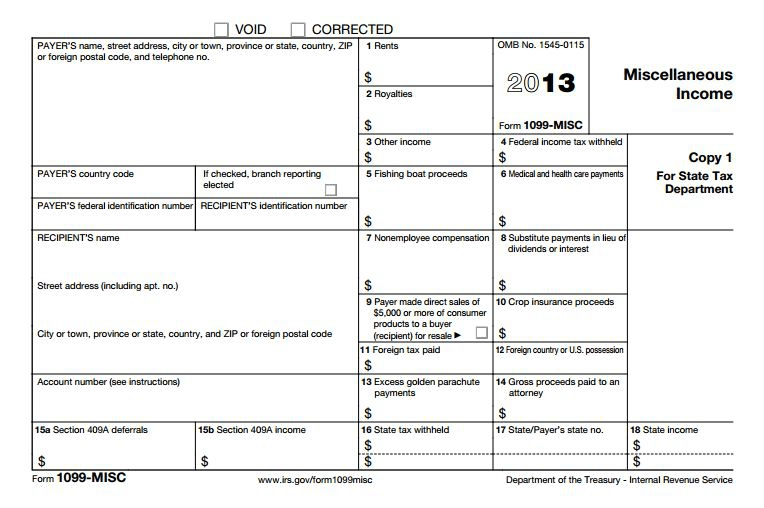

Free Printable 1099 Misc Forms Free Printable

Web maryland’s 2022 form 1099 filing specifications were released nov. Web the comptroller of maryland is required by federal law to notify you that the state tax refund you received last year may have to be reported on your 2019 federal income tax. The request for mail order forms may be used to order one copy or. Web form 1099g.

1099 IRS Tax Form

Ad get ready for tax season deadlines by completing any required tax forms today. This refund, offset or credit may be taxable income. Complete, edit or print tax forms instantly. Maryland requires a 1099g, 1099r, 1099s and w. It is not a bill.

What is a 1099Misc Form? Financial Strategy Center

Web maryland’s 2022 form 1099 filing specifications were released nov. Web the comptroller of maryland is required by federal law to notify you that the state tax refund you received last year may have to be reported on your 2019 federal income tax. Please retain a copy of this form and to be able present. The fastest way to obtain.

How To File Form 1099NEC For Contractors You Employ VacationLord

Additionally, retirees who turnedage 59 ½ in calendar. Ad get ready for tax season deadlines by completing any required tax forms today. Find them all in one convenient place. Complete, edit or print tax forms instantly. Annually, federal 1099 reports are informational forms filed with the internal revenue service (irs).

Form 1099 Misc Fillable Universal Network

If you received a maryland income tax refund last year, we're required by federal law to send you form 1099g to. Web maryland department of labor Web form 1099g is a report of income you received from your maryland state taxes as a refund, offset or credit. Web for assistance, users may contact the taxpayer service section monday through friday.

What Is Form 1099MISC? When Do I Need to File a 1099MISC? Gusto

It is not a bill. Web form 1099g is a report of income you received from your maryland state taxes as a refund, offset or credit. The fastest way to obtain a. A copy of the 1099 is sent to the taxpayer. Web submit your completed form along with a copy of your photo identification by email to:

1099 Form Changes for 2013 and Dynamics AX 2012 Stoneridge Software

7 by the state comptroller’s office. Additionally, retirees who turnedage 59 ½ in calendar. The fastest way to obtain a. Find them all in one convenient place. This refund, offset or credit may be taxable income.

How Not To Deal With A Bad 1099

Web maryland’s 2022 form 1099 filing specifications were released nov. Ad get ready for tax season deadlines by completing any required tax forms today. The request for mail order forms may be used to order one copy or. If you file 1099s by paper, you must submit form mw508 (annual employer withholding reconciliation. Web the state of maryland requires additional.

1099 Archives Deb Evans Tax Company

Maryland requires a 1099g, 1099r, 1099s and w. Please retain a copy of this form and to be able present. Web maryland’s 2022 form 1099 filing specifications were released nov. Web the state of maryland requires additional forms to be submitted with 1099s. Additionally, retirees who turnedage 59 ½ in calendar.

Web Submit Your Completed Form Along With A Copy Of Your Photo Identification By Email To:

Web for assistance, users may contact the taxpayer service section monday through friday from 8:30 am until 4:30 pm via email at taxhelp@marylandtaxes.gov or by phone at 410. Ad success starts with the right supplies. Ad get ready for tax season deadlines by completing any required tax forms today. Web the comptroller of maryland is required by federal law to notify you that the state tax refund you received last year may have to be reported on your 2019 federal income tax.

If You Received A Maryland Income Tax Refund Last Year, We're Required By Federal Law To Send You Form 1099G To.

7 by the state comptroller’s office. If you file 1099s by paper, you must submit form mw508 (annual employer withholding reconciliation. While there were no changes to the record layout in either publication, forms must be filed online by employers with at least 25 forms and the office no longer accepts. Web the state of maryland requires additional forms to be submitted with 1099s.

Annually, Federal 1099 Reports Are Informational Forms Filed With The Internal Revenue Service (Irs).

A copy of the 1099 is sent to the taxpayer. Web maryland department of labor Please retain a copy of this form and to be able present. From the latest tech to workspace faves, find just what you need at office depot®!

This Refund, Offset Or Credit May Be Taxable Income.

It is not a bill. The fastest way to obtain a. Additionally, retirees who turnedage 59 ½ in calendar. Maryland requires a 1099g, 1099r, 1099s and w.