Vehicle Gift Form Texas

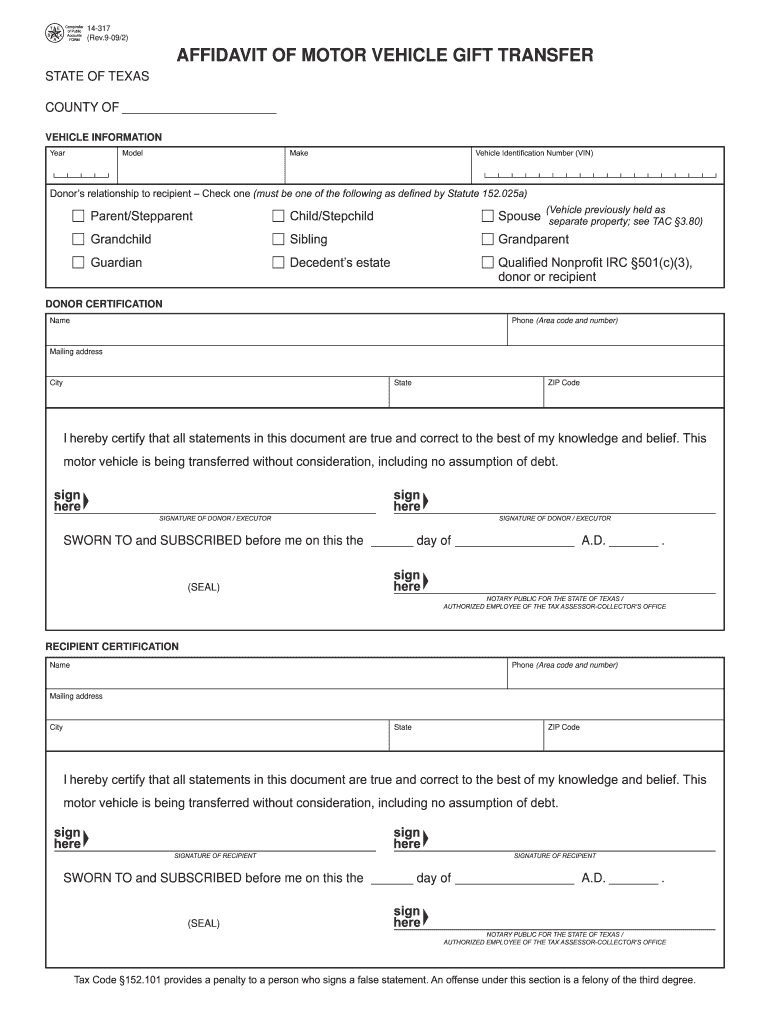

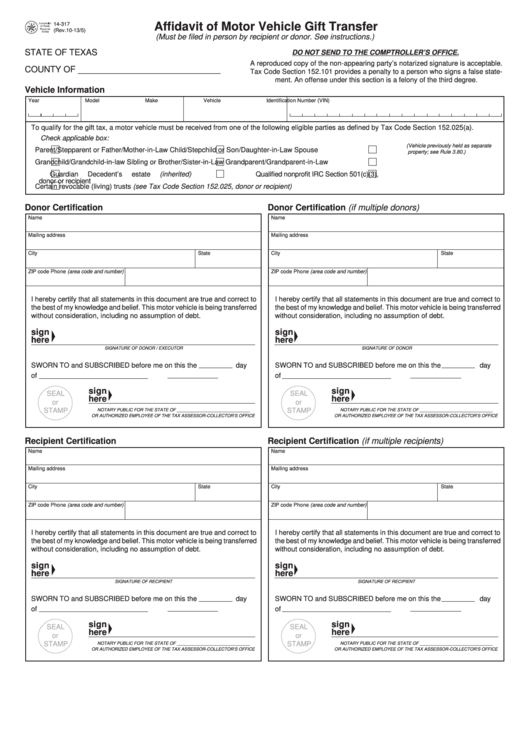

Vehicle Gift Form Texas - The purpose of this affidavit is to document the gift of a motor. To give a vehicle as a gift to a relative or qualifying 501(c)(3): The gift tax is $10, and is paid in lieu of the. Web the purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Web forms from the texas department of motor vehicles include: The signed negotiable title and completed application for texas title and/or. Web affidavit of gift form. Web to qualify to be taxed as a gift ($10), a vehicle must be received from the following eligible parties: Just fancy it by voting! You (the giver) and your son.

Web the purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. The purpose of this affidavit is to document the gift of a motor. Web forms from the texas department of motor vehicles include: Web updated july 18, 2023 here is a simple breakdown of the process to transfer ownership of the vehicle to your son as a gift in texas: Web fill out the texas affidavit of motor vehicle gift transfer form for free! The purpose of this affidavit is to document the gift of a motor. Affidavit of motor vehicle gift transfer. To give a vehicle as a gift to a relative or qualifying 501(c)(3): The gift tax is $10, and is paid in lieu of the. Web to qualify to be taxed as a gift ($10), a vehicle must be received from the following eligible parties:

Web forms from the texas department of motor vehicles include: Web gifting a vehicle. Web the principal parties to the transfer of a motor vehicle as the result of a gift or transfer of title to community property between spouses pursuant to subsection (b) of this section,. Web justia › forms › texas › statewide › department of motor vehicles › affidavit of motor vehicle gift transfer. Web 21 rows form number. Texas affidavit of motor vehicle gift transfer pdf. Web updated july 18, 2023 here is a simple breakdown of the process to transfer ownership of the vehicle to your son as a gift in texas: Web to qualify to be taxed as a gift ($10), a vehicle must be received from the following eligible parties: Keep it simple when filling out your texas affidavit of motor vehicle gift transfer and use. The signed negotiable title and completed application for texas title and/or.

2009 Form TX 14317 Fill Online, Printable, Fillable, Blank pdfFiller

Web fill out the texas affidavit of motor vehicle gift transfer form for free! Web the purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Web justia › forms › texas › statewide › department of motor vehicles › affidavit of motor.

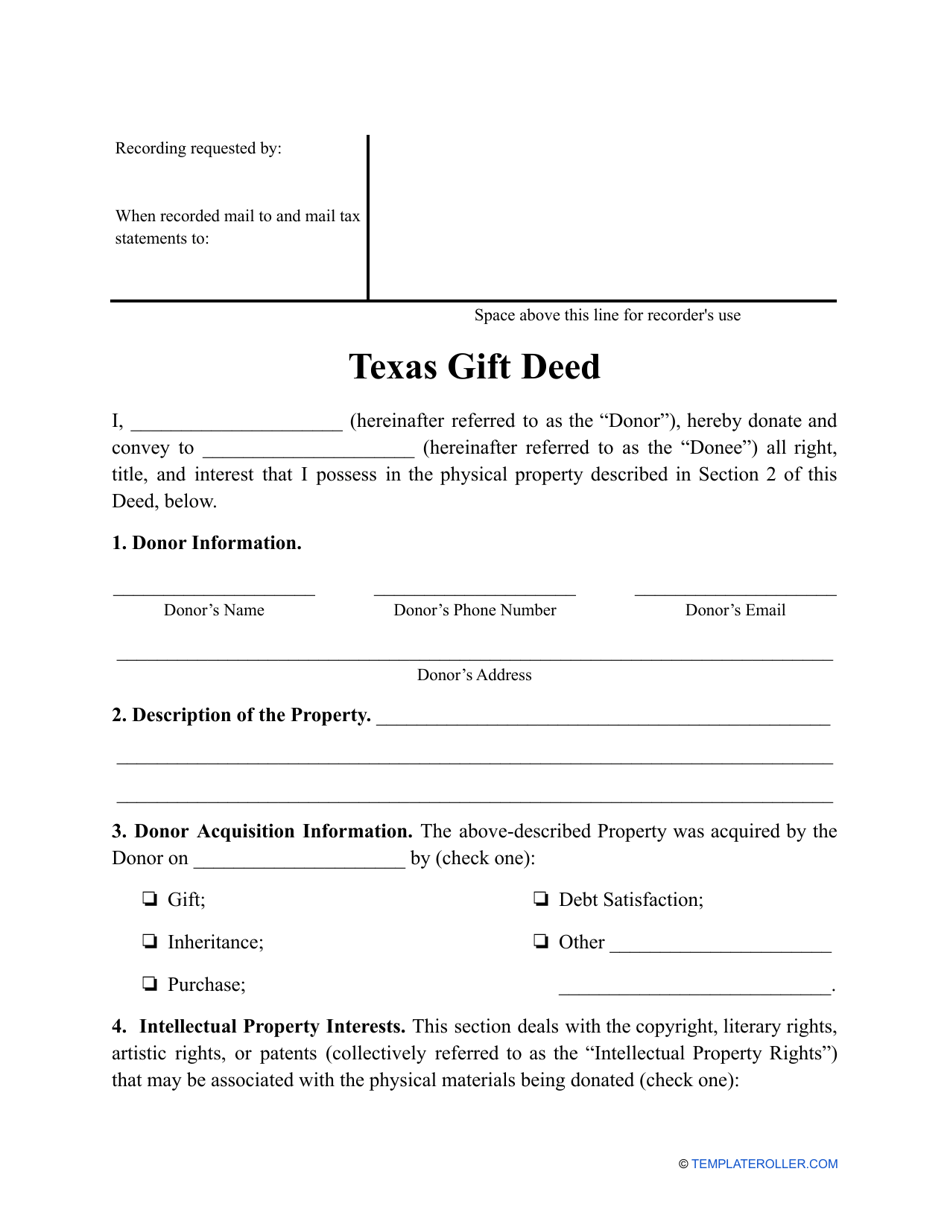

Texas Gift Deed Form Download Printable PDF Templateroller

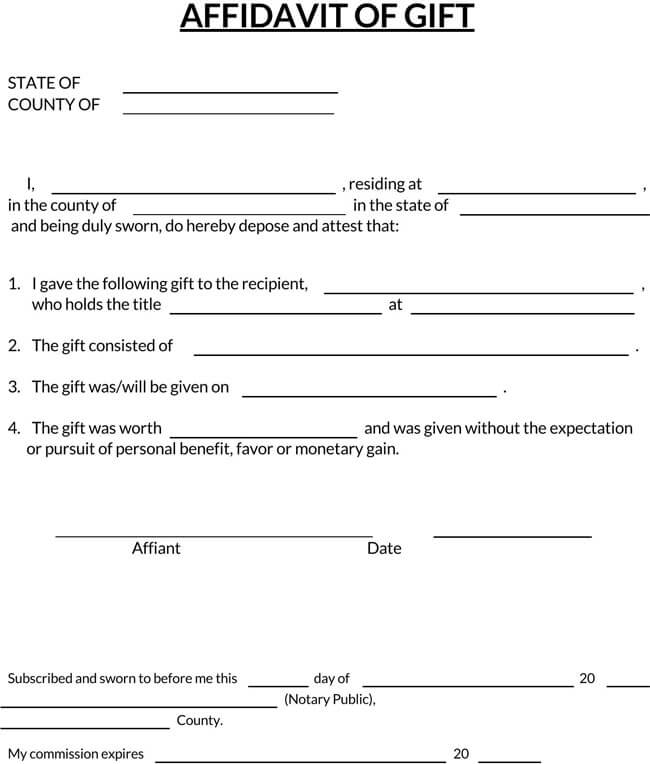

Web affidavit of gift form. You (the giver) and your son. Just fancy it by voting! Web gifting a car in texas involves visiting your county tax office, notifying the texas department of motor vehicles (txdmv), and transferring the title to your. Web forms from the texas department of motor vehicles include:

Gift Affidavit Form Texas Bios Pics

Web to qualify to be taxed as a gift ($10), a vehicle must be received from the following eligible parties: Web the purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. Web forms from the texas department of motor vehicles include: The.

Download Texas Harris County Vehicle Bill of Sale for Free FormTemplate

Web justia › forms › texas › statewide › department of motor vehicles › affidavit of motor vehicle gift transfer. Web fill out the texas affidavit of motor vehicle gift transfer form for free! Web gifting a vehicle. Web forms from the texas department of motor vehicles include: To give a vehicle as a gift to a relative or qualifying.

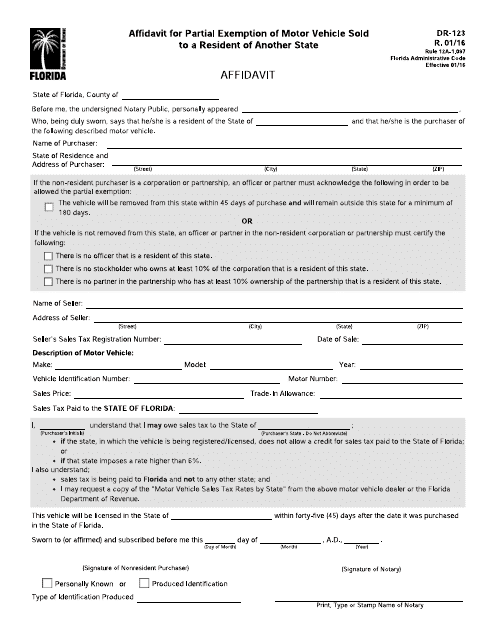

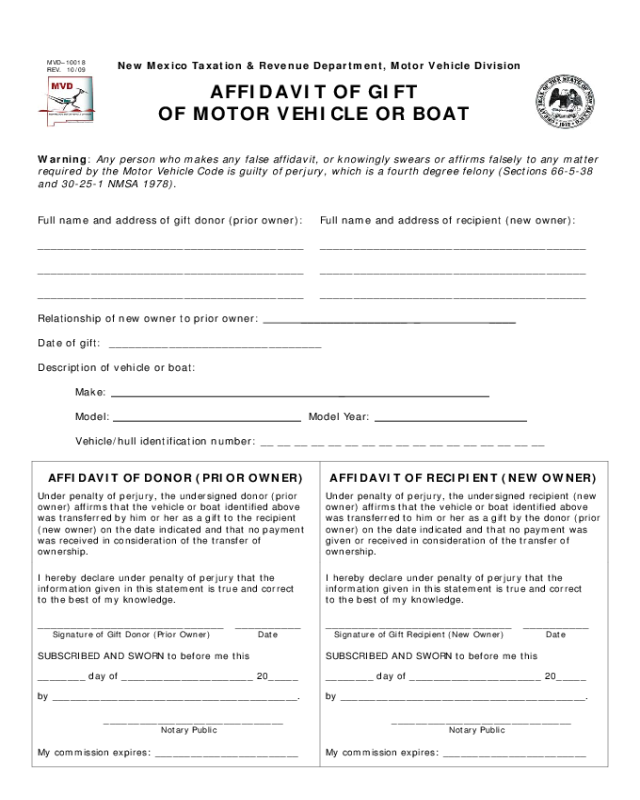

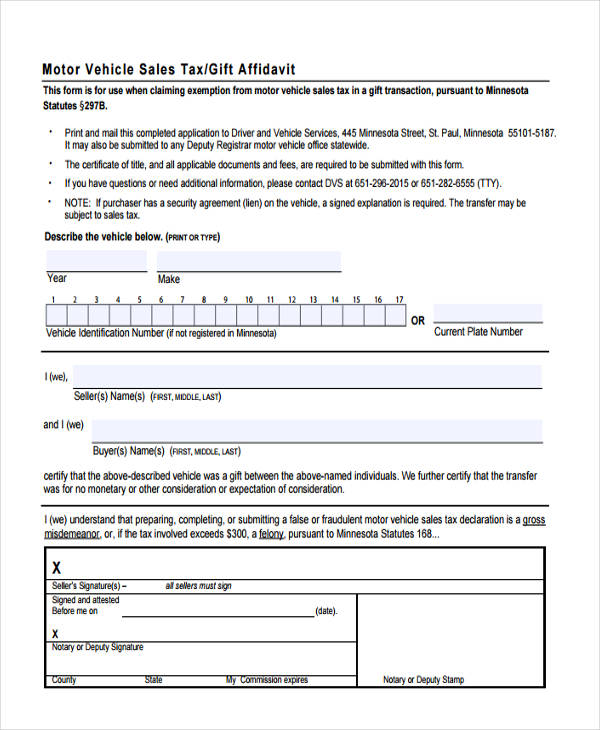

Affidavit Of Motor Vehicle Gift Transfer Florida

Just fancy it by voting! Web the principal parties to the transfer of a motor vehicle as the result of a gift or transfer of title to community property between spouses pursuant to subsection (b) of this section,. You (the giver) and your son. Web gifting a car in texas involves visiting your county tax office, notifying the texas department.

Texas Archives Page 9 of 10 PDFSimpli

You (the giver) and your son. Web justia › forms › texas › statewide › department of motor vehicles › affidavit of motor vehicle gift transfer. Just fancy it by voting! Texas affidavit of motor vehicle gift transfer. The purpose of this affidavit is to document the gift of a motor.

Affidavit Of Gift Motor Vehicle Florida

You (the giver) and your son. The gift tax is $10, and is paid in lieu of the. Web to qualify to be taxed as a gift ($10), a vehicle must be received from the following eligible parties: Keep it simple when filling out your texas affidavit of motor vehicle gift transfer and use. Web fill out the texas affidavit.

Affidavit Of Motor Vehicle Gift Transfer Texas VEHICLE UOI

Web the purpose of this affidavit is to document the gift of a motor vehicle to an eligible recipient as required by texas tax code section 152.062, required statements. The signed negotiable title and completed application for texas title and/or. Web affidavit of gift form. Web fill out the texas affidavit of motor vehicle gift transfer form for free! Web.

How To Transfer A Car Title In Texas As A Gift / After Car Owner Dies

Web justia › forms › texas › statewide › department of motor vehicles › affidavit of motor vehicle gift transfer. You (the giver) and your son. Web fill out the texas affidavit of motor vehicle gift transfer form for free! Web to qualify to be taxed as a gift ($10), a vehicle must be received from the following eligible parties:.

Affidavit Of Gift Of Motor Vehicle VEHICLE UOI

The signed negotiable title and completed application for texas title and/or. Web to qualify to be taxed as a gift ($10), a vehicle must be received from the following eligible parties: Texas affidavit of motor vehicle gift transfer pdf. Web justia › forms › texas › statewide › department of motor vehicles › affidavit of motor vehicle gift transfer. Web.

Web Gifting A Vehicle.

The signed negotiable title and completed application for texas title and/or. The gift tax is $10, and is paid in lieu of the. Web affidavit of gift form. Web gifting a car in texas involves visiting your county tax office, notifying the texas department of motor vehicles (txdmv), and transferring the title to your.

Web The Purpose Of This Affidavit Is To Document The Gift Of A Motor Vehicle To An Eligible Recipient As Required By Texas Tax Code Section 152.062, Required Statements.

You (the giver) and your son. Web updated july 18, 2023 here is a simple breakdown of the process to transfer ownership of the vehicle to your son as a gift in texas: Texas affidavit of motor vehicle gift transfer. Web the principal parties to the transfer of a motor vehicle as the result of a gift or transfer of title to community property between spouses pursuant to subsection (b) of this section,.

Web 21 Rows Form Number.

Texas affidavit of motor vehicle gift transfer pdf. Just fancy it by voting! Affidavit of motor vehicle gift transfer. To give a vehicle as a gift to a relative or qualifying 501(c)(3):

Web Forms From The Texas Department Of Motor Vehicles Include:

Web to qualify to be taxed as a gift ($10), a vehicle must be received from the following eligible parties: Web justia › forms › texas › statewide › department of motor vehicles › affidavit of motor vehicle gift transfer. The purpose of this affidavit is to document the gift of a motor. The purpose of this affidavit is to document the gift of a motor.